OPEN-SOURCE SCRIPT

LANZ Strategy 4.0 [Backtest]

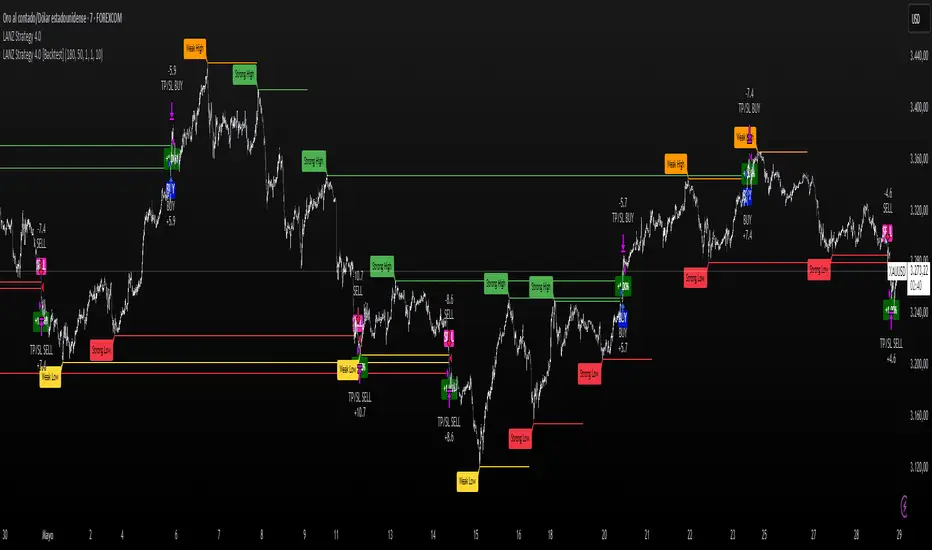

🔷 LANZ Strategy 4.0 — Strategy Execution Based on Confirmed Structure + Risk-Based SL/TP

LANZ Strategy 4.0 [Backtest] is the official backtesting engine for the LANZ Strategy 4.0 trading logic. It simulates real-time executions based on breakout of Strong/Weak Highs or Lows, using a consistent structural system with SL/TP dynamically calculated per trade. With integrated risk management and lot size logic, this script allows traders to validate LANZ Strategy 4.0 performance with real strategy metrics.

🧠 Core Components:

📊 Visual Features:

⚙️ How It Works:

📝 Notes:

📌 Credits:

Backtest engine developed by LANZ based on the official rules of LANZ Strategy 4.0. This script ensures visual and logical consistency between live charting and backtesting simulations.

LANZ Strategy 4.0 [Backtest] is the official backtesting engine for the LANZ Strategy 4.0 trading logic. It simulates real-time executions based on breakout of Strong/Weak Highs or Lows, using a consistent structural system with SL/TP dynamically calculated per trade. With integrated risk management and lot size logic, this script allows traders to validate LANZ Strategy 4.0 performance with real strategy metrics.

🧠 Core Components:

- Confirmed Breakout Entries: Trades are executed only when price breaks the most recent structural level (Strong High or Strong Low), detected using swing pivots.

- Dynamic SL and TP Logic: SL is placed below/above the breakout point with a customizable buffer. TP is defined using a fixed Risk-Reward (RR) ratio.

- Capital-Based Risk Management: Lot size is calculated based on account equity, SL distance, and pip value (e.g. $10 per pip on XAUUSD).

- Clean and Controlled Executions: Only one trade is active at a time. No new entries are allowed until the current position is closed.

📊 Visual Features:

- Automatic plotting of Entry, SL, and TP levels.

- Full control of swing sensitivity (swingLength) and SL buffer.

- SL and TP lines extend visually for clarity of trade risk and reward zones.

⚙️ How It Works:

- Detects pivots and classifies trend direction.

- Waits for breakout above Strong High (BUY) or below Strong Low (SELL).

- Calculates dynamic SL and TP based on buffer and RR.

- Computes trade size automatically based on risk per trade %.

- Executes entry and manages exits via strategy engine.

📝 Notes:

- Ideal for evaluating the LANZ Strategy 4.0 logic over historical data.

- Must be paired with the original indicator (LANZ Strategy 4.0) for live trading.

- Best used on assets with clear structural behavior (gold, indices, FX).

📌 Credits:

Backtest engine developed by LANZ based on the official rules of LANZ Strategy 4.0. This script ensures visual and logical consistency between live charting and backtesting simulations.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.