OPEN-SOURCE SCRIPT

Volume Trend Signals | iSolani

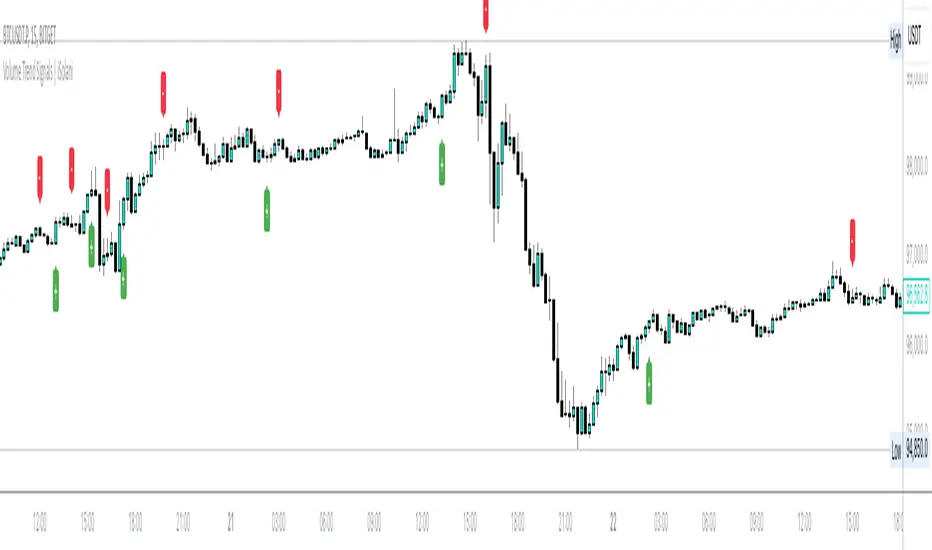

Volume Trend Signals | iSolani: Syncing Price Momentum with Volume Confirmation

In the dance between price action and volume, discerning true trend commitment requires seeing how institutional players vote with their capital. The Volume Trend Signals | iSolani illuminates this interplay by generating precise crossover signals when volume-accelerated price movements gain sustained traction. Unlike conventional volume oscillators, it employs a two-layered confirmation system—blending volatility-adjusted thresholds with adaptive smoothing—to spotlight high-probability entries aligned with smart-money activity.

Core Methodology

The indicator executes a five-phase process to filter meaningful trends:

- Logarithmic Price Scaling: Measures percentage-based price changes via HLC3 typical price, reducing large-value bias in volatile markets.

- Volatility Dynamic Filter: Uses a 30-bar standard deviation of price changes, scaled by user sensitivity (default 2x), to set momentum thresholds.

- Volume Governance: Caps raw volume at 3x its 40-bar SMA, neutralizing outlier spikes while preserving institutional footprints.

- Directional Flow Accumulation: Sums volume as positive/negative based on whether price movement breaches volatility-derived boundaries.

- Signal Refinement: Smooths the Volume Flow Indicator (VFI) with a 3-bar SMA, then triggers alerts via crosses over a 20-bar EMA signal line.

Breaking New Ground

This tool introduces three evolutionary improvements over traditional volume indicators:

- EMA Convergence Signals: Unlike basic zero-cross systems, it requires VFI to overtake its own EMA, confirming sustained momentum shifts.

- Context-Aware Volume: The 3x volume cap adapts to current market activity, preventing false signals during news-driven liquidity spikes.

- Minimalist Visual Alerts: Uses [+] and [-] symbols below/above candles, reducing chart clutter while emphasizing pivotal moments.

Engine Under the Hood

The script’s logic flows through four computational stages:

- Data Conditioning: Computes HLC3 and its log-based rate of change for normalized price analysis.

- Threshold Calibration: Derives dynamic entry/exit levels from 30-period volatility multiplied by user sensitivity.

- Volume Processing: Filters and signs volume based on price meeting threshold criteria.

- Signal Generation: Triggers buy/sell labels when the 3-bar SMA of cumulative flow crosses the 20-bar EMA.

Standard Configuration

Optimized defaults balance responsiveness and reliability:

- VFI Length: 40-bar accumulation window

- Sensitivity: 2.0 (double the volatility-derived threshold)

- Signal Smoothing: 20-bar EMA

- Volume Cap: 3x average (hidden parameter)

- Smoothing: Enabled (3-bar SMA on VFI)

By fusing adaptive volume filtering with EMA-confirmed momentum, the Volume Trend Signals | iSolani cuts through market noise to reveal institutional-grade trend inflection points. Its unique crossover logic—prioritizing confirmation over speed—makes it particularly effective in swing trading and trend-following strategies across equities, commodities, and forex markets.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Get instant access at quantura.io/

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Get instant access at quantura.io/

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.