OPEN-SOURCE SCRIPT

AE - ATR Exhaustion Channel

AE - ATR Exhaustion Channel

📈 Overview

Identify Exhaustion Zones & Trend Breakouts with ATR Precision!

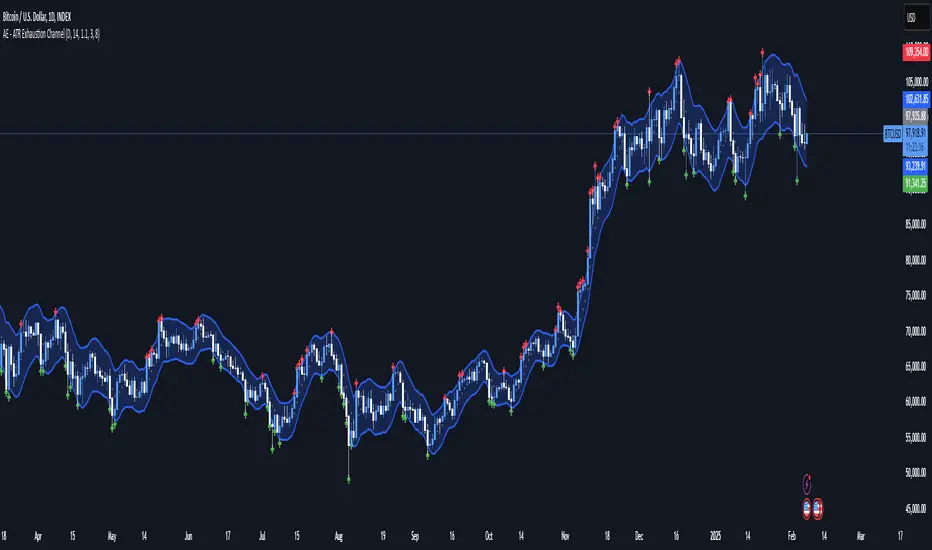

The AE - ATR Exhaustion Channel is a powerful volatility-based trading tool that combines an averaged SMA with ATR bands to dynamically highlight potential trend exhaustion zones. It provides real-time breakout detection by marking when price moves beyond key volatility bands, helping traders spot overextensions and reversals with ease.

🔑 Key Features

✔️ ATR-SMA Hybrid Channel: Uses an averaged SMA as the core trend filter while incorporating adaptive ATR-based bands for precise volatility tracking.

✔️ Dynamic Exhaustion Markers: Marks red crosses when price exceeds the upper band and green crosses when price drops below the lower band.

✔️ Customizable ATR Sensitivity: Adjust the ATR multiplier and length settings to fine-tune band sensitivity based on market conditions.

✔️ Clear Channel Visualization: A gray SMA midpoint and a blue-filled ATR band zone make it easy to track market structure.

📚 How It Works

1️⃣ Averaged SMA Calculation: The script calculates an averaged SMA over a user-defined range (min/max period). This smooths out short-term fluctuations while preserving trend direction.

2️⃣ ATR Band Construction: The ATR value (adjusted by a multiplier) is added to/subtracted from the SMA to form dynamic upper and lower volatility bands.

3️⃣ Exhaustion Detection:

If high > upper ATR band, a red cross is plotted (potential overextension).

If low < lower ATR band, a green cross is plotted (potential reversal zone).

4️⃣ Filled ATR Channel: The area between the upper and lower bands is shaded blue, providing a visual trading range.

🎨 Customization & Settings

⚙️ ATR Length – Adjusts the ATR calculation period (default: 14).

⚙️ ATR Multiplier – Scales the ATR bands for tighter or wider volatility tracking (default: 0.8, adjustable in 0.1 steps).

⚙️ SMA Range (Min/Max Length) – Defines the period range for calculating the averaged SMA (default: 5-20).

⚙️ Rolling Lookback Length – Controls how far back the high/low comparison is calculated (default: 50 bars).

🚀 Practical Usage

📌 Spotting Exhaustion Zones – Look for red/green markers appearing outside the ATR bands, signaling potential trend exhaustion and possible reversal opportunities.

📌 Breakout Confirmation – Price consistently breaching the upper band with momentum could indicate continuation, while repeated touches without strong closes may hint at reversal zones.

📌 Trend Reversal Signals – Watch for green markers below the lower band in uptrends (buy signals) and red markers above the upper band in downtrends (sell signals).

🔔 Alerts & Notifications

📢 Set Alerts for Exhaustion Signals!

Traders can configure alerts to trigger when price breaches the ATR bands, allowing for instant notifications when volatility-based exhaustion is detected.

📊 Example Scenarios

✔ Trend Exhaustion in Overextended Moves – A series of red crosses near resistance may indicate a short opportunity.

✔ Trend Exhaustion in Overextended Moves – A series of red crosses near resistance may indicate an opportunity to open a short trade.

✔ Volatility Compression Breakouts – If price consolidates within the ATR bands and suddenly breaks out, it could signify a momentum shift.

✔ Reversal Catching in Trending Markets – Spot potential trend reversals by looking for green markers below the ATR bands in bullish markets.

🌟 Why Choose AE - ATR Exhaustion Channel?

Trade with Confidence. Spot Volatility. Catch Breakouts.

The AE - ATR Exhaustion Channel is an essential tool for traders looking to identify trend exhaustion, detect breakouts, and manage volatility effectively. Whether you're trading stocks, crypto, or forex, this ATR-SMA hybrid system provides clear visual cues to help you stay ahead of market moves.

✅ Customizable to Fit Any Market

✅ Combines Volatility & Trend Analysis

✅ Easy-to-Use with Instant Breakout Detection

📈 Overview

Identify Exhaustion Zones & Trend Breakouts with ATR Precision!

The AE - ATR Exhaustion Channel is a powerful volatility-based trading tool that combines an averaged SMA with ATR bands to dynamically highlight potential trend exhaustion zones. It provides real-time breakout detection by marking when price moves beyond key volatility bands, helping traders spot overextensions and reversals with ease.

🔑 Key Features

✔️ ATR-SMA Hybrid Channel: Uses an averaged SMA as the core trend filter while incorporating adaptive ATR-based bands for precise volatility tracking.

✔️ Dynamic Exhaustion Markers: Marks red crosses when price exceeds the upper band and green crosses when price drops below the lower band.

✔️ Customizable ATR Sensitivity: Adjust the ATR multiplier and length settings to fine-tune band sensitivity based on market conditions.

✔️ Clear Channel Visualization: A gray SMA midpoint and a blue-filled ATR band zone make it easy to track market structure.

📚 How It Works

1️⃣ Averaged SMA Calculation: The script calculates an averaged SMA over a user-defined range (min/max period). This smooths out short-term fluctuations while preserving trend direction.

2️⃣ ATR Band Construction: The ATR value (adjusted by a multiplier) is added to/subtracted from the SMA to form dynamic upper and lower volatility bands.

3️⃣ Exhaustion Detection:

If high > upper ATR band, a red cross is plotted (potential overextension).

If low < lower ATR band, a green cross is plotted (potential reversal zone).

4️⃣ Filled ATR Channel: The area between the upper and lower bands is shaded blue, providing a visual trading range.

🎨 Customization & Settings

⚙️ ATR Length – Adjusts the ATR calculation period (default: 14).

⚙️ ATR Multiplier – Scales the ATR bands for tighter or wider volatility tracking (default: 0.8, adjustable in 0.1 steps).

⚙️ SMA Range (Min/Max Length) – Defines the period range for calculating the averaged SMA (default: 5-20).

⚙️ Rolling Lookback Length – Controls how far back the high/low comparison is calculated (default: 50 bars).

🚀 Practical Usage

📌 Spotting Exhaustion Zones – Look for red/green markers appearing outside the ATR bands, signaling potential trend exhaustion and possible reversal opportunities.

📌 Breakout Confirmation – Price consistently breaching the upper band with momentum could indicate continuation, while repeated touches without strong closes may hint at reversal zones.

📌 Trend Reversal Signals – Watch for green markers below the lower band in uptrends (buy signals) and red markers above the upper band in downtrends (sell signals).

🔔 Alerts & Notifications

📢 Set Alerts for Exhaustion Signals!

Traders can configure alerts to trigger when price breaches the ATR bands, allowing for instant notifications when volatility-based exhaustion is detected.

📊 Example Scenarios

✔ Trend Exhaustion in Overextended Moves – A series of red crosses near resistance may indicate a short opportunity.

✔ Trend Exhaustion in Overextended Moves – A series of red crosses near resistance may indicate an opportunity to open a short trade.

✔ Volatility Compression Breakouts – If price consolidates within the ATR bands and suddenly breaks out, it could signify a momentum shift.

✔ Reversal Catching in Trending Markets – Spot potential trend reversals by looking for green markers below the ATR bands in bullish markets.

🌟 Why Choose AE - ATR Exhaustion Channel?

Trade with Confidence. Spot Volatility. Catch Breakouts.

The AE - ATR Exhaustion Channel is an essential tool for traders looking to identify trend exhaustion, detect breakouts, and manage volatility effectively. Whether you're trading stocks, crypto, or forex, this ATR-SMA hybrid system provides clear visual cues to help you stay ahead of market moves.

✅ Customizable to Fit Any Market

✅ Combines Volatility & Trend Analysis

✅ Easy-to-Use with Instant Breakout Detection

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Access more of our systems and insights at alphaextract.xyz

All analysis provided by Alpha Extract is for educational and informational purposes only.

All analysis provided by Alpha Extract is for educational and informational purposes only.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Skrip open-source

Dengan semangat TradingView yang sesungguhnya, pembuat skrip ini telah menjadikannya sebagai sumber terbuka, sehingga para trader dapat meninjau dan memverifikasi fungsinya. Salut untuk penulisnya! Meskipun Anda dapat menggunakannya secara gratis, perlu diingat bahwa penerbitan ulang kode ini tunduk pada Tata Tertib kami.

Access more of our systems and insights at alphaextract.xyz

All analysis provided by Alpha Extract is for educational and informational purposes only.

All analysis provided by Alpha Extract is for educational and informational purposes only.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.