OPEN-SOURCE SCRIPT

CHAN CRYPTO RS

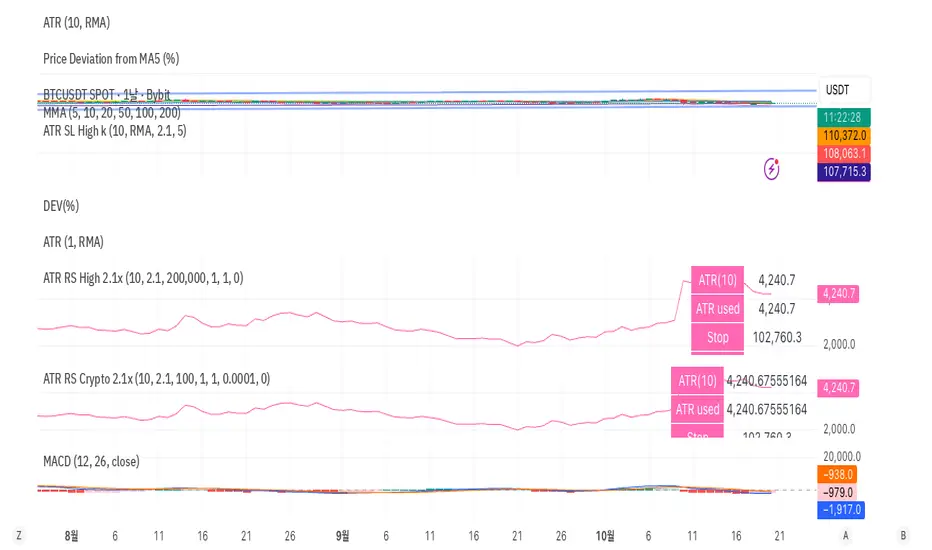

🩷 ATR RS (Crypto / High-based 2.1x, Decimal Safe v2)

This indicator is designed for crypto position sizing and stop calculation using ATR-based risk management. It helps traders automatically determine the stop price, per-unit risk, and optimal position size based on a fixed risk amount in USDT.

🔧 Core Logic

ATR Length (Daily RMA) — calculates the daily Average True Range (ATR) using RMA smoothing.

ATR Multiplier (2.1× default) — defines how far the stop is placed from the daily high.

Stop Price (for Longs) = Daily High − ATR × Multiplier

Per-Unit Risk = (Entry − Stop) × Point Value

Position Size = Risk Amount ÷ Per-Unit Risk

Automatically handles decimal precision for micro-priced crypto assets (e.g., PEPE, SHIB).

Includes safeguards for minimum size and maximum position caps.

💡 Features

Uses Daily ATR without lookahead (no repainting).

Dynamically switches between current and previous ATR for stable results when the daily bar isn’t yet confirmed.

“Snap to tick” ensures stop prices align with the symbol’s tick size.

Table display summarizes ATR, stop price, per-unit risk, total risk, size, and bet amount.

Optional stop label on the chart for visual clarity.

🧮 Output Table

Metric Description

ATR(10) Daily RMA-based ATR

ATR used Chosen ATR (current or previous)

Stop Calculated stop price

Per-unit Risk per coin/unit

Risk Total risk in USDT

Size Optimal position size

Bet Total position value (Entry × Size)

🧠 Ideal For

Crypto traders who use fixed-risk ATR strategies and need precise, decimal-safe position sizing even for ultra-low-priced tokens.

This indicator is designed for crypto position sizing and stop calculation using ATR-based risk management. It helps traders automatically determine the stop price, per-unit risk, and optimal position size based on a fixed risk amount in USDT.

🔧 Core Logic

ATR Length (Daily RMA) — calculates the daily Average True Range (ATR) using RMA smoothing.

ATR Multiplier (2.1× default) — defines how far the stop is placed from the daily high.

Stop Price (for Longs) = Daily High − ATR × Multiplier

Per-Unit Risk = (Entry − Stop) × Point Value

Position Size = Risk Amount ÷ Per-Unit Risk

Automatically handles decimal precision for micro-priced crypto assets (e.g., PEPE, SHIB).

Includes safeguards for minimum size and maximum position caps.

💡 Features

Uses Daily ATR without lookahead (no repainting).

Dynamically switches between current and previous ATR for stable results when the daily bar isn’t yet confirmed.

“Snap to tick” ensures stop prices align with the symbol’s tick size.

Table display summarizes ATR, stop price, per-unit risk, total risk, size, and bet amount.

Optional stop label on the chart for visual clarity.

🧮 Output Table

Metric Description

ATR(10) Daily RMA-based ATR

ATR used Chosen ATR (current or previous)

Stop Calculated stop price

Per-unit Risk per coin/unit

Risk Total risk in USDT

Size Optimal position size

Bet Total position value (Entry × Size)

🧠 Ideal For

Crypto traders who use fixed-risk ATR strategies and need precise, decimal-safe position sizing even for ultra-low-priced tokens.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.