OPEN-SOURCE SCRIPT

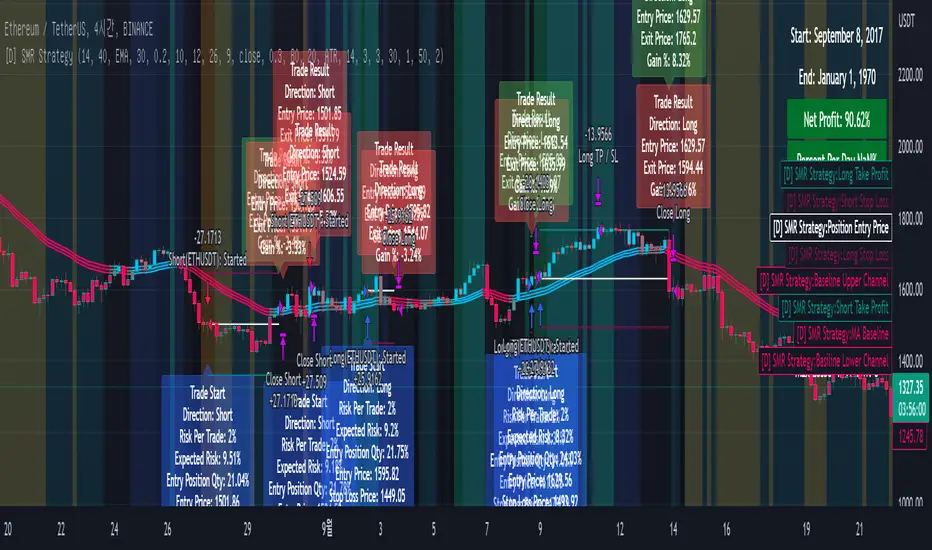

[DuDu95] SSL 4C MACD Laugerre RSI Strategy

Hello Guys! Nice to meet you all!

Before I start, my nickname has changed to 'DuDu95'!!

This is the Strategy introduced by youtube channel.

I made this based on the open source indicator by kevinmck100, vkno422, KivancOzbilgic. Thank you All!

### Entry Logic

1. Long Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0 and current MACD value > previous MACD value

- Laguerre RSI < overbought Line.

2. short Entry Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0 and current MACD value < previous MACD value

- Laguerre RSI > overbought Line.

### Exit Logic

1. Long Exit Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0

2. short Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0

### StopLoss

1. Can Choose Stop Loss Type: Percent, ATR, Previous Low / High.

2. Can Chosse inputs of each Stop Loss Type.

### Take Profit

1. Can set Risk Reward Ratio for Take Profit.

- To simplify backtest, I erased all other options except RR Ratio.

- You can add Take Profit Logic by adding options in the code.

2. Can set Take Profit Quantity.

### Risk Manangement

1. Can choose whether to use Risk Manangement Logic.

- This controls the Quantity of the Entry.

- e.g. If you want to take 3% risk per trade and stop loss price is 6% below the long entry price,

then 50% of your equity will be used for trade.

2. Can choose How much risk you would take per trade.

### Plot

1. Added Labels to check the data of entry / exit positions.

2. Changed and Added color different from the original one. (green: #02732A, red: #D92332, yellow: #F2E313)

Before I start, my nickname has changed to 'DuDu95'!!

This is the Strategy introduced by youtube channel.

I made this based on the open source indicator by kevinmck100, vkno422, KivancOzbilgic. Thank you All!

### Entry Logic

1. Long Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0 and current MACD value > previous MACD value

- Laguerre RSI < overbought Line.

2. short Entry Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0 and current MACD value < previous MACD value

- Laguerre RSI > overbought Line.

### Exit Logic

1. Long Exit Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0

2. short Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0

### StopLoss

1. Can Choose Stop Loss Type: Percent, ATR, Previous Low / High.

2. Can Chosse inputs of each Stop Loss Type.

### Take Profit

1. Can set Risk Reward Ratio for Take Profit.

- To simplify backtest, I erased all other options except RR Ratio.

- You can add Take Profit Logic by adding options in the code.

2. Can set Take Profit Quantity.

### Risk Manangement

1. Can choose whether to use Risk Manangement Logic.

- This controls the Quantity of the Entry.

- e.g. If you want to take 3% risk per trade and stop loss price is 6% below the long entry price,

then 50% of your equity will be used for trade.

2. Can choose How much risk you would take per trade.

### Plot

1. Added Labels to check the data of entry / exit positions.

2. Changed and Added color different from the original one. (green: #02732A, red: #D92332, yellow: #F2E313)

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.