OPEN-SOURCE SCRIPT

Diupdate DOW Theory Price Action Multi-Time Frame

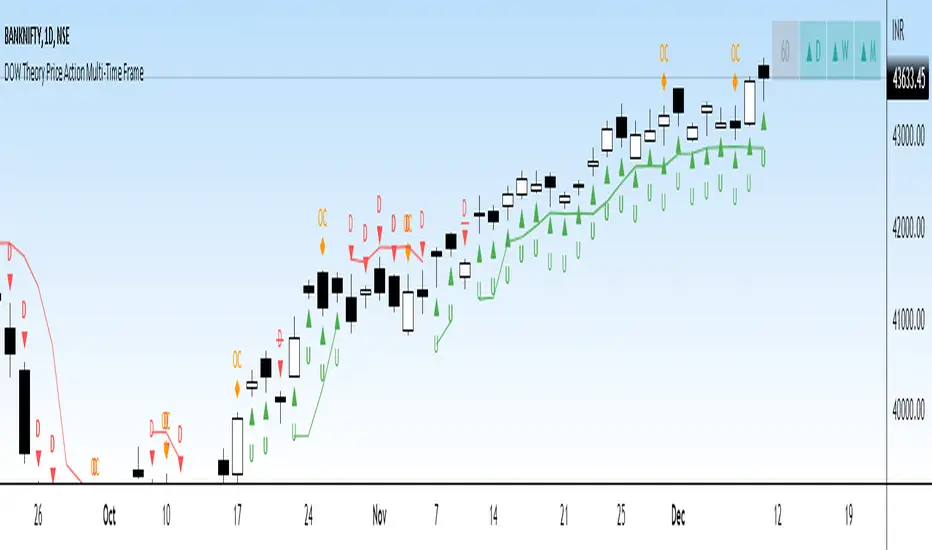

This indicator gives a visual representation of Dow Theory Price action based trend analysis and provides trader a table with 4 different timeframe to align with the trend.

It will help traders identify if it is an ongoing Impulse Wave or a Corrective Wave.

3 rules for Bullish Price Action setup (Uptrend or continuation of existing UpTrend): Denoted by 'U' below the candlestic

HH - Higher High

HL - Higher Low

CAH - Close above prior High

3 rules for Bearish Price Action setup (Downtrend or continuation of existing DownTrend): Denoted by 'D' below the candlestic

LH - Lower High

HL - LowerLow

CAH - Close below prior Low

Exception - Outside Candle: Denoted by 'OC' above the candlestic

Outside reversal is a two-day price pattern that shows when a candle or bar on a candlestick or bar chart falls “outside” of the previous day's candle or bar.

The table posistion can be set be user from the input settings as per his screen setting / resolution.

The trailing line can is also customizable from inputs, recomended value is 3-4.

Ideation Credits: Mr. Vineet Jain

It will help traders identify if it is an ongoing Impulse Wave or a Corrective Wave.

3 rules for Bullish Price Action setup (Uptrend or continuation of existing UpTrend): Denoted by 'U' below the candlestic

HH - Higher High

HL - Higher Low

CAH - Close above prior High

3 rules for Bearish Price Action setup (Downtrend or continuation of existing DownTrend): Denoted by 'D' below the candlestic

LH - Lower High

HL - LowerLow

CAH - Close below prior Low

Exception - Outside Candle: Denoted by 'OC' above the candlestic

Outside reversal is a two-day price pattern that shows when a candle or bar on a candlestick or bar chart falls “outside” of the previous day's candle or bar.

The table posistion can be set be user from the input settings as per his screen setting / resolution.

The trailing line can is also customizable from inputs, recomended value is 3-4.

Ideation Credits: Mr. Vineet Jain

Catatan Rilis

Fixed the code where it the trend was an existing trend was changing without a valid DOW Theory Price action condition becoming true.Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.