OPEN-SOURCE SCRIPT

Diupdate Pi Cycle MACD Inverse Oscillator

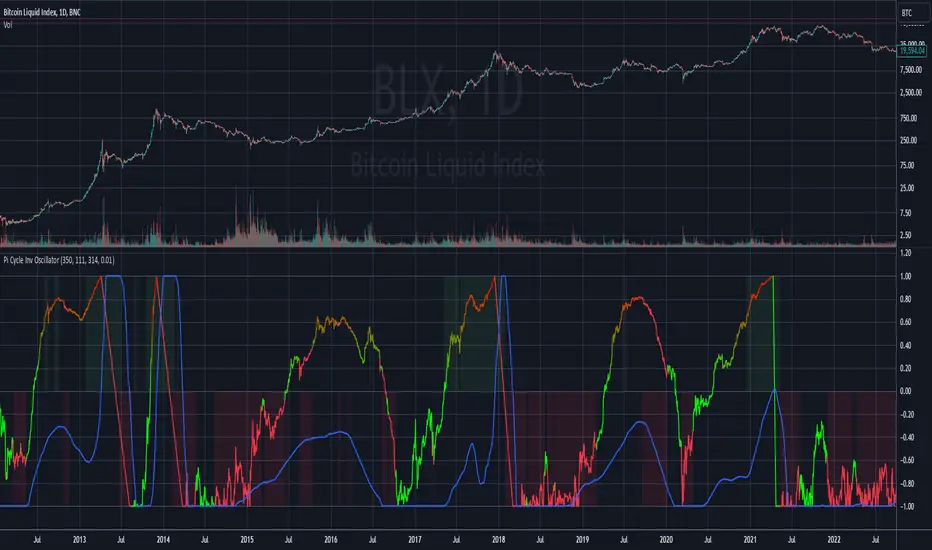

Pi Cycle MACD Inverse Oscillator with Gradient and Days Since Last Top

This indicator is ideal for Bitcoin traders seeking a robust tool to visualize long-term and short-term trends with enhanced clarity and actionable insights.

This script combines the concept of the Pi Cycle indicator with a unique MACD-based inverse oscillator to analyze Bitcoin market trends. It introduces several features to help traders understand market conditions better:

Inverse Oscillator:

- Oscillator ranges between 1 and -1.

- A value of 1 indicates the two moving averages (350 MA and 111 MA) are equal.

- A value of -1 indicates the maximum observed distance between the moving averages during the selected lookback period.

- The oscillator dynamically adjusts to price changes using a configurable scaling factor.

Gradient Visualization:

The oscillator line transitions smoothly from green (closer to -1) to yellow (at 0) and red (closer to 1).

The color gradient provides a quick visual cue for market momentum.

Days Since Last Pi Cycle Top:

Calculates and displays the number of days since the last "Pi Cycle Top" (defined as a crossover between the two moving averages).

The label updates dynamically and appears only on the most recent bar.

Conditional Fill:

Highlights the area between 0 and 1 with a green gradient when the price is above the long moving average.

Enhances visual understanding of the oscillator's position relative to key thresholds.

Inputs:

- Long Moving Average (350 default): Determines the primary trend.

- Short Moving Average (111 default): Measures shorter-term momentum.

- Oscillator Lookback Period (100 default): Defines the range for normalizing the oscillator.

- Price Scaling Factor (0.01 default): Adjusts the normalization to account for large price fluctuations.

How to Use:

- Use the oscillator to identify potential reversal points and trend momentum.

- Look for transitions in the gradient color and the position relative to 0.

- Monitor the "Days Since Last Top" label for insights into the market's cycle timing.

- Utilize the conditional fill to quickly assess when the market is in a favorable position above the long moving average.

This indicator is ideal for Bitcoin traders seeking a robust tool to visualize long-term and short-term trends with enhanced clarity and actionable insights.

This script combines the concept of the Pi Cycle indicator with a unique MACD-based inverse oscillator to analyze Bitcoin market trends. It introduces several features to help traders understand market conditions better:

Inverse Oscillator:

- Oscillator ranges between 1 and -1.

- A value of 1 indicates the two moving averages (350 MA and 111 MA) are equal.

- A value of -1 indicates the maximum observed distance between the moving averages during the selected lookback period.

- The oscillator dynamically adjusts to price changes using a configurable scaling factor.

Gradient Visualization:

The oscillator line transitions smoothly from green (closer to -1) to yellow (at 0) and red (closer to 1).

The color gradient provides a quick visual cue for market momentum.

Days Since Last Pi Cycle Top:

Calculates and displays the number of days since the last "Pi Cycle Top" (defined as a crossover between the two moving averages).

The label updates dynamically and appears only on the most recent bar.

Conditional Fill:

Highlights the area between 0 and 1 with a green gradient when the price is above the long moving average.

Enhances visual understanding of the oscillator's position relative to key thresholds.

Inputs:

- Long Moving Average (350 default): Determines the primary trend.

- Short Moving Average (111 default): Measures shorter-term momentum.

- Oscillator Lookback Period (100 default): Defines the range for normalizing the oscillator.

- Price Scaling Factor (0.01 default): Adjusts the normalization to account for large price fluctuations.

How to Use:

- Use the oscillator to identify potential reversal points and trend momentum.

- Look for transitions in the gradient color and the position relative to 0.

- Monitor the "Days Since Last Top" label for insights into the market's cycle timing.

- Utilize the conditional fill to quickly assess when the market is in a favorable position above the long moving average.

Catatan Rilis

set default lookback period 314 daysCatatan Rilis

set background colour to:- green if the price is abovethe long MA

- orange if price is between the short and long moving averages

- red if the price is below the short MA

Catatan Rilis

Fixed time series to daily so the oscilator works on any time frameCatatan Rilis

Added parameter "Use Fixed BLX Bitcoin Ticker?" to allow either using the currency pair of the current chart in the oscilator calculations, or use the BLX bitcoin ticker in the oscillator calculations regardles of the current chart currenty pair.Catatan Rilis

added optional Normalized MA Distance plotThe Normalized Moving Average Distance provides a scaled comparison of the relative difference between the short and long moving averages (MAs) on the same oscillator scale (-1 to 1). By normalizing the MA distance, the script allows traders to observe the dynamic relationship between the MAs regardless of price level, highlighting trends and shifts more effectively. This is especially useful for spotting changes in momentum and identifying key convergence or divergence points in the market. The normalization ensures consistency across different assets or timeframes, making it a versatile tool for technical analysis.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.