INVITE-ONLY SCRIPT

Trend Following Composite Index ( TFCI )

Diupdate

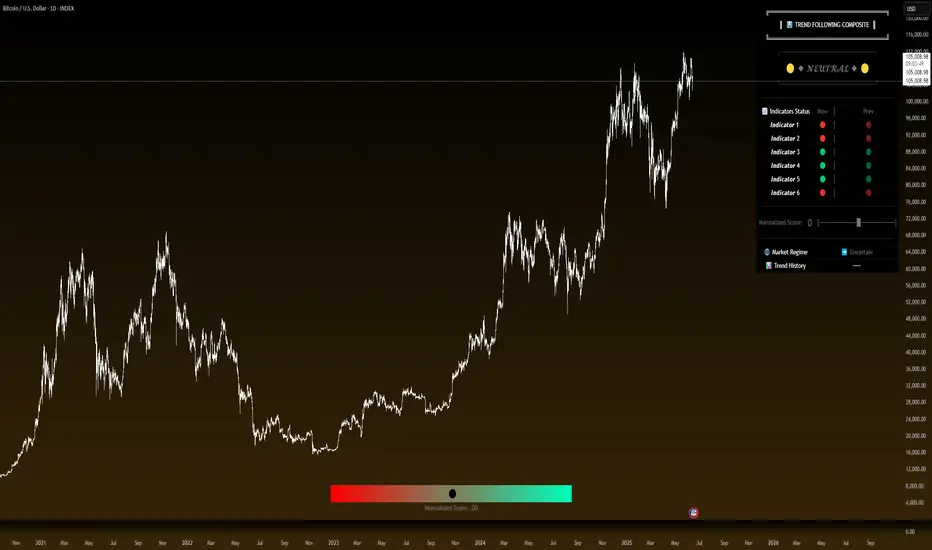

🏆 Trend Following Composite Index (TFCI) 🏆

Overview 🔎

The Trend Following Composite Index (TFCI) is designed to provide traders with a comprehensive view of market trends by combining several technical indicators in a single, unified tool. Each component brings its unique perspective, and together they create a well-rounded signal that may help traders better understand the current market condition. TFCI simplifies the decision-making process by aggregating these signals into one easy-to-read confidence percentage, allowing traders to quickly gauge whether the market is trending upwards, downwards, or is in a period of indecision.

Combining Multiple Indicators for a Unique Edge 🔀

TFCI integrates six different technical indicators, each tuned to capture distinct aspects of market behavior. Rather than relying on any single indicator, TFCI merges their signals into one, providing a more nuanced and potentially more reliable view of the market. This combination helps reduce the weaknesses inherent in any one indicator, offering a more balanced and holistic trend signal.

A Streamlined Confidence Signal 🧮

One of the main advantages of TFCI is that it simplifies the multitude of signals into one easy-to-read confidence percentage. The aggregation of multiple indicators means that no single indicator drives the signal; instead, the combined analysis ensures that only when several conditions align do you get a clear trend indication. This reduces false positives and gives traders a more confident view of the overall market direction.

Why TFCI’s Combination is Unique and Useful 🔍

What makes TFCI stand out is how each of these indicators works together to offer a more comprehensive view of the market:

Tested Across Market Conditions 📅

While no indicator can predict the future, TFCI has been tested in a range of market conditions. Its ability to adapt to different environments (trending, volatile, or range-bound) makes it a versatile tool, though like any technical tool, it should be used alongside other forms of analysis and risk management.

Custom Display Options for Readability 📊

To make TFCI even more versatile, it includes two display modes:

Table Mode: This mode breaks down the signals from each component, showing traders exactly how each element is contributing to the overall confidence score. Ideal for those who want to dig deeper into the details.

https://www.tradingview.com/x/H9zfJgiX/

Gauge Mode: A simplified visual display, perfect for traders who want a quick, at-a-glance view of market conditions.

https://www.tradingview.com/x/s6BYDKL1/

Color Blindness Mode 🌈

TFCI also includes several color palettes for traders affected by color blindness, ensuring everyone can easily interpret the signals.

Conclusion 🔒

TFCI brings together multiple technical indicators in a unique way that aims to improve trend detection by providing a balanced and easy-to-read signal. Its proprietary adjustments and combination of price, volume, and volatility indicators offer a comprehensive view of market conditions, making it a valuable tool for traders of all experience levels. However, it is essential to remember that no past performance can guarantee future results.

Overview 🔎

The Trend Following Composite Index (TFCI) is designed to provide traders with a comprehensive view of market trends by combining several technical indicators in a single, unified tool. Each component brings its unique perspective, and together they create a well-rounded signal that may help traders better understand the current market condition. TFCI simplifies the decision-making process by aggregating these signals into one easy-to-read confidence percentage, allowing traders to quickly gauge whether the market is trending upwards, downwards, or is in a period of indecision.

Combining Multiple Indicators for a Unique Edge 🔀

TFCI integrates six different technical indicators, each tuned to capture distinct aspects of market behavior. Rather than relying on any single indicator, TFCI merges their signals into one, providing a more nuanced and potentially more reliable view of the market. This combination helps reduce the weaknesses inherent in any one indicator, offering a more balanced and holistic trend signal.

- RSI Filter: The RSI helps identify potential overbought or oversold conditions, but when used alone, it can generate false signals. In TFCI, the RSI is smoothed and combined with other metrics to avoid reacting to small fluctuations, making the signals more robust.

- Kijun-Based Band: This component, inspired by the Kijun-sen line from the Ichimoku system, defines adaptive price bands based on market equilibrium. When combined with a smoothing filter, it provides traders with clear visual cues for potential trend reversals, reducing the guesswork.

- Boosted Moving Average: By combining short- and long-term EMAs, this component reacts quickly to price changes, while the "boost" factor enhances its ability to confirm trends early. This combination helps filter out market noise, making it easier to spot genuine trend shifts.

- Deviation Condition: This proprietary moving average adjusts dynamically based on volatility, which means it adapts to fast-changing market conditions. By adjusting its sensitivity based on market deviations, it helps smooth out erratic price movements, creating clearer trend signals.

- VWTSI (Volume-Weighted Trend Strength Indicator): Volume is an essential factor in confirming trends. This indicator looks at price movements in relation to volume to assess the strength of the trend. By factoring in volatility, it ensures that traders are focusing on the strongest market moves, further enhancing the reliability of the signals.

- Supertrend: A volatility-based trailing stop that defines buy and sell points. Its role in TFCI is to help maintain positions during trending markets while avoiding premature exits due to minor pullbacks.

A Streamlined Confidence Signal 🧮

One of the main advantages of TFCI is that it simplifies the multitude of signals into one easy-to-read confidence percentage. The aggregation of multiple indicators means that no single indicator drives the signal; instead, the combined analysis ensures that only when several conditions align do you get a clear trend indication. This reduces false positives and gives traders a more confident view of the overall market direction.

- Bullish signals from several components push the percentage higher.

- Bearish signals lower the percentage.

- A neutral score indicates indecision, signaling a potential range-bound or consolidating market.This consolidated signal allows traders to make quicker decisions without having to interpret several individual indicators, making the tool more user-friendly and practical for daily trading.

Why TFCI’s Combination is Unique and Useful 🔍

What makes TFCI stand out is how each of these indicators works together to offer a more comprehensive view of the market:

- Reduced Noise: By combining multiple indicators, TFCI reduces the likelihood of acting on false signals. The integration of smoothing mechanisms and volume-based confirmations further increases signal reliability.

- More Balanced Analysis: Using indicators that analyze price, volume, volatility, and trend strength, TFCI provides a balanced view of market conditions. Traders can trust that the signal reflects multiple facets of the market rather than just one aspect, making it more adaptable to different market environments.

- Easier to Read: Instead of juggling multiple charts or relying on complex setups, TFCI combines everything into one clear percentage and visual signal. This saves time and reduces the complexity of decision-making.

Tested Across Market Conditions 📅

While no indicator can predict the future, TFCI has been tested in a range of market conditions. Its ability to adapt to different environments (trending, volatile, or range-bound) makes it a versatile tool, though like any technical tool, it should be used alongside other forms of analysis and risk management.

Custom Display Options for Readability 📊

To make TFCI even more versatile, it includes two display modes:

Table Mode: This mode breaks down the signals from each component, showing traders exactly how each element is contributing to the overall confidence score. Ideal for those who want to dig deeper into the details.

https://www.tradingview.com/x/H9zfJgiX/

Gauge Mode: A simplified visual display, perfect for traders who want a quick, at-a-glance view of market conditions.

https://www.tradingview.com/x/s6BYDKL1/

Color Blindness Mode 🌈

TFCI also includes several color palettes for traders affected by color blindness, ensuring everyone can easily interpret the signals.

Conclusion 🔒

TFCI brings together multiple technical indicators in a unique way that aims to improve trend detection by providing a balanced and easy-to-read signal. Its proprietary adjustments and combination of price, volume, and volatility indicators offer a comprehensive view of market conditions, making it a valuable tool for traders of all experience levels. However, it is essential to remember that no past performance can guarantee future results.

Catatan Rilis

Version 1.1 -> Added market regime detection for Trending / Mean reversion and uncertain market environment. Trend indicators does not work well in mean reverting markets, therefore if you want to lower the risk of taking a bad position you can now check the market regime in the table mode, or plot the background color to see if the market is more likely trending or mean reverting. Use with caution as it can be noisy and have false signals due to black swan event for example Catatan Rilis

Small change : Added an input to have normalized score between -1 ( max bearish ) to +1 max Bullish with 2 new inputs for thresholds depending on the display you prefer Skrip hanya-undangan

Akses ke skrip ini dibatasi hanya bagi pengguna yang telah diberi otorisasi oleh penulisnya dan biasanya membutuhkan pembayaran untuk dapat menggunakannya. Anda dapat menambahkannya ke favorit anda, tetapi anda hanya akan dapat menggunakannya setelah meminta izin dan mendapatkan aksesnya dari pembuat skripnya. HubungiKazo_ untuk informasi lebih lanjut, atau ikuti instruksi penulisnya dibawah ini.

TradingView tidak menyarankan untuk membayar untuk sebuah skrip dan menggunakannya kecuali anda 100% mempercayai pembuatnya dan memahami cara kerja skrip tersebut. Dalam banyak kasus, anda dapat menemukan alternatif skrip sumber terbuka yang bagus secara gratis di Skrip Komunitas kami.

Instruksi penulis

″DM on TradingView or visit my website for direct access

Inggin menggunakan skrip ini pada chart?

Peringatan: harap membaca sebelum meminta akses.

----------------------------------------

discord.gg/Jxsw5Czc6r

----------------------------------------

discord.gg/Jxsw5Czc6r

----------------------------------------

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.