OPEN-SOURCE SCRIPT

Diupdate Crypto Bands with Tools

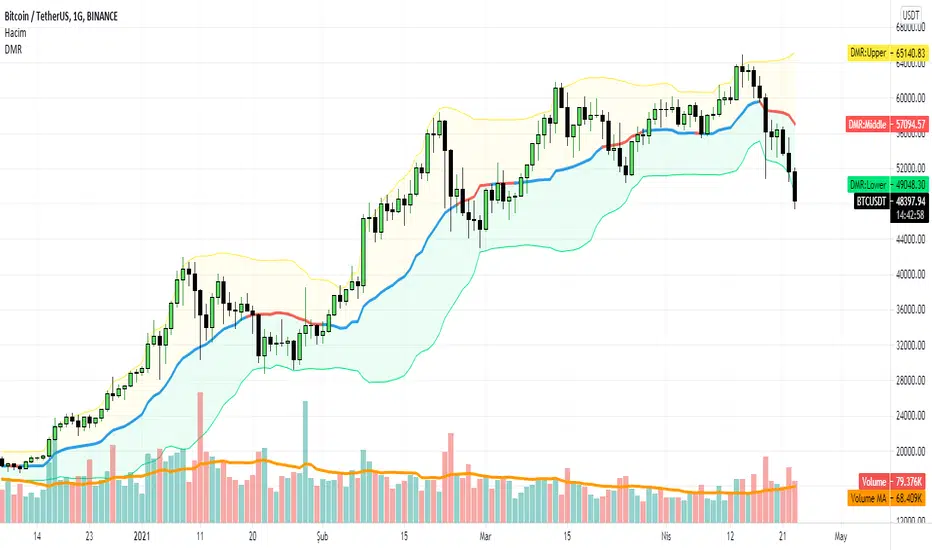

This indicator has 3 bands

1. Upper Band

2. Middle Band

3. Lower Band

1. Upper Band

Average of Moving Average of the Close (add Standard Deviations) and Highest price reached in the prior period

2. Middle Band

Average of upper and middle bands. And middle band also has BUY-SELL function. If middle band is blue you can BUY and if the middle band colored red you can SELL

3. Lower Band

Average of Moving Average of the Close(subtract Standard Deviations) and Lowest price reached in the prior period

Upper and Lower bands can be used for BUY&SELL strategy.

You can buy when price touches the lower band

You can sell when price touches the upper band

Indicator can work with long and short positions aswell

As you can see when price touches the lower band you can be LONG

and when the price touches the upper band you can be SHORT

When stock prices continually touch the upper DMR Band, the prices are thought to be overbought; conversely, when they continually touch the lower band, prices are thought to be oversold, triggering a buy signal. When using DMR Bands, designate the upper and lower bands as price targets.

indicator has ichimoku and some moving averages for checking the support and resistances.

1. Upper Band

2. Middle Band

3. Lower Band

1. Upper Band

Average of Moving Average of the Close (add Standard Deviations) and Highest price reached in the prior period

2. Middle Band

Average of upper and middle bands. And middle band also has BUY-SELL function. If middle band is blue you can BUY and if the middle band colored red you can SELL

3. Lower Band

Average of Moving Average of the Close(subtract Standard Deviations) and Lowest price reached in the prior period

Upper and Lower bands can be used for BUY&SELL strategy.

You can buy when price touches the lower band

You can sell when price touches the upper band

Indicator can work with long and short positions aswell

As you can see when price touches the lower band you can be LONG

and when the price touches the upper band you can be SHORT

When stock prices continually touch the upper DMR Band, the prices are thought to be overbought; conversely, when they continually touch the lower band, prices are thought to be oversold, triggering a buy signal. When using DMR Bands, designate the upper and lower bands as price targets.

indicator has ichimoku and some moving averages for checking the support and resistances.

Catatan Rilis

Changed middle bands color codes.Catatan Rilis

Bug FixesCatatan Rilis

Color ChangesSkrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.