OPEN-SOURCE SCRIPT

London ORB + Session High/Low + FVG

London ORB + Session High/Low + FVG

📘 Script Description: London ORB + Session High/Low + Fair Value Gap

This script is designed to assist intraday traders during the London session open by combining:

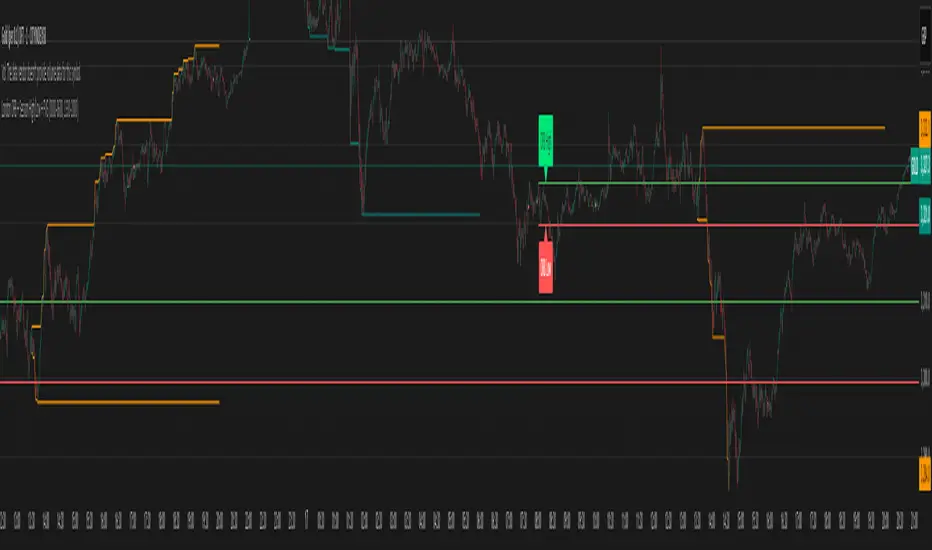

🕒 1. Opening Range Breakout (ORB)

Captures the high and low of the first 15-minute candle after the London open (08:00–08:15 GMT).

Draws lines and labels for the ORB High and Low levels.

Detects breakouts above or below the ORB and plots a triangle signal at the breakout bar.

🌐 2. Asian & US Session Levels

Automatically marks the highs and lows of the Asian (00:00–06:00 GMT) and US (13:30–20:00 GMT) sessions.

Useful for identifying prior session liquidity zones, key support/resistance levels, and potential reaction areas.

📉 3. Fair Value Gaps (FVG)

Highlights imbalances in price action between non-overlapping candles (also known as FVGs or inefficiencies).

Draws a shaded box between candles where gaps exist:

Green for bullish FVGs

Red for bearish FVGs

🔔 4. Alert Support

Optional alerts are built in for:

Long breakout (price breaks above ORB)

Short breakout (price breaks below ORB)

🎯 Use Case

Perfect for:

Day traders looking to capitalize on early volatility at the London open

Traders using liquidity-based strategies, retests, or gap-fills

Visualizing and aligning with prior session highs/lows for structure and context

📘 Script Description: London ORB + Session High/Low + Fair Value Gap

This script is designed to assist intraday traders during the London session open by combining:

🕒 1. Opening Range Breakout (ORB)

Captures the high and low of the first 15-minute candle after the London open (08:00–08:15 GMT).

Draws lines and labels for the ORB High and Low levels.

Detects breakouts above or below the ORB and plots a triangle signal at the breakout bar.

🌐 2. Asian & US Session Levels

Automatically marks the highs and lows of the Asian (00:00–06:00 GMT) and US (13:30–20:00 GMT) sessions.

Useful for identifying prior session liquidity zones, key support/resistance levels, and potential reaction areas.

📉 3. Fair Value Gaps (FVG)

Highlights imbalances in price action between non-overlapping candles (also known as FVGs or inefficiencies).

Draws a shaded box between candles where gaps exist:

Green for bullish FVGs

Red for bearish FVGs

🔔 4. Alert Support

Optional alerts are built in for:

Long breakout (price breaks above ORB)

Short breakout (price breaks below ORB)

🎯 Use Case

Perfect for:

Day traders looking to capitalize on early volatility at the London open

Traders using liquidity-based strategies, retests, or gap-fills

Visualizing and aligning with prior session highs/lows for structure and context

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.