PROTECTED SOURCE SCRIPT

Zonar v1.5

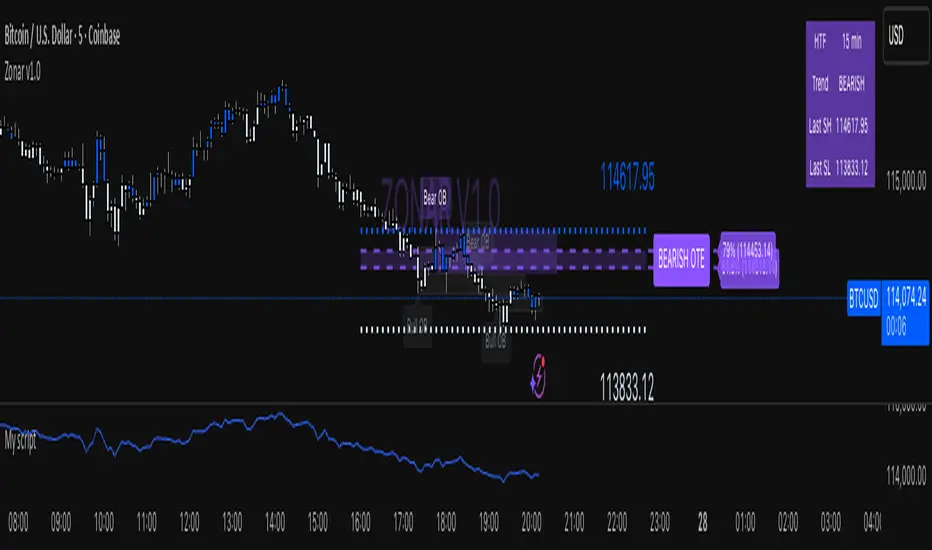

🟣 ZONAR v1.5 — Precision Market Mapping System

ZONAR is a proprietary market-structure engine that fuses price-action logic, real-time trend adaptation, and algorithmic zone validation into one integrated framework.

Unlike typical SMC indicators that simply draw order blocks or FVGs, Zonar reconstructs market intent by dynamically grading and updating structural zones as they evolve.

🧠 Core Logic

Zonar’s engine continuously analyses three key dimensions of price movement:

Hierarchical Market Structure Recognition — Detects higher-timeframe swing ranges, recalibrates the active trend, and synchronizes lower-timeframe structure shifts.

Adaptive Zone Generation — Builds order-block, mitigation-block, and imbalance zones only when algorithmic displacement and retracement criteria are met — filtering out noise and redundant zones.

Zone Integrity Tracking — Every plotted zone is validated, aged, and visually deactivated once mitigated or invalidated, giving traders a clean, self-updating chart environment.

⚙️ What Makes ZONAR Unique

Proprietary Zone Logic: Combines displacement candles, body/-wick validation, and retracement confirmation to mark institutional footprints with higher precision.

Dynamic Higher-Timeframe Context: Each zone aligns automatically with higher-timeframe BOS/CHOCH logic, updating the premium/discount bias in real time.

OTE Mapping Engine: Integrates a built-in Optimized Trade Entry (61.8–79%) range, synchronized with structural swing highs/lows for accurate retracement targeting.

Zone Lifecycle Visualization: Active zones transition through stages — valid → retraced → mitigated — visually represented with color fading and label updates.

Smart Signal Output: Generates live entry, stop-loss, and multi-target projections (TP1–TP3) derived from each zone’s structure and directional bias.

🎯 How It Helps

Zonar filters the chaos of price action into a clean, interpretable map — identifying where liquidity is engineered and where true institutional interest resides. It helps traders anticipate rather than react, focusing only on areas where probability, structure, and precision converge.

ZONAR is a proprietary market-structure engine that fuses price-action logic, real-time trend adaptation, and algorithmic zone validation into one integrated framework.

Unlike typical SMC indicators that simply draw order blocks or FVGs, Zonar reconstructs market intent by dynamically grading and updating structural zones as they evolve.

🧠 Core Logic

Zonar’s engine continuously analyses three key dimensions of price movement:

Hierarchical Market Structure Recognition — Detects higher-timeframe swing ranges, recalibrates the active trend, and synchronizes lower-timeframe structure shifts.

Adaptive Zone Generation — Builds order-block, mitigation-block, and imbalance zones only when algorithmic displacement and retracement criteria are met — filtering out noise and redundant zones.

Zone Integrity Tracking — Every plotted zone is validated, aged, and visually deactivated once mitigated or invalidated, giving traders a clean, self-updating chart environment.

⚙️ What Makes ZONAR Unique

Proprietary Zone Logic: Combines displacement candles, body/-wick validation, and retracement confirmation to mark institutional footprints with higher precision.

Dynamic Higher-Timeframe Context: Each zone aligns automatically with higher-timeframe BOS/CHOCH logic, updating the premium/discount bias in real time.

OTE Mapping Engine: Integrates a built-in Optimized Trade Entry (61.8–79%) range, synchronized with structural swing highs/lows for accurate retracement targeting.

Zone Lifecycle Visualization: Active zones transition through stages — valid → retraced → mitigated — visually represented with color fading and label updates.

Smart Signal Output: Generates live entry, stop-loss, and multi-target projections (TP1–TP3) derived from each zone’s structure and directional bias.

🎯 How It Helps

Zonar filters the chaos of price action into a clean, interpretable map — identifying where liquidity is engineered and where true institutional interest resides. It helps traders anticipate rather than react, focusing only on areas where probability, structure, and precision converge.

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, Anda dapat menggunakannya dengan bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, Anda dapat menggunakannya dengan bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.