OPEN-SOURCE SCRIPT

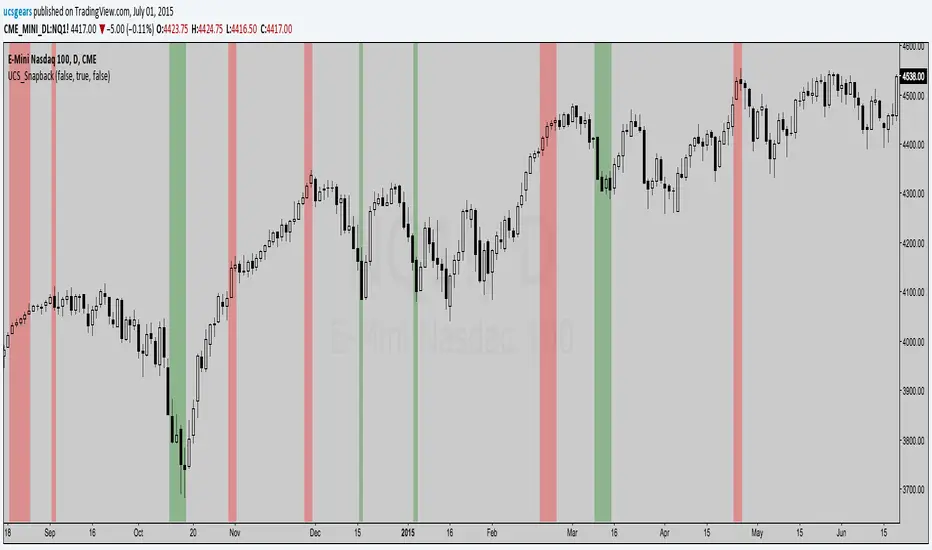

UCS_Extreme Snap Back (TVI)

I am calling it a SNAP BACK indicator.

Utilizing the TVI (Transactional Value Index - Link below for indicator / setups)

You can pretty much guess when any instrument could slow down, last stand in a pullback and the last few candles before losing its strong trend.

It varies per person, a short term trader can use this, Long term traders can hedge with options.

A great tool for my trading. Thought I will share this.

This utilizes TVI indicator, currently the TVI is manipulated manually, I have automated a version for future release.

Embrace trading - keep the money flowing.

Utilizing the TVI (Transactional Value Index - Link below for indicator / setups)

You can pretty much guess when any instrument could slow down, last stand in a pullback and the last few candles before losing its strong trend.

It varies per person, a short term trader can use this, Long term traders can hedge with options.

A great tool for my trading. Thought I will share this.

This utilizes TVI indicator, currently the TVI is manipulated manually, I have automated a version for future release.

Embrace trading - keep the money flowing.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Uday C Santhakumar

udaycs.substack.com/

udaycs.substack.com/

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Uday C Santhakumar

udaycs.substack.com/

udaycs.substack.com/

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.