OPEN-SOURCE SCRIPT

Diupdate FACTOR MONITOR

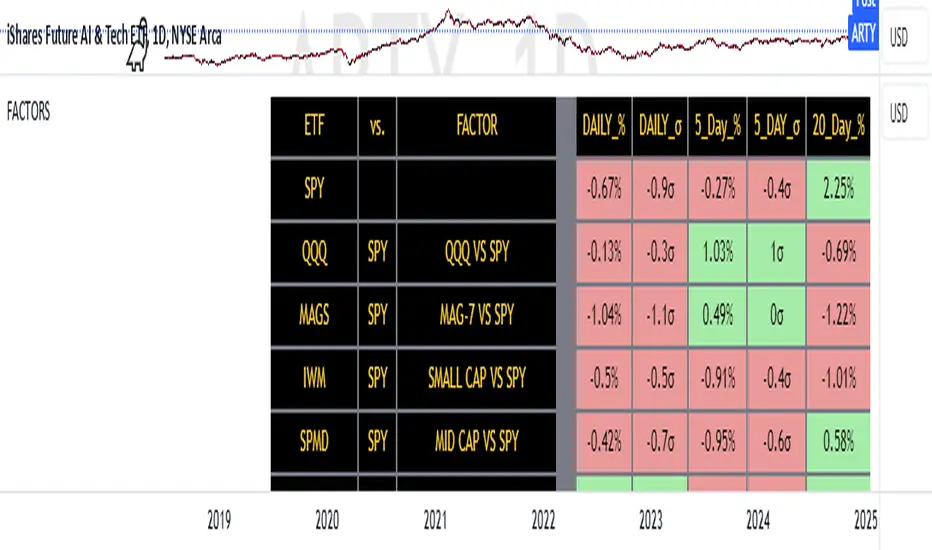

The Factor Monitor is a comprehensive designed to track relative strength and standard deviation movements across multiple market segments and investment factors. The indicator calculates and displays normalized percentage moves and their statistical significance (measured in standard deviations) across daily, 5-day, and 20-day periods, providing a multi-timeframe view of market dynamics.

Key Features:

Real-time tracking of relative performance between various ETF pairs (e.g., QQQ vs SPY, IWM vs SPY)

Standard deviation scoring system that identifies statistically significant moves

Color-coded visualization (green/red) for quick interpretation of relative strength

Multiple timeframe analysis (1-day, 5-day, and 20-day moves)

Monitoring of key market segments:

Style factors (Value, Growth, Momentum)

Market cap segments (Large, Mid, Small)

Sector relative strength

Risk factors (High Beta vs Low Volatility)

Credit conditions (High Yield vs Investment Grade)

The tool is particularly valuable for:

Identifying significant factor rotations in the market

Assessing market breadth through relative strength comparisons

Spotting potential trend changes through statistical deviation analysis

Monitoring sector leadership and market regime shifts

Quantifying the magnitude of market moves relative to historical norms

Key Features:

Real-time tracking of relative performance between various ETF pairs (e.g., QQQ vs SPY, IWM vs SPY)

Standard deviation scoring system that identifies statistically significant moves

Color-coded visualization (green/red) for quick interpretation of relative strength

Multiple timeframe analysis (1-day, 5-day, and 20-day moves)

Monitoring of key market segments:

Style factors (Value, Growth, Momentum)

Market cap segments (Large, Mid, Small)

Sector relative strength

Risk factors (High Beta vs Low Volatility)

Credit conditions (High Yield vs Investment Grade)

The tool is particularly valuable for:

Identifying significant factor rotations in the market

Assessing market breadth through relative strength comparisons

Spotting potential trend changes through statistical deviation analysis

Monitoring sector leadership and market regime shifts

Quantifying the magnitude of market moves relative to historical norms

Catatan Rilis

Just changed colors around to make more readableCatatan Rilis

Updated MAGS exchangeSkrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.