PROTECTED SOURCE SCRIPT

[Jett.][GoldenRush] Market Direction

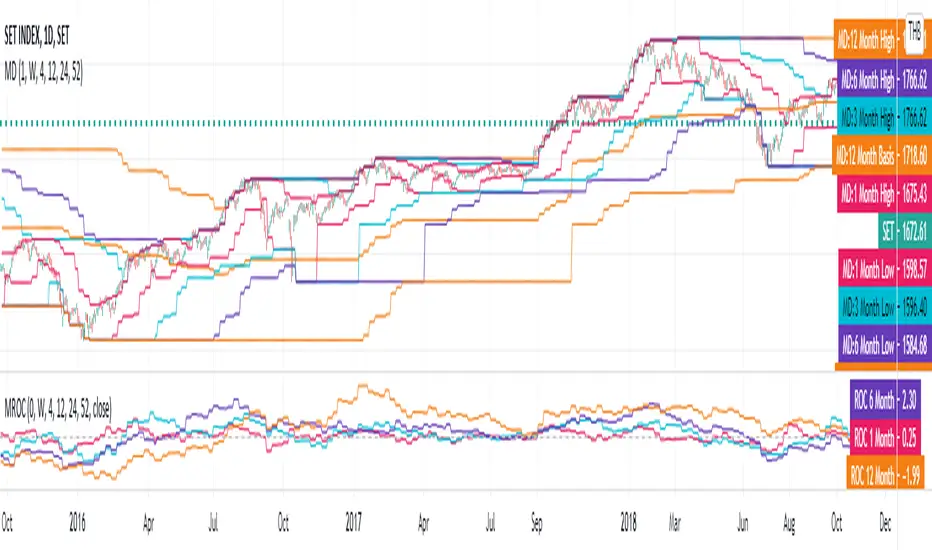

This script was created to analyze levels of market trends.

This is an indicator that is used to analyze the overall 2 levels.

1.Considering the index's key trends (Strategic Level)

2.Trend Analysis (Tactical Level)

To get a big overview of the trend and catch short-term movements. In this indicator, there are 4 levels of momentum measurements.

with the default setting

Major trends (Strategic Level)

1.We have the highest and lowest prices in the 52-week or 1-year scale.

2.We use the average of the highest and lowest prices(basis of 52-week). can be filtering the overview of the trend

3.As for the trend in 24-week or 6-month. Used to find the direction of the price And helps confirm that a trend is starting to take a certain direction.

Sub-level trend (Tactical Level)

1.Price in the level 12-week or 3-month. We use it to calculate the direction of movement in the short term, it is possible that the market will be bullish or bearish in 3-month.

2.And the 12-week or 3-month price is a confirmation of how strongly the short-term price moves in any direction.

3.If there will be a correction of the price base 12 weeks or 3-month price swings always happen first.

4.The 1-month price is the same as the trigger, if the market has a breakout in any way it could mean the start of a short sway.

By this indicator Besides being used to measure direction or trend, it can also be used as a significant filter for both support and resistance for short, medium, long term.

Jet.T.S. Trader

This is an indicator that is used to analyze the overall 2 levels.

1.Considering the index's key trends (Strategic Level)

2.Trend Analysis (Tactical Level)

To get a big overview of the trend and catch short-term movements. In this indicator, there are 4 levels of momentum measurements.

with the default setting

Major trends (Strategic Level)

1.We have the highest and lowest prices in the 52-week or 1-year scale.

2.We use the average of the highest and lowest prices(basis of 52-week). can be filtering the overview of the trend

3.As for the trend in 24-week or 6-month. Used to find the direction of the price And helps confirm that a trend is starting to take a certain direction.

Sub-level trend (Tactical Level)

1.Price in the level 12-week or 3-month. We use it to calculate the direction of movement in the short term, it is possible that the market will be bullish or bearish in 3-month.

2.And the 12-week or 3-month price is a confirmation of how strongly the short-term price moves in any direction.

3.If there will be a correction of the price base 12 weeks or 3-month price swings always happen first.

4.The 1-month price is the same as the trigger, if the market has a breakout in any way it could mean the start of a short sway.

By this indicator Besides being used to measure direction or trend, it can also be used as a significant filter for both support and resistance for short, medium, long term.

Jet.T.S. Trader

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, Anda dapat menggunakannya dengan bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, Anda dapat menggunakannya dengan bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.