PROTECTED SOURCE SCRIPT

False highs and lows

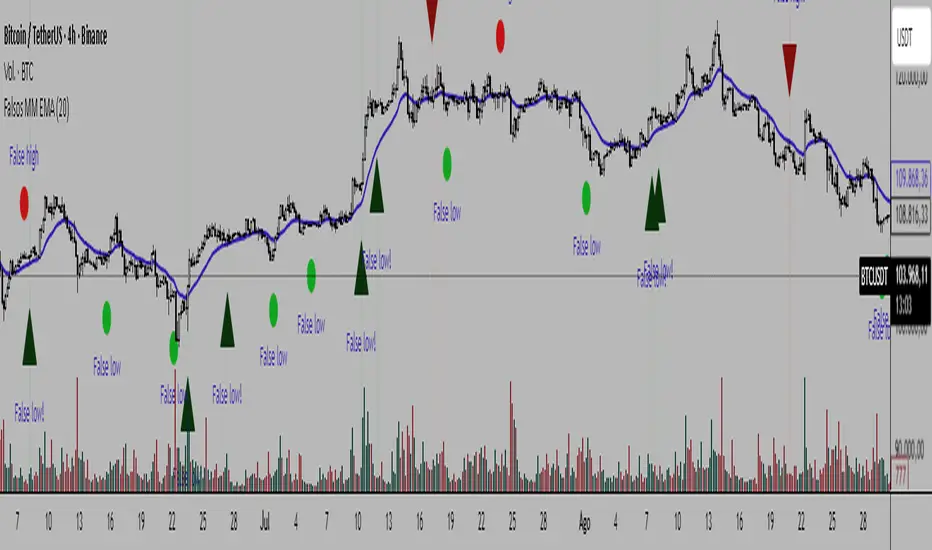

This technical indicator shows points of probable reversal. Specifically, it exploits the phenomenon of false highs and lows: supply or demand entries with strong momentum.

The signals with green and red arrows are in favor of the trend and above the EMA 20, so you should pay close attention to them. The signals marked with green and red circles also show great opportunities, but they should be studied with greater caution.

Warnings:

-Avoid entries on false highs when there is strong buying pressure (evident in bullish candles with high momentum).

-Avoid entries on false lows when there is strong selling pressure (evident in bearish candles with high momentum).

-Avoid entries on false lows when there is clear resistance and the price is overbought.

-Avoid entries on false highs when there is nearby support and the price is oversold.

-Avoid trading in very narrow price ranges.

-Wait for the close of the signaled candle for the pattern to be valid.

-I recommend using tight stop losses below the low (or above the high) of the pattern, and targeting reward-to-risk ratios that do not exceed 1:1 in most cases.

The signals with green and red arrows are in favor of the trend and above the EMA 20, so you should pay close attention to them. The signals marked with green and red circles also show great opportunities, but they should be studied with greater caution.

Warnings:

-Avoid entries on false highs when there is strong buying pressure (evident in bullish candles with high momentum).

-Avoid entries on false lows when there is strong selling pressure (evident in bearish candles with high momentum).

-Avoid entries on false lows when there is clear resistance and the price is overbought.

-Avoid entries on false highs when there is nearby support and the price is oversold.

-Avoid trading in very narrow price ranges.

-Wait for the close of the signaled candle for the pattern to be valid.

-I recommend using tight stop losses below the low (or above the high) of the pattern, and targeting reward-to-risk ratios that do not exceed 1:1 in most cases.

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, anda dapat menggunakannya secara bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

📖Revista El Especulador:

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Skrip terproteksi

Skrip ini diterbitkan sebagai sumber tertutup. Namun, anda dapat menggunakannya secara bebas dan tanpa batasan apa pun – pelajari lebih lanjut di sini.

📖Revista El Especulador:

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.