OPEN-SOURCE SCRIPT

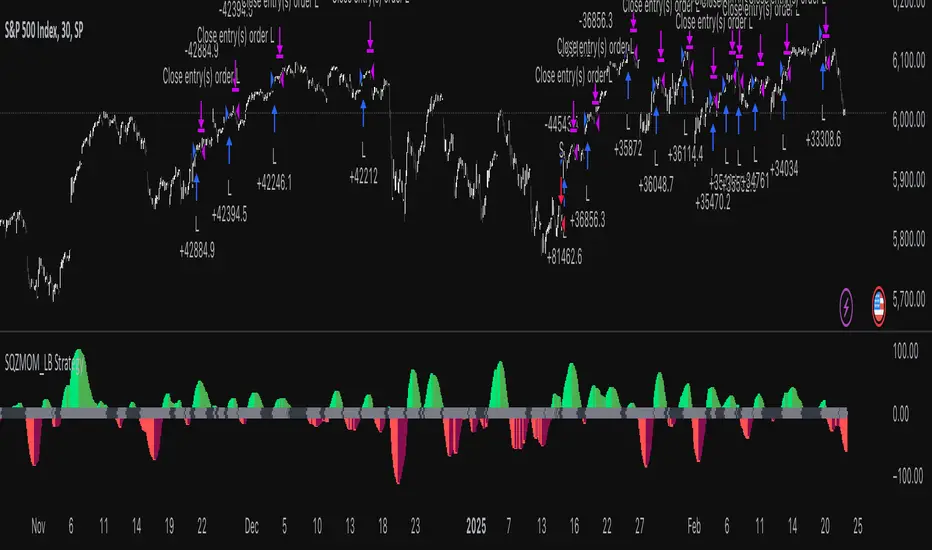

Squeeze Momentum Indicator Strategy [LazyBear + PineIndicators]

The Squeeze Momentum Indicator Strategy (SQZMOM_LB Strategy) is an automated trading strategy based on the Squeeze Momentum Indicator developed by LazyBear, which itself is a modification of John Carter's "TTM Squeeze" concept from his book Mastering the Trade (Chapter 11). This strategy is designed to identify low-volatility phases in the market, which often precede explosive price movements, and to enter trades in the direction of the prevailing momentum.

Concept & Indicator Breakdown

The strategy employs a combination of Bollinger Bands (BB) and Keltner Channels (KC) to detect market squeezes:

Squeeze Condition:

Momentum Calculation:

Signal Colors:

Strategy Logic

The script uses historical volatility conditions and momentum trends to generate buy/sell signals and manage positions.

1. Entry Conditions

Long Position (Buy)

Short Position (Sell)

2. Exit Conditions

Long Exit:

Short Exit:

Position Sizing

Position size is dynamically adjusted based on 8% of strategy equity, divided by the current closing price, ensuring risk-adjusted trade sizes.

How to Use This Strategy

Apply on Suitable Markets:

Best for stocks, indices, and forex pairs with momentum-driven price action.

Works on multiple timeframes but is most effective on higher timeframes (1H, 4H, Daily).

Confirm Entries with Additional Indicators:

The author recommends ADX or WaveTrend to refine entries and avoid false signals.

Risk Management:

Since the strategy dynamically sizes positions, it's advised to use stop-losses or risk-based exits to avoid excessive drawdowns.

Final Thoughts

The Squeeze Momentum Indicator Strategy provides a systematic approach to trading volatility expansions, leveraging the classic TTM Squeeze principles with a unique linear regression-based momentum calculation. Originally inspired by John Carter’s method, LazyBear's version and this strategy offer a refined, adaptable tool for traders looking to capitalize on market momentum shifts.

Concept & Indicator Breakdown

The strategy employs a combination of Bollinger Bands (BB) and Keltner Channels (KC) to detect market squeezes:

Squeeze Condition:

- When Bollinger Bands are inside the Keltner Channels (Black Crosses), volatility is low, signaling a potential upcoming price breakout.

- When Bollinger Bands move outside Keltner Channels (Gray Crosses), the squeeze is released, indicating an expansion in volatility.

Momentum Calculation:

- A linear regression-based momentum value is used instead of traditional momentum indicators.

- The momentum histogram is color-coded to show strength and direction:

- Lime/Green: Increasing bullish momentum

- Red/Maroon: Increasing bearish momentum

Signal Colors:

- Black: Market is in a squeeze (low volatility).

- Gray: Squeeze is released, and volatility is expanding.

- Blue: No squeeze condition is present.

Strategy Logic

The script uses historical volatility conditions and momentum trends to generate buy/sell signals and manage positions.

1. Entry Conditions

Long Position (Buy)

- The squeeze just released (Gray Cross after Black Cross).

- The momentum value is increasing and positive.

- The momentum is at a local low compared to the past 100 bars.

- The price is above the 100-period EMA.

- The closing price is higher than the previous close.

Short Position (Sell)

- The squeeze just released (Gray Cross after Black Cross).

- The momentum value is decreasing and negative.

- The momentum is at a local high compared to the past 100 bars.

- The price is below the 100-period EMA.

- The closing price is lower than the previous close.

2. Exit Conditions

Long Exit:

- The momentum value starts decreasing (momentum lower than previous bar).

Short Exit:

- The momentum value starts increasing (momentum higher than previous bar).

Position Sizing

Position size is dynamically adjusted based on 8% of strategy equity, divided by the current closing price, ensuring risk-adjusted trade sizes.

How to Use This Strategy

Apply on Suitable Markets:

Best for stocks, indices, and forex pairs with momentum-driven price action.

Works on multiple timeframes but is most effective on higher timeframes (1H, 4H, Daily).

Confirm Entries with Additional Indicators:

The author recommends ADX or WaveTrend to refine entries and avoid false signals.

Risk Management:

Since the strategy dynamically sizes positions, it's advised to use stop-losses or risk-based exits to avoid excessive drawdowns.

Final Thoughts

The Squeeze Momentum Indicator Strategy provides a systematic approach to trading volatility expansions, leveraging the classic TTM Squeeze principles with a unique linear regression-based momentum calculation. Originally inspired by John Carter’s method, LazyBear's version and this strategy offer a refined, adaptable tool for traders looking to capitalize on market momentum shifts.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.