OPEN-SOURCE SCRIPT

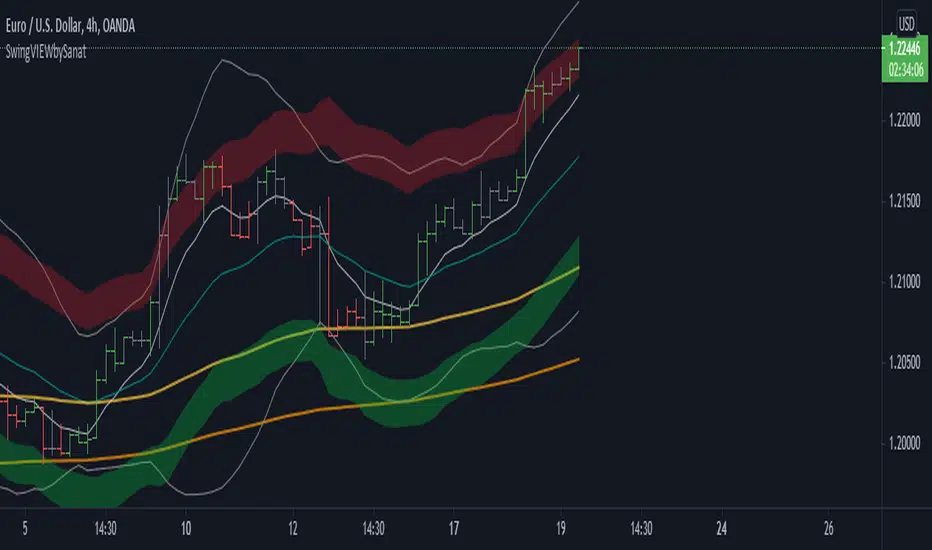

Diupdate SVIEW

This is momentum based indicator

Input

1. Two EMA

2. Stochastic

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

29 minutes ago

Release Notes:

This is combination of

1. Ema diff

2. stochastic

3. Keltner channel

4. Bollinger bands

5. bunch of EMAs

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

Input

1. Two EMA

2. Stochastic

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

29 minutes ago

Release Notes:

This is combination of

1. Ema diff

2. stochastic

3. Keltner channel

4. Bollinger bands

5. bunch of EMAs

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

Catatan Rilis

Default layout simplifiedLogic for bar color modified

Catatan Rilis

update in this version1. for bar color, smooth stochastic used in place of stochastic

2. default layout made visually more simple

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.