Indikator, Strategi dan Perpustakaan

Introducing the Trend Continuation Signals by AlgoAlpha 🌟🚀 Elevate your trading game with this multipurpose indicator, designed to pinpoint trend continuation opportunities as well as highlight volatility and oversold/overbought conditions. Whether you're a trading novice or a seasoned market veteran, this tool offers intuitive visual cues to boost your...

█ Overview The Predictive Trend and Structure indicator is designed for traders seeking to identify future trend directions and interruptions in trend continuation. This indicator is unique because it employs standard deviation to predict upcoming trend directions and potential trend continuation levels. This enables traders to stay ahead of the market. ...

█ Overview The Volume SuperTrend AI is an advanced technical indicator used to predict trends in price movements by utilizing a combination of traditional SuperTrend calculation and AI techniques, particularly the k-nearest neighbors (KNN) algorithm. The Volume SuperTrend AI is designed to provide traders with insights into potential market trends, using...

Anit Momentum Indicator: A Powerful Trend Continuation Tool for Long-Only Strategies The "Anit Momentum Indicator" (AMI) is a powerful technical analysis tool designed to assist traders in identifying potential trend continuation opportunities in the financial markets. Unlike traditional trend reversal indicators, AMI is specifically crafted for long-only...

█ Overview The Ross Hook pattern is one of the most consistent and successful trading patterns that have been around for years. The Ross Hook is the first correction following the breakout of the 1-2-3 formation . This means that the Ross Hook only occurs in established trends. In other words, Ross Hook is a trend continuation setup. To fully understand the...

█ This Indicator shows a wick-off check pattern applied to a moving average. This pattern appears when a candle opens below the moving average and closes above it, or when it opens above a moving average and closes below it. This causes a wick to go through the moving average: a wick-off check moving average. █ Usages: This indicator detects small...

Welcome traveler ! Here is my first indicator I made after 3 days of hardlearning pine code (beginner in coding). I hope it will please you, if you have any suggestion to enhance this indicator, do not hesitate to give me your thoughts in the comments section or by Private message on trading View ! How does it works ? It's a simple MACD strategy as describe...

A Directional Bias to stop me trading against the trend Utilising EMA'S - I personally view on the 15M TF but it can be set on any 40/50/60 15Minute STF and 13/35/50 - 30M 1H and 4H HTF Mixing them together in direction and location to each other Gives a 6 colour system for keeping away from trading against trend Dark Red Both Align - Sells Only do not...

This is very simple trend following or momentum strategy. If the price change over the past number of bars is positive, we buy. If the price change over the past number of bars is negative, we sell. This is surprisingly robust, simple, and effective especially on trendy markets such as cryptos. Works for many markets such as: INDEX:BTCUSD INDEX:ETHUSD ...

Delta Volume is Difference between Buying Volume and Selling Volume. This indicator gives the Delta Volume based on Lower TimeFrame Candles. It utilizes security_lower_tf() function, a function that provides Lower TF candle data in Higher TF Chart. security_lower_tf() is a new function provided by TradingView yesterday. If you are a PineScript Programmer, I...

Bollinger Bands are mostly used for trend reversal. I believe they should be used for Trend Continuation and Trend Confirmation. In this Trending Bollinger Bands script you will see two bands drawn on chart. The Upper band is suggestive of Uptrend and Lower Band is suggestive of Downtrend Market. It just provides the guidance of where the market is now and...

The leading indicator is helpful to identify early entries and exits (especially near support and resistance). Green = trend up Red = trend down How it works: The leading indicator calculates the difference between price and an exponential moving average. Adding the difference creates a negative lag relative to the original function. Negative lag is what...

Level: 3 Background Developed by M. H. Pee, the Trend Continuation Factor aims to help traders identify whether the market is trending, and, in case it is, in what direction it is headed. It can be used in any time frame, with every currency pair and is suitable for beginner traders. Function The indicator is comprised of two lines, namely the PlusTCF and...

The system uses 1 hour and 15 min timeframe data. Signals coming from 15 min Inverse Fisher Transform of SMI and stochastic RSI are confirmed by 1 hour Inverse Fisher Transform SMI, according to the following rules: long cond.: 15 min IFTSMI crosses ABOVE -0.5 or SRSI k-line crosses ABOVE 50 while 1-hour IFTSMI is already ABOVE -0.5 short cond.:15 min IFTSMI...

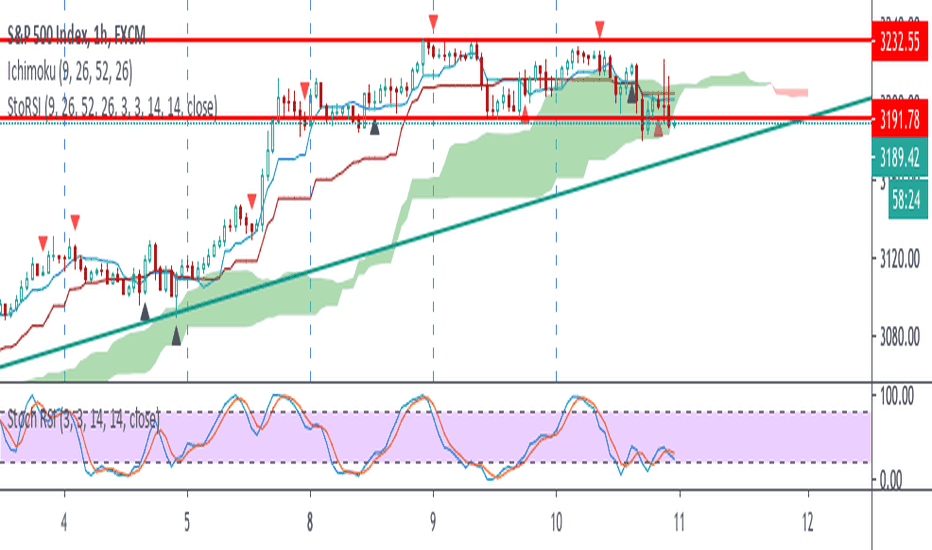

This script uses 25-75 treshold of stochastic RSI with the help of kijun-sen as confirmation, to find entry points to any trend either newly developed or an established one. I just realized it on the 1 hour SPX chart. Sure it can be used on other symbols. Crossing above/below 25/75 line of sto RSI is considered as buy/sell signal. Signals are evaluated whether...

This script determines, plots and alerts on probable trend initiation and continuation points, using tenkan-sen(conversion line of ichimoku), kijun-sen(baseline of ichimoku) and stochastic RSI, for 1 H SPX. New long/short trend initiates when prices cross above/below kijun sen. The trend continues when prices cross above/below tenkan-sen or stochastic RSI...

The Market State Indicator was created by John Ehlers (Stocks & Commodities V. 38:06 (8–15)) and this is technically part of three indicators in one so I'm splitting each one to a separate script. This particular indicator was designed for the market state which acts as a trend direction and tells you whether the trend is strong in either direction. Keep in mind...

![Trend Continuation Signals [AlgoAlpha] BTCUSD: Trend Continuation Signals [AlgoAlpha]](https://s3.tradingview.com/9/91oMc2ib_mid.png)

![Wick-off Check Moving Average [Misu] BTCUSDT: Wick-off Check Moving Average [Misu]](https://s3.tradingview.com/n/NBRO3jSQ_mid.png)

![Leading Indicator [TH] MATICUSD: Leading Indicator [TH]](https://s3.tradingview.com/y/yxF07nBJ_mid.png)

![[blackcat] L3 M.H. Pee Trend Continuation Factor BTCUSDT: [blackcat] L3 M.H. Pee Trend Continuation Factor](https://s3.tradingview.com/y/ymW2vLS6_mid.png)

![Ehlers Market State Indicator [CC] AAPL: Ehlers Market State Indicator [CC]](https://s3.tradingview.com/r/r2qIxy0l_mid.png)