Yellow: A Clearing Network Unifying Fragmented Blockchains

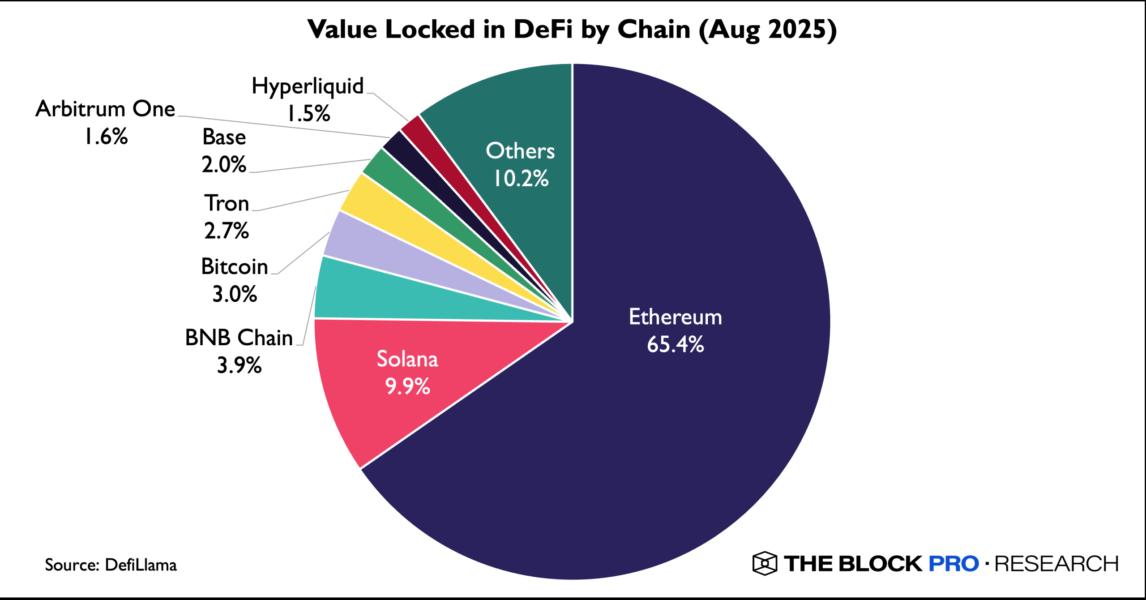

The DeFi landscape remains highly fragmented. Liquidity is siloed within isolated blockchains, and moving assets across them requires bridges that introduce latency, exorbitant fees, and significant counterparty risk. This fragmentation limits capital efficiency and undermines seamless user experiences.

Meanwhile, high-frequency trading and micropayments are unviable on-chain. Blockspace constraints and gas fees make real-time interactions cost-prohibitive and slow.

What’s missing in the digital assets space is a purpose-built clearing layer that can unify fragmented liquidity, enable transparent price discovery, and scale with demand.

Yellow’s Clearing Layer Approach

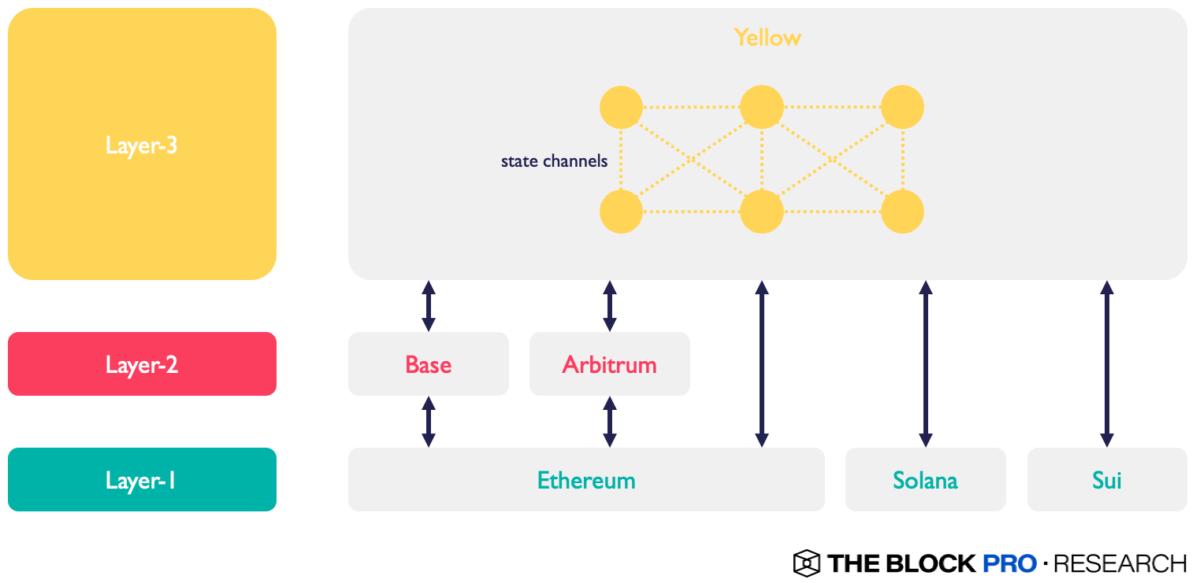

Yellow addresses fragmentation by introducing a chain-agnostic clearing network that drastically reduces cross-chain friction and settlement delays. Instead of settling each transaction on-chain, Yellow batches off-chain trades and finalizes only the net outcomes.

This architecture supports billions of off-chain messages per day, offering throughput that far exceeds existing Layer-1 and Layer-2 networks.

At its core, Yellow is a Layer-3 mesh network composed of state channels, designed to abstract away the underlying blockchains. It provides a unified virtual ledger where applications interact seamlessly across chains.

Developers no longer need to engineer around interoperability challenges. They can build directly on Yellow, focusing on product logic and user experience rather than infrastructure.

Yellow’s design draws inspiration from Bitcoin’s Lightning Network. Participants post collateral into smart contracts on supported blockchain networks and open high-speed state channels with other brokers. Within these channels, liabilities are updated off-chain at high frequency while maintaining synchronized virtual balances.

When liabilities become significant or at scheduled settlement times, channels are closed and net settlements are written back to the base layer using state channel contracts. This eliminates the bottlenecks of on-chain settlements while preserving security and enforcing transaction finality.

By combining high-frequency off-chain updates with efficient net settlement, Yellow resolves two of DeFi’s most critical pain points: multi-chain fragmentation and cross-chain communication latency. This lays the groundwork for scalable, trust-minimized financial infrastructure across all chains.

Technical Framework

At the heart of Yellow’s architecture is Nitrolite, a modular framework built on the ERC‑7824 standard for off-chain state channels. Nitrolite enables users and brokers to conduct real-time trading by exchanging liabilities and updating positions off-chain, while retaining cryptographic guarantees of enforceability through smart contracts. This setup ensures that all activity remains verifiable and enforceable on-chain.

Each broker on Yellow operates a ClearNode, which provides a trustless execution layer that functions as the network’s message hub and settlement engine. ClearNodes coordinate high‑frequency liability updates across participants and enforce net settlements on multiple blockchains, forming the backbone of Yellow’s chain-agnostic clearing network.

Applications

Trading & Payments

Yellow’s founding mission is to build a lightning-fast, off-chain clearing and settlement network for digital assets, serving as a crypto-native analogue to the Electronic Communication Networks (ECNs) in traditional securities markets.

At the core of this vision is NeoDAX, Yellow’s modular brokerage infrastructure stack. It offers a streamlined setup experience and is designed for high scalability, capable of supporting hundreds of thousands of transactions per second. NeoDAX combines the performance of centralized exchanges (CEXs) with the security principles of decentralized exchanges (DEXs).

Yellow’s peer-to-peer liquidity aggregation system mitigates counterparty risk through a fully automated net settlement process. The network levies a small clearing fee, calculated as a percentage of the net settlement liability, which directly funds the Yellow treasury.

Additionally, Loculus, a crypto-native AI terminal, integrates five core services—trading, research, learning, narratives, and airdrop discovery—into a single, personalized interface powered by the Yellow SDK. This architecture guarantees instant and gasless trade execution in a terminal that analyzes real-time market conditions to deliver personalized results.

Beyond exchange trading, Yellow facilitates cross-chain token transfers, which opens the door to broader applications, enabling near-instant, low-cost payments in contexts such as retail or live events.

At the same time, Yellow’s role as a trustless, chain-agnostic clearing layer makes it more directly comparable to SWIFT’s function in global financial markets, which is a neutral infrastructure layer that connects fragmented institutions and ensures secure, efficient settlement across borders. In the digital asset space, Yellow provides that same backbone for brokers and exchanges operating across multiple blockchains.

Enterprise Integration

Yellow’s modular architecture allows enterprises to integrate crypto functionality gradually, adding components such as sign-in modules, custody contracts, trading interfaces, and admin panels directly into their existing Web2 products. This incremental approach reduces technical overhead and accelerates time-to-market for digital asset features. For example, Credit Swap is a peer-to-peer platform that helps crypto holders qualify for traditional mortgages by connecting them to proxy buyers who can assist in securing conventional bank loans, with Yellow’s state channels managing high-speed auction and bidding to match users.

Because Yellow is chain-agnostic, enterprises can support multiple blockchains without hassle. State channels abstract away the complexities of cross-chain settlement and collateral management, enabling seamless interaction across disparate networks.

For instance, a fintech or e-commerce company can integrate Yellow to offer asset trading or token-based payments within their existing services. A ticketing platform can embed a Yellow-compatible wallet to enable users to purchase event tickets and merchandise with digital assets from any supported blockchain. A good example of this is Beatwav, an event-centric commerce platform that utilizes state channels to provide instant, gas-free payments for event purchases, offering near-instant settlement.

This benefits developers through plug-and-play modules that accelerate deployment, while users enjoy a frictionless, low-fee experience. The result is a significantly lower barrier to Web3 integration for traditional businesses looking to expand into the realm of digital assets.

Key Differentiators

Yellow’s Layer-3 clearing network addresses liquidity fragmentation more effectively than bridges or single-chain DEX aggregators, by linking brokers and exchanges across multiple blockchains through state-channel infrastructure.

Because only the net outcome of trade batches is written to the base chain, Yellow achieves throughput on par with centralized exchanges, far exceeding what today’s Layer-1 and Layer-2 blockchains can support.

Its chain-agnostic design contrasts with other interoperability solutions that require bespoke bridge infrastructure or custom chain adapters, allowing developers to build cross-chain products without dealing with low-level plumbing.

Its trustless model further distinguishes Yellow from legacy clearing houses, since collateral is locked in smart contracts rather than with centralized intermediaries, mitigating counterparty default risk and preserving user control.

Finally, regulatory alignment differentiates Yellow from most DeFi protocols by mirroring traditional capital market structures, separating custody, clearing, and execution, while still allowing KYC/AML enforcement at the network edge. This reduces compliance friction and simplifies licensing requirements across jurisdictions.

Adoption Drivers

Several upcoming milestones could be critical in driving Yellow’s initial adoption.

In 2025, the team plans to deliver the first major release of the ClearNode technology stack, establishing the foundation for Yellow’s production-ready clearing infrastructure.

Following this, the roadmap includes expanding support for both EVM and non‑EVM blockchains, introducing account-abstraction-enabled cross-chain swaps, and growing the brokerage ecosystem. Together, these steps will broaden protocol utility while reducing integration barriers for developers and partners.

Yellow abstracts away the complexity of interoperability, enabling builders to easily integrate the Layer-3 network into their applications. Gaming studios, fintech platforms, and emerging DeFi apps can tap into Yellow without re-engineering their infrastructure, accelerating time-to-market and expanding the protocol’s network effects.

The introduction of the native protocol token, YELLOW, adds a powerful economic layer to the network. Transaction and clearing fees will be paid in YELLOW, and brokers must lock the token as collateral to open state channels. If a participant fails to settle within the pre-agreed period, their deposit can be slashed, creating strong incentives for honest behavior.

Institutional backing further strengthens Yellow’s position. A $10 million seed round led by Ripple co‑founder Chris Larsen, with participation from Consensys Ventures and GSR Capital, signals strong industry confidence.

As traditional financial institutions deepen their investment in modern, blockchain‑based clearing systems, Yellow’s trustless, scalable design aligns well with evolving infrastructure demands.

Ultimately, the pace and scale of adoption will depend on execution and market receptivity. But with a solid technical roadmap, regulatory alignment, and strong capital backing, Yellow has the foundations to play an important role in emerging cross-chain financial infrastructure.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.