OPEN-SOURCE SCRIPT

Diupdate Leverage Calculator

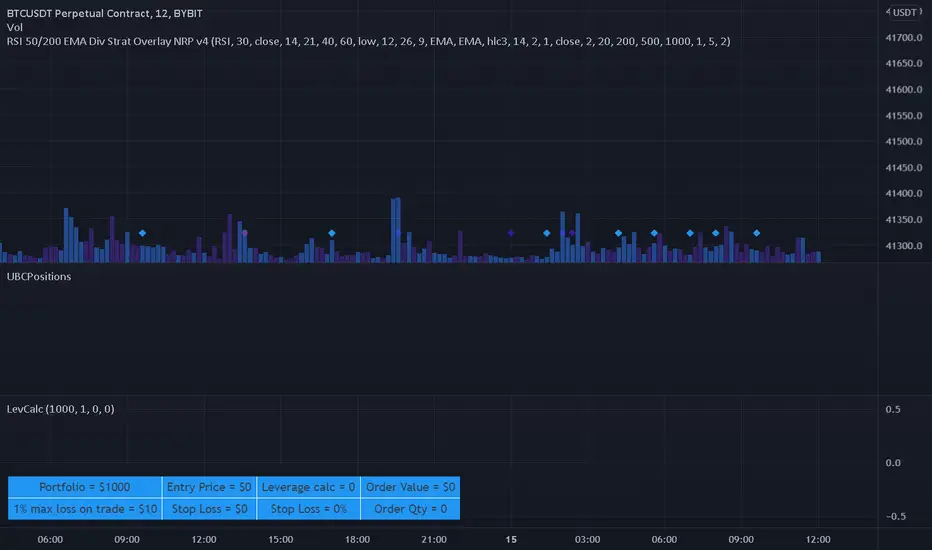

This script is intended to be used as a risk management calculator.

It will calculate the best leverage to use based on the maximum percentage of loss you are willing to incur on your trading portfolio.

Also calculates the order value and order qty based on your inputs.

Please note this calculator does not take into account any trading fees imposed by the exchange you are using.

*** Only risking 1% to 5% of your portfolio is considered good risk management ***

*** Not financial advice ***

------ Settings Inputs -----------------------------------------------------------------------------------------------------

"Portfolio Size" -- enter your portfolio balance

"% Willing to lose on this trade" -- enter the percent of your portfolio you are willing to lose if the stop loss is hit

"Entry Price" -- enter the price at which you will enter the trade

"Stop Loss Price" -- enter the price at which your stop loss will be set

----------------------------------------------------------------------------------------------------------------------------

------ Outputs -------------------------------------------------------------------------------------------------------------

"Portfolio" -- displays the portfolio balance entered in settings

"max loss on trade" -- displays the % loss entered in settings and the corresponding amount of your portfolio

"Entry Price" -- displays the entry price entered in settings

"Stop Loss Price" -- displays the stop loss price entered in settings

"Stop Loss %" -- displays the calculated percentage loss from the entry price

"Leverage calc" -- displays the calculated leverage based on your max loss and stop loss settings

"Order Value" -- displays the value of the order based on the calculated leverage

"Order Qty" -- displays the calculated order qty based on the calculated leverage

It will calculate the best leverage to use based on the maximum percentage of loss you are willing to incur on your trading portfolio.

Also calculates the order value and order qty based on your inputs.

Please note this calculator does not take into account any trading fees imposed by the exchange you are using.

*** Only risking 1% to 5% of your portfolio is considered good risk management ***

*** Not financial advice ***

------ Settings Inputs -----------------------------------------------------------------------------------------------------

"Portfolio Size" -- enter your portfolio balance

"% Willing to lose on this trade" -- enter the percent of your portfolio you are willing to lose if the stop loss is hit

"Entry Price" -- enter the price at which you will enter the trade

"Stop Loss Price" -- enter the price at which your stop loss will be set

----------------------------------------------------------------------------------------------------------------------------

------ Outputs -------------------------------------------------------------------------------------------------------------

"Portfolio" -- displays the portfolio balance entered in settings

"max loss on trade" -- displays the % loss entered in settings and the corresponding amount of your portfolio

"Entry Price" -- displays the entry price entered in settings

"Stop Loss Price" -- displays the stop loss price entered in settings

"Stop Loss %" -- displays the calculated percentage loss from the entry price

"Leverage calc" -- displays the calculated leverage based on your max loss and stop loss settings

"Order Value" -- displays the value of the order based on the calculated leverage

"Order Qty" -- displays the calculated order qty based on the calculated leverage

Catatan Rilis

Cleaned up commented code to comply with house rulesSkrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.