OPEN-SOURCE SCRIPT

Understanding order sizes

type: properties manipulation, no programming needed

time required: 15minutes, at least

level: medium (need to know contracts, trading pairs)

A strategy can "appear" to work or be broken depending on the pile of cash that is working on. This amount is defined in the strat properties, under "order size".

For noobs (like me) this is very confusing at first :)

A strat opens/closes positions using units, a generic measure for the chart being operated on. Thes "units" can be a fixed amount of cash, a fixed amount of contracts, or a floating amount based on the last profits made. I recommend checking my previous strat to figure the case of contracts .

So, any trading price is the amount of "things" you get for some "cash". The things are the first unit, the "cash" is the second. Some examples:

XAU/USD - 1 xau oz is worth x dollars

BTC/USD - 1 bitcoin is worth x dollars

GBP/EUR - 1 pound is worth x euros

To add to confusion, a lot of markets the "unit size" is different from what the strat thinks it is. An options contract is 100 shares(the unit), 1 xau contract is 10 oz(units), 1 eur/usd contract is 100k euros and so on... so, after figuring out how the sizes work in a strat, then the sizes must be adapted for the specific market in question.

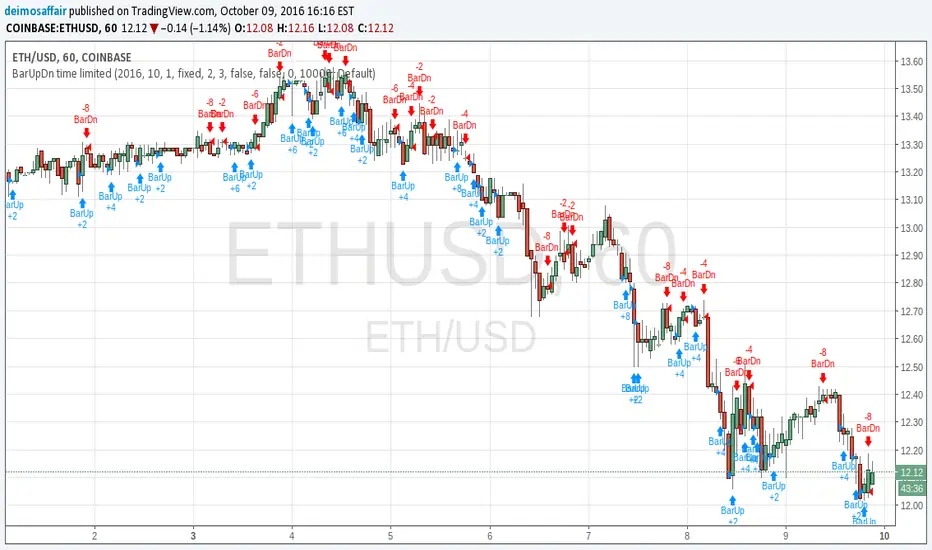

The choice os using the ETHUSD pair is because:

1 - you can buy 1eth, unlike a gold contract for example, so 1 "unit" = 1 eth, easier to get

2 - ETH is around 12 bucks, wich gives round numbers on the math, easier to wrap the brains around :)

3- is an unusual pair, so the regular contract sizes don't apply, and the brain is not conditioned to work inside the box ;)

You will have to access the script properties, to change the values. As these values are changed you will see exactly the differences in the values of the strat.

Text is too long, check the comments for all the cases

time required: 15minutes, at least

level: medium (need to know contracts, trading pairs)

A strategy can "appear" to work or be broken depending on the pile of cash that is working on. This amount is defined in the strat properties, under "order size".

For noobs (like me) this is very confusing at first :)

A strat opens/closes positions using units, a generic measure for the chart being operated on. Thes "units" can be a fixed amount of cash, a fixed amount of contracts, or a floating amount based on the last profits made. I recommend checking my previous strat to figure the case of contracts .

So, any trading price is the amount of "things" you get for some "cash". The things are the first unit, the "cash" is the second. Some examples:

XAU/USD - 1 xau oz is worth x dollars

BTC/USD - 1 bitcoin is worth x dollars

GBP/EUR - 1 pound is worth x euros

To add to confusion, a lot of markets the "unit size" is different from what the strat thinks it is. An options contract is 100 shares(the unit), 1 xau contract is 10 oz(units), 1 eur/usd contract is 100k euros and so on... so, after figuring out how the sizes work in a strat, then the sizes must be adapted for the specific market in question.

The choice os using the ETHUSD pair is because:

1 - you can buy 1eth, unlike a gold contract for example, so 1 "unit" = 1 eth, easier to get

2 - ETH is around 12 bucks, wich gives round numbers on the math, easier to wrap the brains around :)

3- is an unusual pair, so the regular contract sizes don't apply, and the brain is not conditioned to work inside the box ;)

You will have to access the script properties, to change the values. As these values are changed you will see exactly the differences in the values of the strat.

Text is too long, check the comments for all the cases

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.