PROTECTED SOURCE SCRIPT

ASE Additionals v1

ASE Additionals is a statistics-driven indicator that combines multiple features to provide traders with valuable statistics to help their trading. This indicator offers a customizable table that includes statistics for VWAP with customizable standard deviation waves.

Per the empirical rule, the following is a schedule for what percent of volume should be traded between the standard deviation range:

The statistics table presents five different pieces of data

Given the user’s inputs, they will see the upper and lower extremes of the day. For example, if the user changed the inner st. dev input to 2, 95.44% of the volume should be traded within the inner band. If the user changed the outer st. dev input to 3, 99.73% of the volume should be traded within the outer band. Thus, statistically, 2.145% ((99.73%-95.44%)/2) of volume should be traded between the upper and lower band fill.

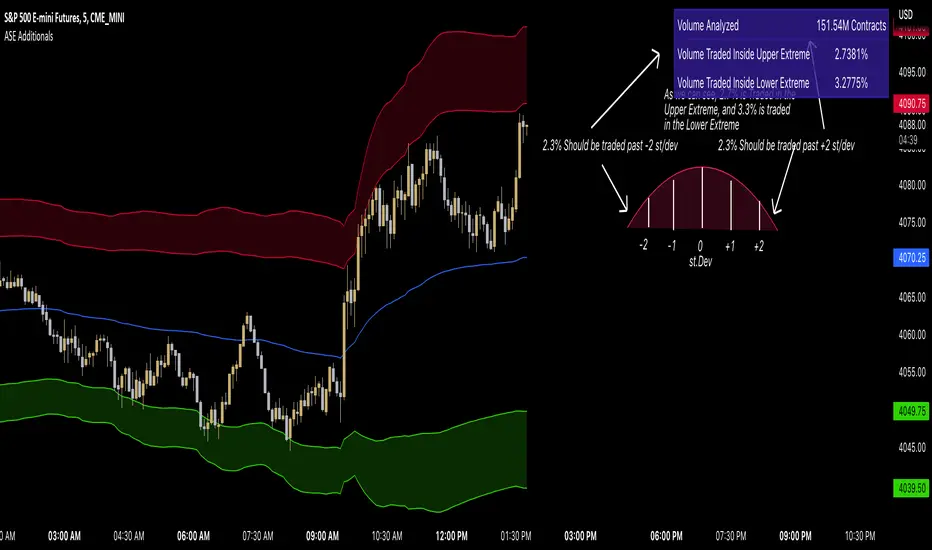

In the chart above, the bands are the 2nd and 3rd standard deviation inputs. We notice that out of the 151 Million Contracts, the actual percentage of volume traded in the upper extreme was 2.7%, and the actual percentage of the volume traded in the lower extreme was 3.3%. Given the empirical rule, about 2.145% of the volume should be traded in the upper extreme band, and 2.145% of the volume should be traded in the lower extreme band. Based on the statistics table, the empirical rule is true when applied to the volume-weighted average price.

The trader should recognize that statistics is all about probability and there is a margin for error, so the bands should be used as a bias, not an entry. For example, given the +/-2 and 3 standard deviations, statistically, if 2.145% of the volume is traded within the upper band extreme, you shouldn’t look for a long trade if the current price is in the band. Likewise, if 2.145% of the volume is traded within the lower band extreme, you shouldn’t look for a short trade if the current price is in the band.

Additionally, we provide traders with the Daily, Weekly, and Monthly OHLC levels. Open, High, Low, and Close are significant levels, especially on major timeframes. Once price has touched the level, the line changes from dashed/dotted to solid.

Features

Settings

How to Use

The VWAP price line acts as the 'Fair Value' or the 'Equilibrium' of the price session. Just as the VWAP Waves show the session's upper and lower extreme possibilities. While we can find entries from VWAP , our analysis uses it more as confirmation. OHLC levels are to be used as support and resistance levels. These levels provide us with great entry and target opportunities as they are essential and can show pivots in price action.

Per the empirical rule, the following is a schedule for what percent of volume should be traded between the standard deviation range:

- +/- 1 standard deviation: 68.26% of volume should be trading within this range

- +/- 2 standard deviation: 95.44% of volume should be trading within this range

- +/- 3 standard deviation: 99.73% of volume should be trading within this range

- +/- 4 standard deviation: 99.9937% of volume should be trading within this range

- +/- 5 standard deviation: 99.999943% of volume should be trading within this range

- +/- 6 standard deviation: 99.9999998% of volume should be trading within this range

The statistics table presents five different pieces of data

- Volume Analyzed: Amount of contracts analyzed for the statistics

- Volume Traded Inside Upper Extreme: Calculated by taking the amount of volume traded inside the Upper Extreme band divided by the total amount of contracts analyzed

- Volume Traded Inside Lower Extreme: Calculated by taking the amount of volume traded inside the Lower Extreme band divided by the total amount of contracts analyzed

Given the user’s inputs, they will see the upper and lower extremes of the day. For example, if the user changed the inner st. dev input to 2, 95.44% of the volume should be traded within the inner band. If the user changed the outer st. dev input to 3, 99.73% of the volume should be traded within the outer band. Thus, statistically, 2.145% ((99.73%-95.44%)/2) of volume should be traded between the upper and lower band fill.

In the chart above, the bands are the 2nd and 3rd standard deviation inputs. We notice that out of the 151 Million Contracts, the actual percentage of volume traded in the upper extreme was 2.7%, and the actual percentage of the volume traded in the lower extreme was 3.3%. Given the empirical rule, about 2.145% of the volume should be traded in the upper extreme band, and 2.145% of the volume should be traded in the lower extreme band. Based on the statistics table, the empirical rule is true when applied to the volume-weighted average price.

The trader should recognize that statistics is all about probability and there is a margin for error, so the bands should be used as a bias, not an entry. For example, given the +/-2 and 3 standard deviations, statistically, if 2.145% of the volume is traded within the upper band extreme, you shouldn’t look for a long trade if the current price is in the band. Likewise, if 2.145% of the volume is traded within the lower band extreme, you shouldn’t look for a short trade if the current price is in the band.

Additionally, we provide traders with the Daily, Weekly, and Monthly OHLC levels. Open, High, Low, and Close are significant levels, especially on major timeframes. Once price has touched the level, the line changes from dashed/dotted to solid.

Features

- VWAP Price line and standard deviation waves to analyze the equilibrium and extremes of the sessions trend

- Previous Day/WEEK/Month OHLC levels provide Major timeframe key levels

Settings

- VWAP Equilibrium: Turn on the VWAP line

- VWAP Waves: Turn on the VWAP standard deviation waves

- Inner St. Dev: Changes the inner band standard deviation to show the percentage of volume traded within

- Outer St. Dev: Changes the outer band standard deviation to show the percentage of volume traded within

- Upper Extreme: Change the color of the upper VWAP wave

- Lower Extreme: Change the color of the lower VWAP wave

- Wave Opacity: Change the opacity of the waves (0= completely transparent, 100=completely solid)

- Statistics Table: Turn on or off the statistics table

- Statistics Table Settings: Change the Table Color, Text Color, Text Size, and Table Position

- Previous Day/Week/Month OHLC: Choose; All, Open, Close, High, Low, and the color of the levels

- OHLC Level Settings: Change the OHLC label color, line style, and line width

How to Use

The VWAP price line acts as the 'Fair Value' or the 'Equilibrium' of the price session. Just as the VWAP Waves show the session's upper and lower extreme possibilities. While we can find entries from VWAP , our analysis uses it more as confirmation. OHLC levels are to be used as support and resistance levels. These levels provide us with great entry and target opportunities as they are essential and can show pivots in price action.

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, Anda dapat menggunakannya dengan bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, Anda dapat menggunakannya dengan bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.