OPEN-SOURCE SCRIPT

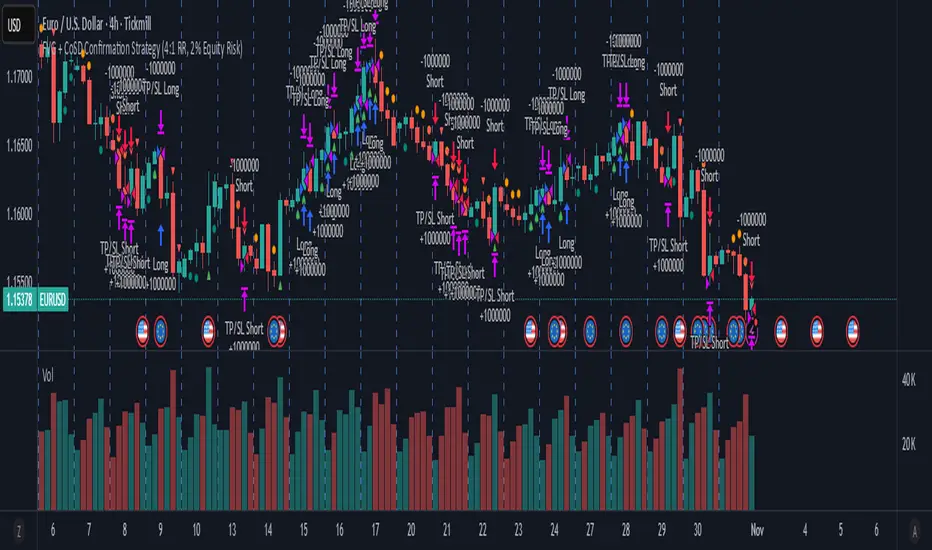

FVG + CoSD Confirmation Strategy (6:1 RR, 2% Equity Risk)

This strategy combines two powerful displacement signals — Fair Value Gaps (FVG) and Change of State of Delivery (CoSD) — to capture high-conviction directional moves. It sets a directional bias when either signal appears, but only enters a trade once both FVG and CoSD confirm in the same direction. This dual-filter approach helps reduce noise and improve entry precision.

Key features:

✅ Bias lock on first signal: Directional bias is set by either FVG or CoSD, but trades only trigger when both align.

✅ 6:1 reward-to-risk targeting: Take profit is set at sixtimes the stop distance, allowing for high-RR setups.

✅ Fixed stop buffer: SL is calculated using a static tick buffer for simplicity and consistency.

✅ Exit on opposing signal: Trades are closed when an opposite FVG or CoSD appears, signaling structural reversal.

📈 Optimized for EURUSD on the 4-hour timeframe, where its structural logic and risk parameters are best aligned with market rhythm and volatility.

This strategy is ideal for traders who want to combine price imbalance with structural confirmation, while maintaining disciplined risk management and directional clarity.

Key features:

✅ Bias lock on first signal: Directional bias is set by either FVG or CoSD, but trades only trigger when both align.

✅ 6:1 reward-to-risk targeting: Take profit is set at sixtimes the stop distance, allowing for high-RR setups.

✅ Fixed stop buffer: SL is calculated using a static tick buffer for simplicity and consistency.

✅ Exit on opposing signal: Trades are closed when an opposite FVG or CoSD appears, signaling structural reversal.

📈 Optimized for EURUSD on the 4-hour timeframe, where its structural logic and risk parameters are best aligned with market rhythm and volatility.

This strategy is ideal for traders who want to combine price imbalance with structural confirmation, while maintaining disciplined risk management and directional clarity.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, penulis skrip ini telah menjadikannya sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Hormat untuk penulisnya! Meskipun anda dapat menggunakannya secara gratis, ingatlah bahwa penerbitan ulang kode tersebut tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, penulis skrip ini telah menjadikannya sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Hormat untuk penulisnya! Meskipun anda dapat menggunakannya secara gratis, ingatlah bahwa penerbitan ulang kode tersebut tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.