INVITE-ONLY SCRIPT

PRO_Traiding Trend Indicator

Diupdate

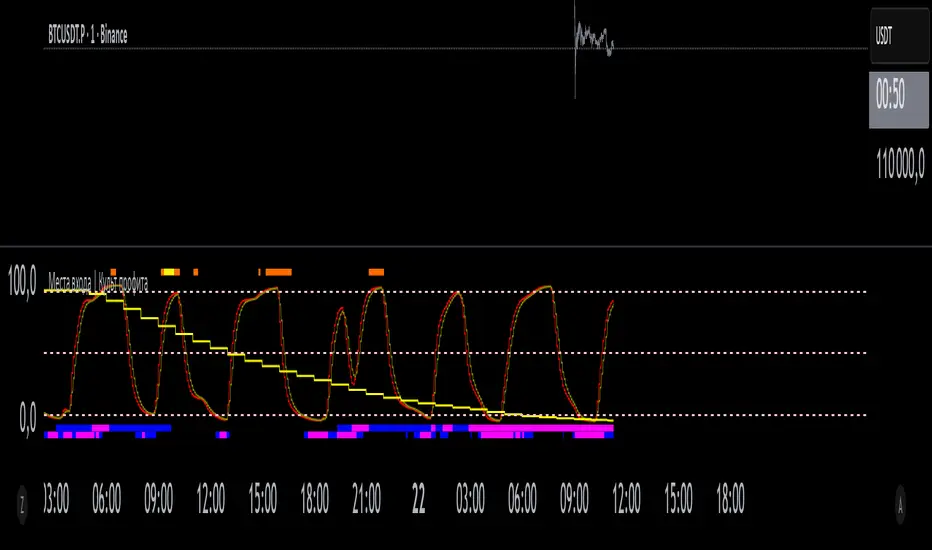

This indicator helps to determine at what stage the market is.

What is included in this indicator:

1. Trend Line - orande

2. ROP line - green and red

3. RSI Line - violet

What is the principle of the indicator?

1. Trend Line - orande

The principle of operation of this line is that at the entrance, data (closing and opening) / 2.

Further, with this data, the transformation is carried out. Then the data is fed into the RSI function.

2. ROP line - green and red

This is an auxiliary indicator based on a combined technical indicator of smoothed and weighted rates of price change from the book Martin Pring on Market Momentum

3. RSI Line - violet

Relative strength index is a technical analysis indicator that determines the strength of a trend and the likelihood of its change.

How does this indicator help in trading?

Trend Line - a trend line, orange on the chart.

This is an oscillator - showing the direction of the trend, as well as the phase in which the trend is.

The Trend Line ranges from 0 to 100. Control lines are drawn through 5 from the bottom of the Low Line, and 95 from the top (Upper Line).

Bullish trend

A bullish trend starts from the upward intersection of the Trend Line and the Low Line (5) and lasts until the intersection of the Trend Line and the Upper Line (95) from top to bottom.

In a phase when the trend is bullish and the Trend Line is above the Upper Line, a bull run may start. It is necessary to wait for the culmination of purchases.

What information and benefits we get from the indicator:

1. Knowing in what phase the market, ie. in the growth phase. You understand that you need to trade up. And don't go against the trend.

2. Seeing that the indicator is above line 95 (Upper Line), you understand that a bull run can happen, and you should also wait for the culmination of price growth and close long positions.

Bearish trend

The bearish trend starts from the top down intersection of the Trend Line and the Upper Line (95) and lasts until the upward intersection of the Trend Line and the Low Line (5).

In the phase when the trend is bearish and the Trend Line is below the Low Line, a panic sale may start. It is necessary to wait for the culmination of sales.

What information and benefits we get from the indicator:

1. Knowing in what phase the market, ie. in the fall phase. You understand that you need to trade down. And don't go against the trend.

2. Seeing that the indicator is below line 5 (Low Line), you understand that a panic sale can happen, and you should also wait for the culmination of the price fall and close the short position.

ROP line - Rate of price change

This is the price rate line. It helps to find the culmination point and reversal, as well as to understand the price direction.

This indicator consists of two lines:

- Green line - main;

- The red line is the signal line.

There is also a Zero Line.

Usage logic

Direction of movement and position of the relative Zero line

Bullish trend

If the indicator lines are above the Zero Line, as well as the green line above the red, this means an upward movement. The trend is bullish.

If the indicator lines are above the Zero Line, and the green line is below the red one, it means that the price has reversed and is in the phase of correction or reversal.

Bearish trend

If the indicator lines are below the Zero Line and the green line is below the red one, it means that the price is going down. The trend is bearish.

If the indicator lines are below the Zero Line, as well as the green line above the red, then the price has reversed and is either in a correction or reversal phase.

Climax points

Climax points are pivot points. A reversal occurs when the green and red lines cross.

When the green line crosses the red one upwards, the trend will go up.

When the green line crosses the red one downwards, the trend will go down.

The culmination of purchases and a reversal should be expected provided that the indicator lines are above the Zero Line, and the green line crosses the red one from top to bottom.

The climax of selling and a reversal must be expected provided that the indicator lines are below the Zero Line, and the green line crosses the red one from top to bottom.

3. RSI Line

The RSI line is needed as an auxiliary tool.

If you missed the entry point, then you need to enter the position on the pullback of the RSI line. In the same direction as that of the Trend Line.

Use the link below to obtain For more info and screenshots please visit Website Tab Trand Indicator.

Please do not ask permission to access the comments.

To get access, use the link below to obtain please refer to our website, there in the indicator section there is a return form for the application..

Who used this script, please leave a comment below.

What is included in this indicator:

1. Trend Line - orande

2. ROP line - green and red

3. RSI Line - violet

What is the principle of the indicator?

1. Trend Line - orande

The principle of operation of this line is that at the entrance, data (closing and opening) / 2.

Further, with this data, the transformation is carried out. Then the data is fed into the RSI function.

2. ROP line - green and red

This is an auxiliary indicator based on a combined technical indicator of smoothed and weighted rates of price change from the book Martin Pring on Market Momentum

3. RSI Line - violet

Relative strength index is a technical analysis indicator that determines the strength of a trend and the likelihood of its change.

How does this indicator help in trading?

Trend Line - a trend line, orange on the chart.

This is an oscillator - showing the direction of the trend, as well as the phase in which the trend is.

The Trend Line ranges from 0 to 100. Control lines are drawn through 5 from the bottom of the Low Line, and 95 from the top (Upper Line).

Bullish trend

A bullish trend starts from the upward intersection of the Trend Line and the Low Line (5) and lasts until the intersection of the Trend Line and the Upper Line (95) from top to bottom.

In a phase when the trend is bullish and the Trend Line is above the Upper Line, a bull run may start. It is necessary to wait for the culmination of purchases.

What information and benefits we get from the indicator:

1. Knowing in what phase the market, ie. in the growth phase. You understand that you need to trade up. And don't go against the trend.

2. Seeing that the indicator is above line 95 (Upper Line), you understand that a bull run can happen, and you should also wait for the culmination of price growth and close long positions.

Bearish trend

The bearish trend starts from the top down intersection of the Trend Line and the Upper Line (95) and lasts until the upward intersection of the Trend Line and the Low Line (5).

In the phase when the trend is bearish and the Trend Line is below the Low Line, a panic sale may start. It is necessary to wait for the culmination of sales.

What information and benefits we get from the indicator:

1. Knowing in what phase the market, ie. in the fall phase. You understand that you need to trade down. And don't go against the trend.

2. Seeing that the indicator is below line 5 (Low Line), you understand that a panic sale can happen, and you should also wait for the culmination of the price fall and close the short position.

ROP line - Rate of price change

This is the price rate line. It helps to find the culmination point and reversal, as well as to understand the price direction.

This indicator consists of two lines:

- Green line - main;

- The red line is the signal line.

There is also a Zero Line.

Usage logic

Direction of movement and position of the relative Zero line

Bullish trend

If the indicator lines are above the Zero Line, as well as the green line above the red, this means an upward movement. The trend is bullish.

If the indicator lines are above the Zero Line, and the green line is below the red one, it means that the price has reversed and is in the phase of correction or reversal.

Bearish trend

If the indicator lines are below the Zero Line and the green line is below the red one, it means that the price is going down. The trend is bearish.

If the indicator lines are below the Zero Line, as well as the green line above the red, then the price has reversed and is either in a correction or reversal phase.

Climax points

Climax points are pivot points. A reversal occurs when the green and red lines cross.

When the green line crosses the red one upwards, the trend will go up.

When the green line crosses the red one downwards, the trend will go down.

The culmination of purchases and a reversal should be expected provided that the indicator lines are above the Zero Line, and the green line crosses the red one from top to bottom.

The climax of selling and a reversal must be expected provided that the indicator lines are below the Zero Line, and the green line crosses the red one from top to bottom.

3. RSI Line

The RSI line is needed as an auxiliary tool.

If you missed the entry point, then you need to enter the position on the pullback of the RSI line. In the same direction as that of the Trend Line.

Use the link below to obtain For more info and screenshots please visit Website Tab Trand Indicator.

Please do not ask permission to access the comments.

To get access, use the link below to obtain please refer to our website, there in the indicator section there is a return form for the application..

Who used this script, please leave a comment below.

Catatan Rilis

In this update, another line has been added - ROP RSI (red rop rsi line)This is RSI, with an incoming ROP.

What does this line show?

It has the same function as a regular ROP line.

Added for convenience.

What is the logic of work?

Sell when crossing line 95 from top to bottom.

It is even better if the Trend Line is also greater than line 95.

Buy when crossing line 5 from top to bottom.

It is even better if the Trend Line is also below line 5.

Catatan Rilis

Added option to change time frame (resolution)Catatan Rilis

Update scrin shotCatatan Rilis

add filter line for 5-8-15m strategy.update rsi line algoritm.

Catatan Rilis

Opportunity to change boundaries 5-95.A simple way to install alerts.

Catatan Rilis

Добавлен новый фильтр, NRFL - New Filter ROP.С помощью данного фильтра можно распознать разворот немного раньше ROP RSI. Что дает преимущество в торговле.

Используется на все тф, совместно с ROP RSI.

Catatan Rilis

Добавлена возможность добавления на один индикатор линию ROP RSI, другого таймфрейма. Обновлен алгоритм линии RSI.

Catatan Rilis

Добавлена возможность смены тайм фрейма на основных инструментах.Catatan Rilis

Возможность изменять тайм фрейм rsi lineCatatan Rilis

По просьбам трудящихся RSI Line пере позиционирована.Catatan Rilis

fixCatatan Rilis

10-я версия индикатора.- Подкорректирован алгоритм роботы ROP RSI, удалось убрать лишние шумы.

- Добавлена медленная линия slow ROP RSI (включается в настройках). С помощью нее можно контролировать направление ROP RSI, а так же ставить оповещения на разворот.

Подписчики могут получить доступ к старой версии запросив к ней доступ.

Catatan Rilis

- Добавлен режим автоматическая \ ручная настройка- Добавлены исправление

- Убрана лишняя линия RSI

Catatan Rilis

Переработка автоматической настройки, добавление дополнительного тайфмрейма.Catatan Rilis

Убрана перефильтрованность. Обновлён индикатор trend. Trend используется для определения направления. Trend над 95 и зелёный - лонг.

Trend под 5 и красный - шорт.

Catatan Rilis

Изменено отображения Trend line автоматического и ручного режима(чтоб не склеивались)Skrip hanya-undangan

Akses ke skrip ini dibatasi hanya bagi pengguna yang telah diberi otorisasi oleh penulisnya dan biasanya membutuhkan pembayaran untuk dapat menggunakannya. Anda dapat menambahkannya ke favorit anda, tetapi anda hanya akan dapat menggunakannya setelah meminta izin dan mendapatkan aksesnya dari pembuat skripnya. HubungiPRO_Traiding untuk informasi lebih lanjut, atau ikuti instruksi penulisnya dibawah ini.

TradingView tidak menyarankan untuk membayar untuk sebuah skrip dan menggunakannya kecuali anda 100% mempercayai pembuatnya dan memahami cara kerja skrip tersebut. Dalam banyak kasus, anda dapat menemukan alternatif skrip sumber terbuka yang bagus secara gratis di Skrip Komunitas kami.

Instruksi penulis

″Перейдите на сайт в профиле, найдите статью в ней есть ссылка для получения доступа.

Inggin menggunakan skrip ini pada chart?

Peringatan: harap membaca sebelum meminta akses.

Web site - pro-traiding.ru/

Telegramm chanel - t.me/theprotrade

Telegramm chanel - t.me/theprotrade

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.