OPEN-SOURCE SCRIPT

Diupdate FVG 15 min Pilot

Overview

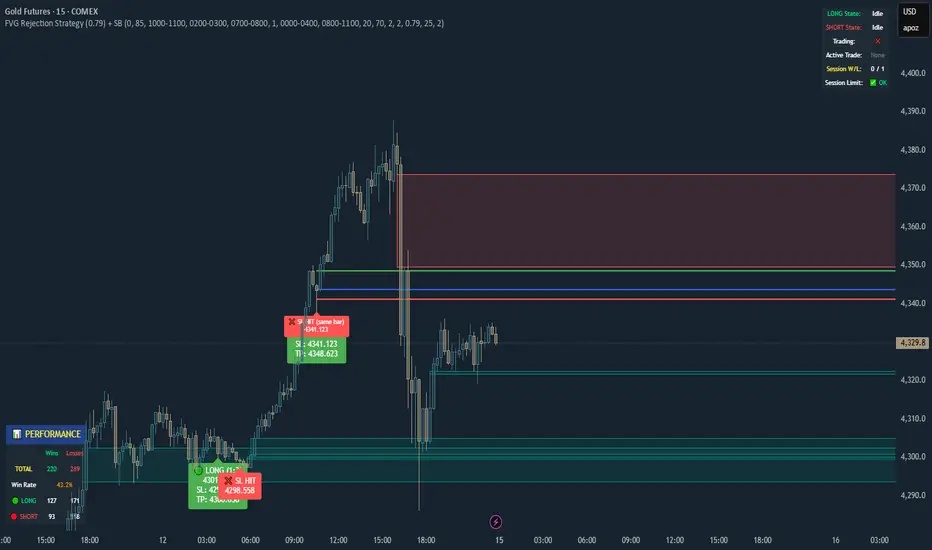

This indicator implements a fully automated FVG (Fair Value Gap) rejection trading strategy with precise entry management, session limitation, and performance tracking. The indicator identifies fair value gaps, waits for the first tap into the 0.79 level, and automatically accepts entries with a fixed stop loss and an adjustable risk-reward ratio.

Overview

This indicator implements a fully automated FVG (Fair Value Gap) rejection trading strategy with precise entry management, session limitation, and performance tracking. The indicator detects fair value gaps, waits for the first tap into the 0.79 level, and automatically accepts entries with a fixed stop loss and an adjustable risk-reward ratio.

... Core Trading Logic

Entry Conditions

For LONG (Bullish FVG Rejection):

A bullish FVG must exist (upward price gap)

FVG must not be older than X candles (default: 20)

FVG must not be larger than X ticks (default: 50)

FVG must not have been tapped (not even before the trading session)

Price must touch the 0.79 level of the FVG

Entry occurs exactly at the 0.79 level (79% of the lower to the upper edge of the FVG)

SL is placed X ticks below the entry (default: 25)

TP is calculated based on a risk:reward ratio (default: 1:1)

For SHORT (Bearish FVG Rejection):

Identical logic to bearish FVGs

Entry at the 0.79 level (79% of the upper to the lower edge)

SL X ticks above the entry

TP is calculated based on a risk:reward ratio

This indicator implements a fully automated FVG (Fair Value Gap) rejection trading strategy with precise entry management, session limitation, and performance tracking. The indicator identifies fair value gaps, waits for the first tap into the 0.79 level, and automatically accepts entries with a fixed stop loss and an adjustable risk-reward ratio.

Overview

This indicator implements a fully automated FVG (Fair Value Gap) rejection trading strategy with precise entry management, session limitation, and performance tracking. The indicator detects fair value gaps, waits for the first tap into the 0.79 level, and automatically accepts entries with a fixed stop loss and an adjustable risk-reward ratio.

... Core Trading Logic

Entry Conditions

For LONG (Bullish FVG Rejection):

A bullish FVG must exist (upward price gap)

FVG must not be older than X candles (default: 20)

FVG must not be larger than X ticks (default: 50)

FVG must not have been tapped (not even before the trading session)

Price must touch the 0.79 level of the FVG

Entry occurs exactly at the 0.79 level (79% of the lower to the upper edge of the FVG)

SL is placed X ticks below the entry (default: 25)

TP is calculated based on a risk:reward ratio (default: 1:1)

For SHORT (Bearish FVG Rejection):

Identical logic to bearish FVGs

Entry at the 0.79 level (79% of the upper to the lower edge)

SL X ticks above the entry

TP is calculated based on a risk:reward ratio

Catatan Rilis

FVG Rejection Strategy (0.79) + Silver Bullet - Indicator DescriptionThis advanced trading indicator combines Fair Value Gap (FVG) detection with a precise rejection-based entry system and Silver Bullet (SB) timing windows.

Key Features:

FVG Detection:

Automatically identifies bullish and bearish Fair Value Gaps

Visual display with customizable boxes that extend until invalidated

Optional body-based or wick-based detection

Minimum gap size filter in ticks

Silver Bullet Sessions:

Three configurable time windows (default: Asia, London, New York opens)

Visual markers with vertical lines at session boundaries

Alerts for FVGs created during SB sessions

Timezone: Europe/Berlin

Rejection Entry Model:

Long Setups: Enter at 0.79 level (79% fill) of bullish FVGs when price taps from above

Short Setups: Enter at 0.79 level of bearish FVGs when price taps from below

Only trades "fresh" (untapped) FVGs during configured trading sessions

Prevents entries on FVGs that were previously tapped outside trading windows

Risk Management:

Fixed stop loss distance in ticks

Adjustable Risk:Reward ratio for take profit (default 1:1)

Maximum FVG age filter (default 20 bars)

Maximum FVG size filter (default 50 ticks)

Session-based trade limits (max wins/losses per session)

Trade Tracking:

Automatic SL/TP hit detection

Visual entry signals with price levels

Real-time performance statistics (win rate, total/long/short performance)

Debug table showing current state and session limits

Settings:

Two independent trading windows

Separate long/short activation

Show/hide entry signals and SL/TP lines

Comprehensive alert conditions for all events

Perfect for ICT-style traders looking for high-probability rejection setups within specific timeframes.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.