OPEN-SOURCE SCRIPT

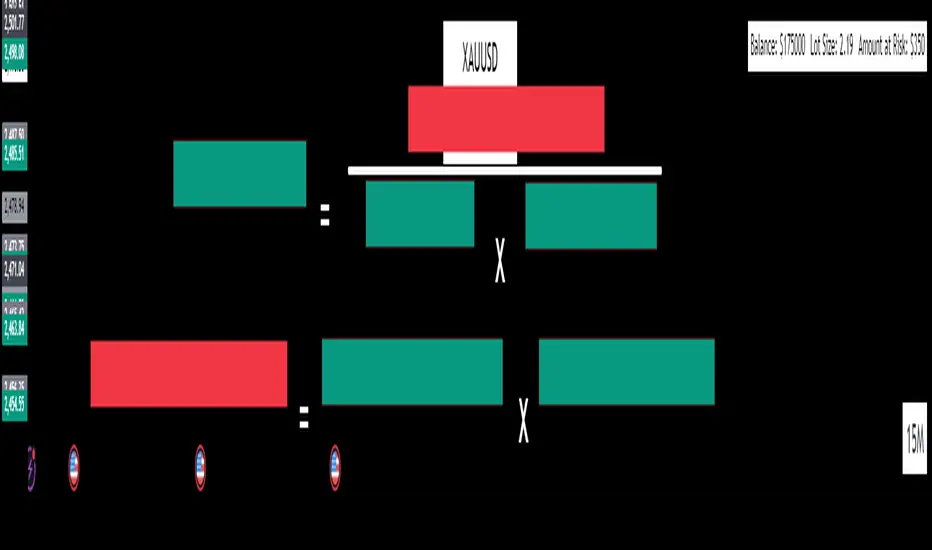

Lot Size Calculator by MenolakRugi

The Lot Size Formula in forex trading is a critical tool that offers several key benefits to traders:

🟢Risk Management: By using the formula, traders can control the amount of capital they risk on each trade. This helps prevent excessive losses by aligning the lot size with a predefined risk tolerance, such as 1% or 2% of the account balance.

🟢Consistent Position Sizing: The formula ensures that position sizes are calculated based on the specific trade setup, including the distance to the stop loss. This consistency helps avoid over-leveraging and reduces the emotional aspect of trading.

🟢Adaptability: The lot size can be adjusted according to different currency pairs and market conditions. This flexibility ensures that traders can apply the formula across various trading instruments and environments.

🟢Improved Profit Potential: By managing risk effectively, traders can protect their capital while maximizing profit opportunities. When losses are controlled, traders are able to stay in the market longer and compound their gains over time.

🟢Precision in Trade Planning: Calculating the lot size allows traders to plan their trades more precisely, aligning their strategies with the amount they are willing to risk. This leads to more disciplined and structured trading, reducing impulsive decisions.

In summary, the lot size formula helps maintain a balanced approach to trading, where both risk and reward are carefully managed to increase the chances of long-term success.

🟢Risk Management: By using the formula, traders can control the amount of capital they risk on each trade. This helps prevent excessive losses by aligning the lot size with a predefined risk tolerance, such as 1% or 2% of the account balance.

🟢Consistent Position Sizing: The formula ensures that position sizes are calculated based on the specific trade setup, including the distance to the stop loss. This consistency helps avoid over-leveraging and reduces the emotional aspect of trading.

🟢Adaptability: The lot size can be adjusted according to different currency pairs and market conditions. This flexibility ensures that traders can apply the formula across various trading instruments and environments.

🟢Improved Profit Potential: By managing risk effectively, traders can protect their capital while maximizing profit opportunities. When losses are controlled, traders are able to stay in the market longer and compound their gains over time.

🟢Precision in Trade Planning: Calculating the lot size allows traders to plan their trades more precisely, aligning their strategies with the amount they are willing to risk. This leads to more disciplined and structured trading, reducing impulsive decisions.

In summary, the lot size formula helps maintain a balanced approach to trading, where both risk and reward are carefully managed to increase the chances of long-term success.

Skrip open-source

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Skrip open-source

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.