OPEN-SOURCE SCRIPT

Diupdate [blackcat] L2 Ehlers Fisher Adaptive RSI

Level: 2

Background

John F. Ehlers introuced adding the Fisher Transform to the Adaptive RSI in his "Cycle Analytics for Traders" chapter 15 on 2013.

Function

The purpose of the Fisher transform is to take any indicator having a nominally zero mean and bounded between the limits of −1 to +1 and convert the amplitude so that the transformed indicator has an approximate normal probability distribution. The variable MyRSI ranges between zero and one, and therefore to accommodate the conditions for the Fisher transform, this variable must be translated and dilated to range between −1 and +1. If the MyRSI variable does not range fully between zero and one, you can shorten the RSI lookback period to be less than half the measured dominant cycle, or you can simply multiply it by a magnification factor as Dr. Ehlers have done in the code fragment. The amplifying factor was selected to make the indicator rarely exceed the two sigma points in the output. The amplified RSI is then limited to be within the range of −0.999 to +0.999 to avoid a computer crash, and then is used to compute the Fisher transform. The plus and minus two standard deviation levels are included in the indicator display.

Key Signal

Fish --> Fisher Adaptive RSI fast line

Trigger --> Fisher Adaptive RSI slow line

Pros and Cons

100% John F. Ehlers definition translation, even variable names are the same. This help readers who would like to use pine to read his book.

Remarks

The 61th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

John F. Ehlers introuced adding the Fisher Transform to the Adaptive RSI in his "Cycle Analytics for Traders" chapter 15 on 2013.

Function

The purpose of the Fisher transform is to take any indicator having a nominally zero mean and bounded between the limits of −1 to +1 and convert the amplitude so that the transformed indicator has an approximate normal probability distribution. The variable MyRSI ranges between zero and one, and therefore to accommodate the conditions for the Fisher transform, this variable must be translated and dilated to range between −1 and +1. If the MyRSI variable does not range fully between zero and one, you can shorten the RSI lookback period to be less than half the measured dominant cycle, or you can simply multiply it by a magnification factor as Dr. Ehlers have done in the code fragment. The amplifying factor was selected to make the indicator rarely exceed the two sigma points in the output. The amplified RSI is then limited to be within the range of −0.999 to +0.999 to avoid a computer crash, and then is used to compute the Fisher transform. The plus and minus two standard deviation levels are included in the indicator display.

Key Signal

Fish --> Fisher Adaptive RSI fast line

Trigger --> Fisher Adaptive RSI slow line

Pros and Cons

100% John F. Ehlers definition translation, even variable names are the same. This help readers who would like to use pine to read his book.

Remarks

The 61th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Catatan Rilis

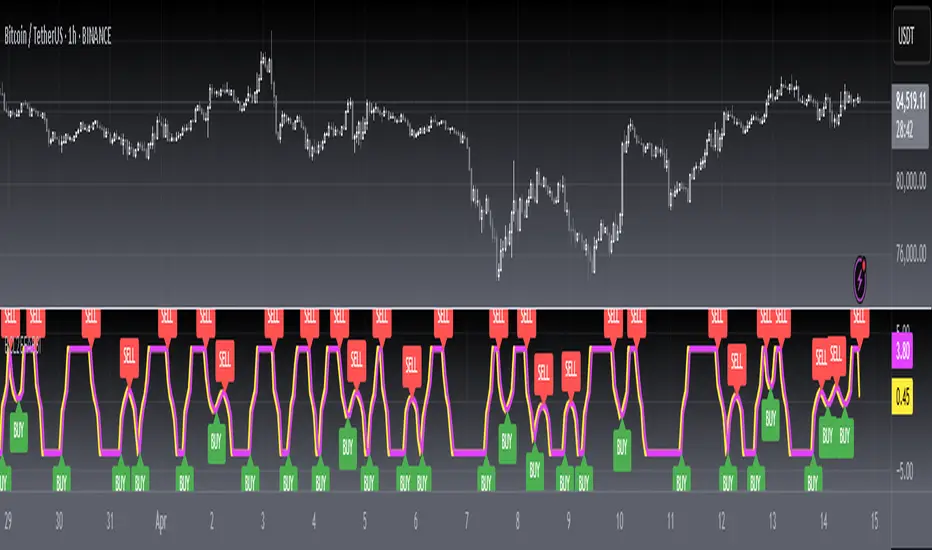

OVERVIEWThe [blackcat] L2 Ehlers Fisher Adaptive RSI indicator combines Ehlers' cycle detection with Fisher Transform to create an adaptive RSI that adapts to market cycles, providing enhanced trading signals.

FEATURES

• Implements Ehlers' cycle detection algorithm

• Features Fisher Transform for signal enhancement

• Calculates adaptive RSI based on dominant cycle periods

• Provides visual buy/sell signals

• Adjustable AvgLength parameter for customization

HOW TO USE

Add the indicator to your chart

Configure the AvgLength input parameter: • Default value: 3 • Range: 1-100

Interpret the signals: • Yellow line represents Fisher-transformed RSI • Fuchsia line shows trigger level • Green labels indicate buy signals • Red labels indicate sell signals

LIMITATIONS

• Performance depends on market conditions

• Requires sufficient historical data

• Best suited for longer timeframes

NOTES

• Dominant cycle range: 10-48 bars

• Fisher RSI bounds: ±0.999

• Labels are plotted with 0.01 offset for visibility

• Uses Pearson correlation for cycle detection

• Maximum of 500 labels displayed at once

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.