OPEN-SOURCE SCRIPT

Diupdate Risk Volume Calculator

Bid volume calculation from average volatility

On label (top to bot):

Percents - averaged by [smoothing] moving in timeframe resolution

Cash - selected risk volume in usdt

Lots - bid volume in lots wich moving in Percents with used leverage is Cash

U can switch on channels to visualise volatility*2 channel or stakan settings

On label (top to bot):

Percents - averaged by [smoothing] moving in timeframe resolution

Cash - selected risk volume in usdt

Lots - bid volume in lots wich moving in Percents with used leverage is Cash

U can switch on channels to visualise volatility*2 channel or stakan settings

Catatan Rilis

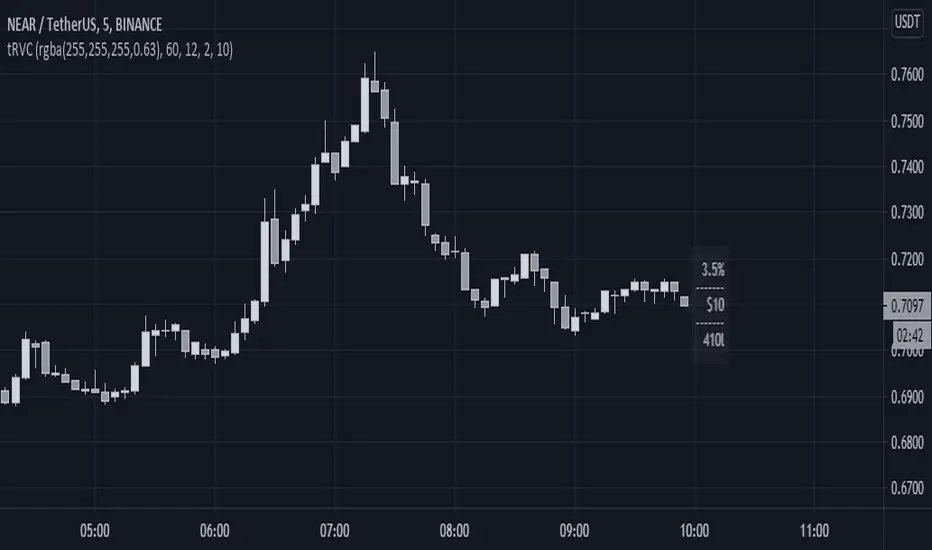

Position volume calculation based on the average instrument volatility and the amount of risk in base currencyOn label (top to bot):

Percents (0.6%) - average moving in selected resolution

Cash ($10) - risk volume in base currency

Lots (2.77l) - the volume of the bet with a 0.6% move will create a profit or loss of 10

U can switch on channels to visualise volatility*2 channel or stakan settings

Catatan Rilis

Position volume calculation based on the average instrument volatility as amount of risk in base currencyOn label (top to bot):

Percents (1.7%) - average moving in selected resolution (60)

Cash ($10) - risk amount in base currency

Lots (19.613l) - the volume of bet wich 1.7% moving create a profit or loss of $10

U can switch on channels to visualise volatility*2 channel

Catatan Rilis

Added smart lots volume rounderSkrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.