OPEN-SOURCE SCRIPT

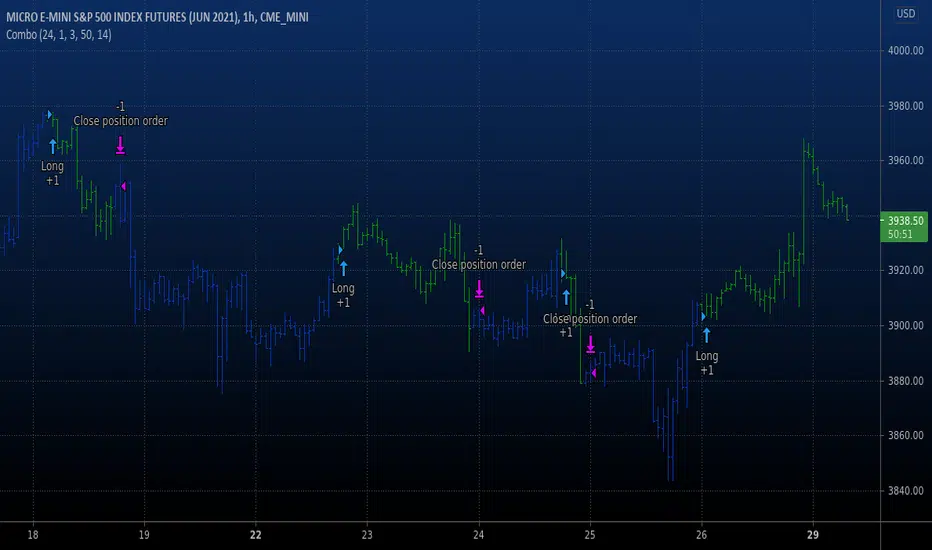

Combo Backtest 123 Negative Volume Index

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

The theory behind the indexes is as follows: On days of increasing

volume, you can expect prices to increase, and on days of decreasing

volume, you can expect prices to decrease. This goes with the idea of

the market being in-gear and out-of-gear. Both PVI and NVI work in similar

fashions: Both are a running cumulative of values, which means you either

keep adding or subtracting price rate of change each day to the previous day`s

sum. In the case of PVI, if today`s volume is less than yesterday`s, don`t add

anything; if today`s volume is greater, then add today`s price rate of change.

For NVI, add today`s price rate of change only if today`s volume is less than

yesterday`s.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

The theory behind the indexes is as follows: On days of increasing

volume, you can expect prices to increase, and on days of decreasing

volume, you can expect prices to decrease. This goes with the idea of

the market being in-gear and out-of-gear. Both PVI and NVI work in similar

fashions: Both are a running cumulative of values, which means you either

keep adding or subtracting price rate of change each day to the previous day`s

sum. In the case of PVI, if today`s volume is less than yesterday`s, don`t add

anything; if today`s volume is greater, then add today`s price rate of change.

For NVI, add today`s price rate of change only if today`s volume is less than

yesterday`s.

WARNING:

- For purpose educate only

- This script to change bars colors.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.