OPEN-SOURCE SCRIPT

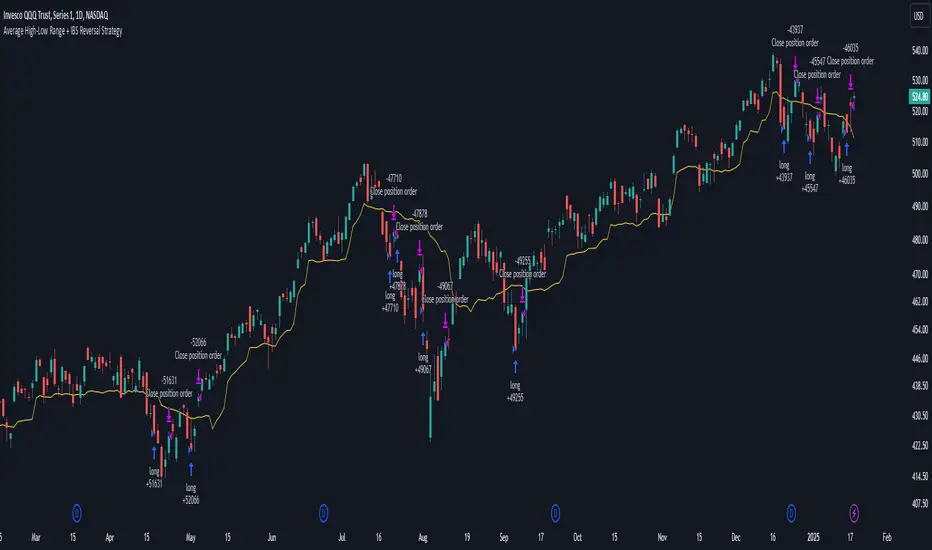

Average High-Low Range + IBS Reversal Strategy

█ STRATEGY DESCRIPTION

The "Average High-Low Range + IBS Reversal Strategy" is a mean-reversion strategy designed to identify potential buying opportunities when the price deviates significantly from its average high-low range and the Internal Bar Strength (IBS) indicates oversold conditions. It enters a long position when specific conditions are met and exits when the price shows strength by exceeding the previous bar's high. This strategy is suitable for use on various timeframes.

█ WHAT IS THE AVERAGE HIGH-LOW RANGE?

The Average High-Low Range is calculated as the Simple Moving Average (SMA) of the difference between the high and low prices over a specified period. It helps identify periods of increased volatility and potential reversal points.

█ WHAT IS INTERNAL BAR STRENGTH (IBS)?

Internal Bar Strength (IBS) is a measure of where the closing price is relative to the high and low of the bar. It is calculated as:

Pine Script®

A low IBS value (e.g., below 0.2) indicates that the close is near the low of the bar, suggesting oversold conditions.

█ SIGNAL GENERATION

1. LONG ENTRY

A Buy Signal is triggered when:

2. EXIT CONDITION

█ ADDITIONAL SETTINGS

█ PERFORMANCE OVERVIEW

The "Average High-Low Range + IBS Reversal Strategy" is a mean-reversion strategy designed to identify potential buying opportunities when the price deviates significantly from its average high-low range and the Internal Bar Strength (IBS) indicates oversold conditions. It enters a long position when specific conditions are met and exits when the price shows strength by exceeding the previous bar's high. This strategy is suitable for use on various timeframes.

█ WHAT IS THE AVERAGE HIGH-LOW RANGE?

The Average High-Low Range is calculated as the Simple Moving Average (SMA) of the difference between the high and low prices over a specified period. It helps identify periods of increased volatility and potential reversal points.

█ WHAT IS INTERNAL BAR STRENGTH (IBS)?

Internal Bar Strength (IBS) is a measure of where the closing price is relative to the high and low of the bar. It is calculated as:

IBS = (Close - Low) / (High - Low)

A low IBS value (e.g., below 0.2) indicates that the close is near the low of the bar, suggesting oversold conditions.

█ SIGNAL GENERATION

1. LONG ENTRY

A Buy Signal is triggered when:

- The close price has been below the buy threshold (calculated as `upper - (2.5 * hl_avg)`) for a specified number of consecutive bars (`bars_below_threshold`).

- The IBS value is below the specified buy threshold (`ibs_buy_treshold`).

- The signal occurs within the specified time window (between `Start Time` and `End Time`).

2. EXIT CONDITION

- A Sell Signal is generated when the current closing price exceeds the high of the previous bar (`close > high[1]`). This indicates that the price has shown strength, potentially confirming the reversal and prompting the strategy to exit the position.

█ ADDITIONAL SETTINGS

- Length: The lookback period for calculating the average high-low range. Default is 20.

- Bars Below Threshold: The number of consecutive bars the price must remain below the buy threshold to trigger a Buy Signal. Default is 2.

- IBS Buy Threshold: The IBS value below which a Buy Signal is triggered. Default is 0.2.

- Start Time and End Time: The time window during which the strategy is allowed to execute trades.

█ PERFORMANCE OVERVIEW

- This strategy is designed for mean-reverting markets and performs best when the price frequently deviates from its average high-low range.

- It is sensitive to oversold conditions, as indicated by the IBS, which helps to identify potential reversals.

- Backtesting results should be analyzed to optimize the Length, Bars Below Threshold, and IBS Buy Threshold parameters for specific instruments.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.