OPEN-SOURCE SCRIPT

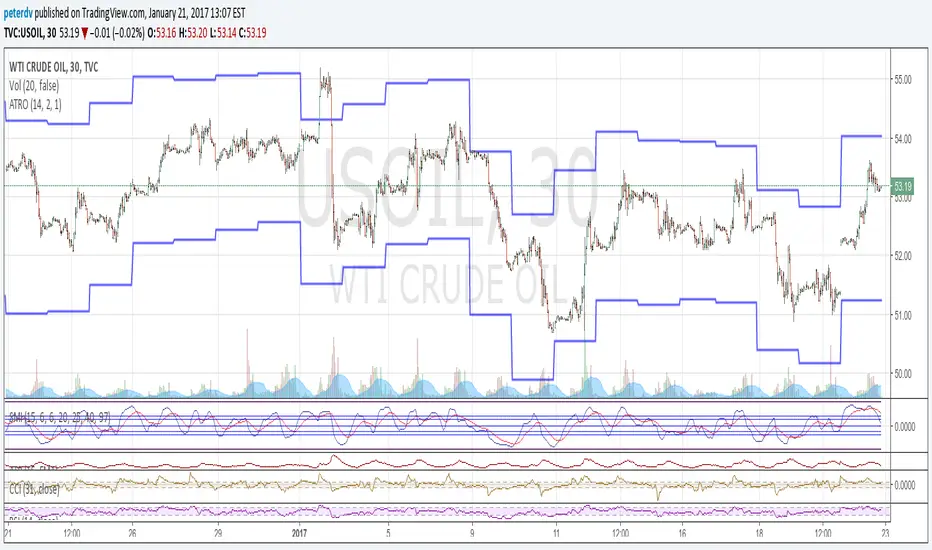

Average True Range Overlay

Plots ATR calculated on a daily basis as an overlay on the current chart.

Implemented using the builtin atr function.

ATR is a volatility indicator

originally developed by J. Welles Wilder, Jr. for commodities:

New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research. ISBN 978-0-89459-027-6.

The range of a day's trading is simply R = high − low.

The true range extends it to yesterday's closing price if it was outside of today's range:

TR = max[(high-low), abs(high-close(previous)), abs(low - close(previous))]

The average true range is an N-day smoothed moving average of the TR values.

A first stab at a sensible stop loss level might be 3*ATR below recent peak.

Implemented using the builtin atr function.

ATR is a volatility indicator

originally developed by J. Welles Wilder, Jr. for commodities:

New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research. ISBN 978-0-89459-027-6.

The range of a day's trading is simply R = high − low.

The true range extends it to yesterday's closing price if it was outside of today's range:

TR = max[(high-low), abs(high-close(previous)), abs(low - close(previous))]

The average true range is an N-day smoothed moving average of the TR values.

A first stab at a sensible stop loss level might be 3*ATR below recent peak.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.