Trend vs Mean Reversion Indicator (ADF Test) {DCAquant}

The ADF Trend/Mean Reversion Analysis Indicator, is a groundbreaking tool engineered to discern the underlying structure of financial markets. It employs the esteemed Augmented Dickey-Fuller (ADF) test to analyze time series data, providing traders with a robust statistical basis to distinguish between trending and mean-reverting market environments.

Comprehensive Market Analysis:

Advanced Statistical Foundation: Leverages the ADF test to statistically evaluate the likelihood of a trend sustaining or a reversion to the mean, making it a critical component of a quantitative trader’s toolkit.

Market Condition Visualization: The indicator’s color-coded system serves as a visual guide to the current market state, helping traders identify shifts in market dynamics with ease.

Configurable Sensitivity: Customizable parameters allow for fine-tuning the indicator's responsiveness, ensuring adaptability across various assets and market conditions.

Enhanced Indicator Features:

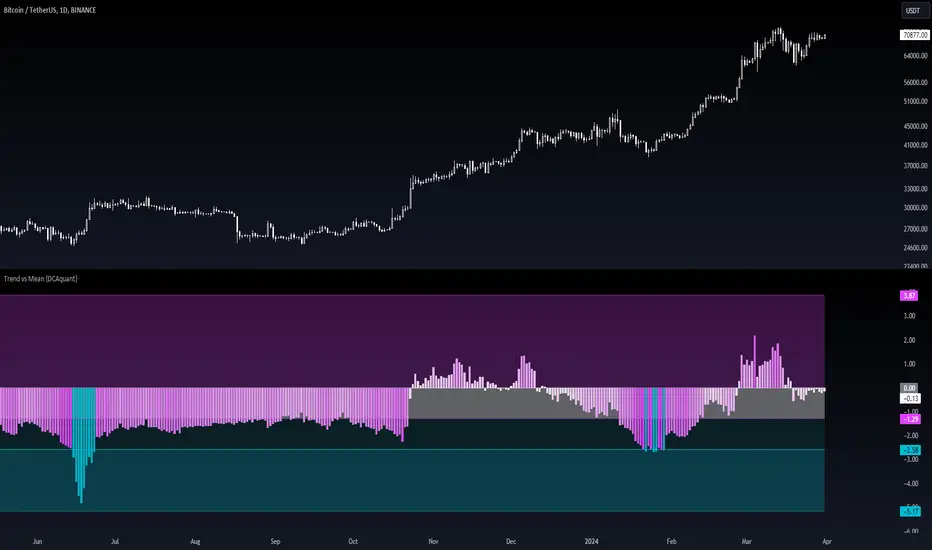

Aqua and Teal Bars: Depict a market that is statistically more inclined toward mean reversion, potentially signaling retracements or reversals, hence providing strategic points for counter-trend entries.

Fuchsia and Purple Bars: Identify a trending market regime where the persistence of price direction is statistically significant, thus supporting strategies that follow the trend.

Adaptive to Market Caps and Assets: Whether applied to broad market indices or individual securities, this indicator dynamically adjusts, making it an invaluable asset for diverse trading portfolios.

Strategic Trading Implications:

Dual-Strategy Adaptation: The indicator's nuanced presentation allows traders to switch between trend-following and counter-trend strategies, providing a flexible approach to both long-term investors and short-term traders.

Robust Signal Confirmation: It enhances trade confirmation when used alongside other technical indicators such as moving averages, momentum oscillators, or volume-based measures, offering a multi-layered analysis.

Informed Decision Making: By understanding the statistical tendencies of market behavior, traders can make more informed decisions that align with their individual risk profiles and trading objectives.

Customization and Optimization:

Selectable Confidence Levels: Choose from 90%, 95%, or 99% confidence levels to match the statistical rigor with your risk appetite.

Flexible Source and Lookback Periods: Adjust the price source and historical window to optimize the ADF test's application to different trading styles and timeframes, from intra-day to long-term analysis.

In-depth Indicator Usage:

Mean Reversion Opportunities: Utilize the indicator's mean-reverting signals to identify potential tops or bottoms, and adjust your position sizes and stop-loss placements accordingly.

Trend Continuation: In trending phases, use the indicator’s readings to reinforce your conviction in holding positions, managing trades with the confidence of statistical backing.

Disclaimer and Best Practices:

The ADF Trend/Mean Reversion Analysis Indicator {DCAquant} represents a fusion of statistical theory and technical analysis, designed to augment the trader's insight. It is intended to be used as a component of a holistic trading strategy. While it offers a sophisticated analysis, all traders are advised to apply rigorous risk management and not to rely solely on one indicator for trading signals.

Skrip hanya-undangan

Hanya pengguna yang disetujui oleh penulis yang dapat mengakses skrip ini. Anda perlu meminta dan mendapatkan izin untuk menggunakannya. Izin ini biasanya diberikan setelah pembayaran. Untuk detail selengkapnya, ikuti petunjuk penulis di bawah ini atau hubungi DCAquant secara langsung.

Harap diperhatikan bahwa skrip pribadi khusus undangan ini belum ditinjau oleh moderator skrip, dan kepatuhannya terhadap Tata Tertib belum dipastikan. TradingView TIDAK menyarankan untuk membayar atau menggunakan skrip kecuali Anda sepenuhnya mempercayai pembuatnya dan memahami cara kerjanya. Anda juga dapat menemukan alternatif yang gratis dan sumber terbuka di skrip komunitas kami.

Instruksi penulis

Pernyataan Penyangkalan

Skrip hanya-undangan

Hanya pengguna yang disetujui oleh penulis yang dapat mengakses skrip ini. Anda perlu meminta dan mendapatkan izin untuk menggunakannya. Izin ini biasanya diberikan setelah pembayaran. Untuk detail selengkapnya, ikuti petunjuk penulis di bawah ini atau hubungi DCAquant secara langsung.

Harap diperhatikan bahwa skrip pribadi khusus undangan ini belum ditinjau oleh moderator skrip, dan kepatuhannya terhadap Tata Tertib belum dipastikan. TradingView TIDAK menyarankan untuk membayar atau menggunakan skrip kecuali Anda sepenuhnya mempercayai pembuatnya dan memahami cara kerjanya. Anda juga dapat menemukan alternatif yang gratis dan sumber terbuka di skrip komunitas kami.