PROTECTED SOURCE SCRIPT

PPO+Stoch_MTM

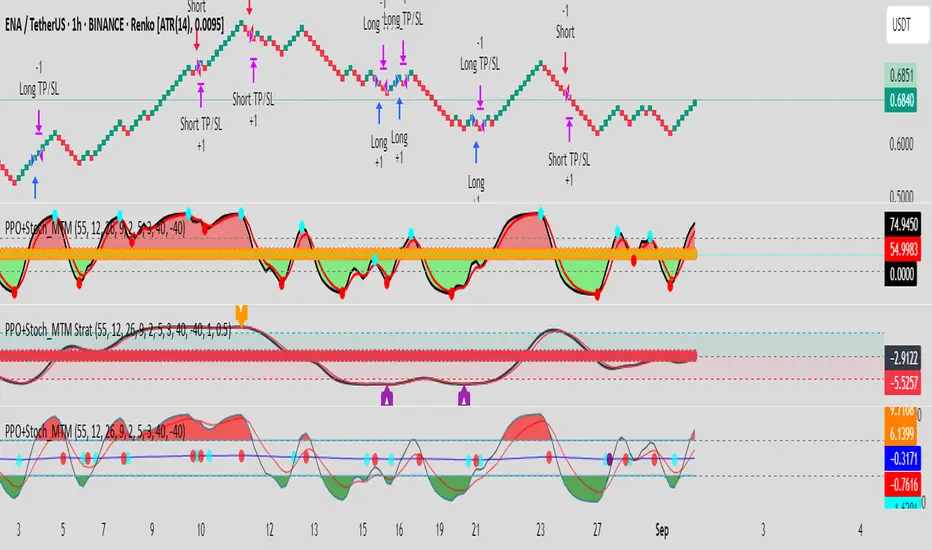

PPO + Stoch_MTM (SMI) — Description

Version: Pine v6

What this indicator does

Computes a PPO (Percentage Price Oscillator) and a smoothed SMI-like stochastic (Stoch_MTM), plots both and their signals in one pane.

Shows histogram of PPO momentum (PPO − PPO signal), SMI (K) and SMI signal (D).

Detects and marks simple bullish / bearish divergences on SMI and PPO (visual lines + markers).

Draws SMI pivot tops / bottoms (small crosses) for structure reference.

Optionally fills the area above/below zero for quick buy/sell zone visualization.

Default inputs (exposed)

Use long term Divergences? = true

Lookback Period = 55

PPO: Fast Length = 12, Slow Length = 26, Signal Length = 9, Smoother = 2

SMI: Percent K Length = 5, Percent D Length = 3

Overbought = 40, Oversold = −40

Toggle options: show/hide PPO plots, SMI plots, divergences, pivots, and SMI zone fill

Plots & visuals

PPO (line), PPO signal (line), PPO histogram (columns)

SMI K (black line) and SMI D (red line)

Overbought / Oversold levels (dashed lines) and zero line (dotted)

Colored semi-transparent fill: green when SMI > 0, red when SMI < 0 (optional)

Divergence lines: purple for bullish, orange for bearish (drawn between indicator swings)

Markers: small labeled shapes for BUY / SELL triggers (basic cross confirmations)

Buy / Sell signal logic (default example)

Buy: PPO histogram > 0 and SMI crosses above SMI signal (simple confirmation)

Sell: PPO histogram < 0 and SMI crosses below SMI signal

Divergences and pivots are visual aids — combine with price action and risk rules.

How to use (practical notes)

Use longer timeframes or appropriately sized Renko bricks for reduced whipsaw; this indicator is an oscillator, not a standalone order system.

Treat divergence lines as early warning / context — validate with price structure (higher highs / lower lows).

Use the show/hide toggles to declutter the pane depending on your workflow.

Add alerts on the BUY/SELL signal shapes or custom alertcondition(...) if you want push/WebHook alerts.

Limitations & risks

Not a guarantee of profitability — oscillators produce false signals in strong trends or during low liquidity.

Divergence detection is simplified to be robust and fast; proprietary divergence engines may behave differently.

Backtest any rule set before live trading; apply position sizing and risk controls.

Recommended quick start

Add indicator to chart with defaults.

Test visually on 1H / 4H (or Renko charts scaled to ATR-based brick) to see signal behaviour.

Use PPO histogram + SMI K/D cross for entry signals; require price structure confirmation for trade entry.

Add stop-loss (recent swing low/high) and fixed risk per trade (e.g., 0.25–1% equity).

Version: Pine v6

What this indicator does

Computes a PPO (Percentage Price Oscillator) and a smoothed SMI-like stochastic (Stoch_MTM), plots both and their signals in one pane.

Shows histogram of PPO momentum (PPO − PPO signal), SMI (K) and SMI signal (D).

Detects and marks simple bullish / bearish divergences on SMI and PPO (visual lines + markers).

Draws SMI pivot tops / bottoms (small crosses) for structure reference.

Optionally fills the area above/below zero for quick buy/sell zone visualization.

Default inputs (exposed)

Use long term Divergences? = true

Lookback Period = 55

PPO: Fast Length = 12, Slow Length = 26, Signal Length = 9, Smoother = 2

SMI: Percent K Length = 5, Percent D Length = 3

Overbought = 40, Oversold = −40

Toggle options: show/hide PPO plots, SMI plots, divergences, pivots, and SMI zone fill

Plots & visuals

PPO (line), PPO signal (line), PPO histogram (columns)

SMI K (black line) and SMI D (red line)

Overbought / Oversold levels (dashed lines) and zero line (dotted)

Colored semi-transparent fill: green when SMI > 0, red when SMI < 0 (optional)

Divergence lines: purple for bullish, orange for bearish (drawn between indicator swings)

Markers: small labeled shapes for BUY / SELL triggers (basic cross confirmations)

Buy / Sell signal logic (default example)

Buy: PPO histogram > 0 and SMI crosses above SMI signal (simple confirmation)

Sell: PPO histogram < 0 and SMI crosses below SMI signal

Divergences and pivots are visual aids — combine with price action and risk rules.

How to use (practical notes)

Use longer timeframes or appropriately sized Renko bricks for reduced whipsaw; this indicator is an oscillator, not a standalone order system.

Treat divergence lines as early warning / context — validate with price structure (higher highs / lower lows).

Use the show/hide toggles to declutter the pane depending on your workflow.

Add alerts on the BUY/SELL signal shapes or custom alertcondition(...) if you want push/WebHook alerts.

Limitations & risks

Not a guarantee of profitability — oscillators produce false signals in strong trends or during low liquidity.

Divergence detection is simplified to be robust and fast; proprietary divergence engines may behave differently.

Backtest any rule set before live trading; apply position sizing and risk controls.

Recommended quick start

Add indicator to chart with defaults.

Test visually on 1H / 4H (or Renko charts scaled to ATR-based brick) to see signal behaviour.

Use PPO histogram + SMI K/D cross for entry signals; require price structure confirmation for trade entry.

Add stop-loss (recent swing low/high) and fixed risk per trade (e.g., 0.25–1% equity).

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, anda dapat menggunakannya secara bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, anda dapat menggunakannya secara bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.