OPEN-SOURCE SCRIPT

Diupdate Strongest Trendline

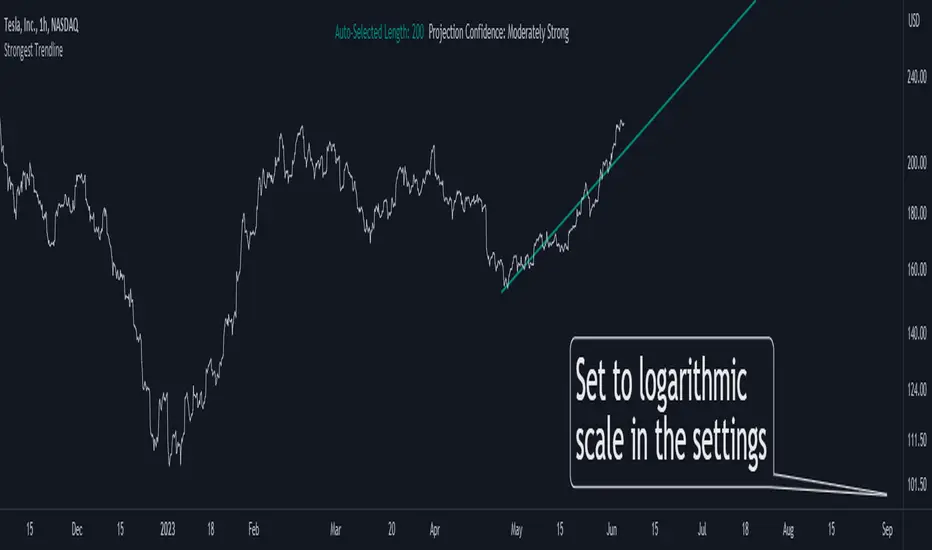

Unleashing the Power of Trendlines with the "Strongest Trendline" Indicator.

Trendlines are an invaluable tool in technical analysis, providing traders with insights into price movements and market trends. The "Strongest Trendline" indicator offers a powerful approach to identifying robust trendlines based on various parameters and technical analysis metrics.

When using the "Strongest Trendline" indicator, it is recommended to utilize a logarithmic scale. This scale accurately represents percentage changes in price, allowing for a more comprehensive visualization of trends. Logarithmic scales highlight the proportional relationship between prices, ensuring that both large and small price movements are given due consideration.

One of the notable advantages of logarithmic scales is their ability to balance price movements on a chart. This prevents larger price changes from dominating the visual representation, providing a more balanced perspective on the overall trend. Logarithmic scales are particularly useful when analyzing assets with significant price fluctuations.

In some cases, traders may need to scroll back on the chart to view the trendlines generated by the "Strongest Trendline" indicator. By scrolling back, traders ensure they have a sufficient historical context to accurately assess the strength and reliability of the trendline. This comprehensive analysis allows for the identification of trendline patterns and correlations between historical price movements and current market conditions.

The "Strongest Trendline" indicator calculates trendlines based on historical data, requiring an adequate number of data points to identify the strongest trend. By scrolling back and considering historical patterns, traders can make more informed trading decisions and identify potential entry or exit points.

When using the "Strongest Trendline" indicator, a higher Pearson's R value signifies a stronger trendline. The closer the Pearson's R value is to 1, the more reliable and robust the trendline is considered to be.

In conclusion, the "Strongest Trendline" indicator offers traders a robust method for identifying trendlines with significant predictive power. By utilizing a logarithmic scale and considering historical data, traders can unleash the full potential of this indicator and gain valuable insights into price trends. Trendlines, when used in conjunction with other technical analysis tools, can help traders make more informed decisions in the dynamic world of financial markets.

Trendlines are an invaluable tool in technical analysis, providing traders with insights into price movements and market trends. The "Strongest Trendline" indicator offers a powerful approach to identifying robust trendlines based on various parameters and technical analysis metrics.

When using the "Strongest Trendline" indicator, it is recommended to utilize a logarithmic scale. This scale accurately represents percentage changes in price, allowing for a more comprehensive visualization of trends. Logarithmic scales highlight the proportional relationship between prices, ensuring that both large and small price movements are given due consideration.

One of the notable advantages of logarithmic scales is their ability to balance price movements on a chart. This prevents larger price changes from dominating the visual representation, providing a more balanced perspective on the overall trend. Logarithmic scales are particularly useful when analyzing assets with significant price fluctuations.

In some cases, traders may need to scroll back on the chart to view the trendlines generated by the "Strongest Trendline" indicator. By scrolling back, traders ensure they have a sufficient historical context to accurately assess the strength and reliability of the trendline. This comprehensive analysis allows for the identification of trendline patterns and correlations between historical price movements and current market conditions.

The "Strongest Trendline" indicator calculates trendlines based on historical data, requiring an adequate number of data points to identify the strongest trend. By scrolling back and considering historical patterns, traders can make more informed trading decisions and identify potential entry or exit points.

When using the "Strongest Trendline" indicator, a higher Pearson's R value signifies a stronger trendline. The closer the Pearson's R value is to 1, the more reliable and robust the trendline is considered to be.

In conclusion, the "Strongest Trendline" indicator offers traders a robust method for identifying trendlines with significant predictive power. By utilizing a logarithmic scale and considering historical data, traders can unleash the full potential of this indicator and gain valuable insights into price trends. Trendlines, when used in conjunction with other technical analysis tools, can help traders make more informed decisions in the dynamic world of financial markets.

Catatan Rilis

I have removed the display of Pearson's correlation coefficient and replaced it with confidence levels in the strength of the trend.Catatan Rilis

Minor bugs fixedCatatan Rilis

Minor bug fixedCatatan Rilis

Just added the phrase "Set to logarithmic scale in the settings" to the chart :)Catatan Rilis

Updated trend strength levels denominationsCatatan Rilis

Colors updatedCatatan Rilis

Added option to display the second strongest trendline.Catatan Rilis

Multiple levels of trend strength addedCatatan Rilis

I have added more lengths to find the best trendline further back in time.I have removed the calculation for the second-best trendline, as it was incorrect.

However, please note that the indicator may take a few seconds to calculate and display the strongest trendline because it utilizes a significant amount of resources.

Catatan Rilis

Auto-Selected Length added at the bottom right of the chart.Catatan Rilis

Minor adjustmentsCatatan Rilis

adjustments to the position of the tables and the colorsCatatan Rilis

Added option for plotting deviation bands.Catatan Rilis

Default channel visibility added and intermediate deviation bands included.Catatan Rilis

I have finally removed the default channel visibility, allowing everyone to add it if desired :)Catatan Rilis

Improved version in terms of calculation speed.Catatan Rilis

Minor updateCatatan Rilis

major update- new ultra-fast version

- bug fixed regarding the longest selected length, which now automatically fits into the available history

Don't forget to use logarithmic scale.

Catatan Rilis

Minor UpdateCatatan Rilis

The Annualized performance corresponding to the period of the Strongest Trendline drawn by the indicator has been added (only displayed in the Daily timeframe).Catatan Rilis

Major Update: This update introduces the 'Most Active Levels' feature. Users can now visualize the price level with the highest trading activity within the trend channel.

This level is calculated based on either the number of price touches or trading volume.

The new options allow users to toggle this feature on/off, choose the calculation method, and customize the line's appearance.

Additionally, users can adjust the channel to center around this most active level for a more refined trend representation.

Catatan Rilis

Minor Update: Two new checkboxes were added to enable or disable the display of the Auto-Selected Period and Projection Confidence table lines.Catatan Rilis

Minor Update: Enabled CAGR calculation for both daily and weekly timeframes.Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Plan the trade ⚡ Trade the plan

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Plan the trade ⚡ Trade the plan

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.