Expect correction to be standard and healthy -NewEdge Wealth

- Nasdaq up ~0.6%, S&P 500 edges lower, DJI down ~0.5%

- Real estate weakest S&P 500 sector; tech leads gainers

- Euro STOXX 600 index up ~0.1%

- Dollar, gold ~flat; crude up modestly; bitcoin slips

- U.S. 10-Year Treasury yield rises to ~4.34%

EXPECT CORRECTION TO BE STANDARD AND HEALTHY -NEWEDGE WEALTH (1215 EDT/1615 GMT)

Long-term Treasury yields have been on the rise, and, in fact, on Monday, the U.S. 10-Year Treasury yield US10Y has hit its highest level since 2007.

As Cameron Dawson, chief investment officer at NewEdge Wealth, sees it, there are a number of factors behind the recent move higher in yields including: better U.S. economic data, increased Treasury supply to finance the swelling fiscal deficit, decreased Treasury demand from foreign buyers, the Fed's expressed hope that it can cuts rates in 2024 if real rates rise, and the discussion of a higher long-term neutral rate given economic resilience in the face of higher Fed policy rates.

Interestingly, Dawson notes that the rise in yields is occurring just as the one-year anniversary of Chairman Powell's "curt and hawkish" speech at Jackson Hole approaches. That speech last year jolted equity markets from their bullish summer slumber and sparked the slide into the October 2022 lows.

"Despite Powell's 2022 warning of 'pain', a 'sustained period of below trend growth', and 'using our tools forcefully to bring demand and supply into better balance', we have seen little evidence of the impact of higher rates slowing U.S. economic growth," writes Dawson in a note.

At this year's Jackson Hole Symposium later this week, NewEdge expects discussion about that neutral rate, trying to make sense of economic resilience despite higher rates and broad expectations for weakness.

Tactically, for equities, Dawson expects the current corrective period to continue in the near-term. Shorter term, she says U.S. equities are nearing oversold levels which could support slight stabilization. However, she is cautious given a tough seasonal stretch through October, and no sign yet of a washout.

Dawson does highlight that we are starting to see a spike in downside protection (looking at measures like the put/call ratio), but she says it has not reached prior extremes yet.

"For now, we expect a 'standard' and healthy U.S. equity correction (throughout U.S. equity history, high-single-digit to low-teen corrections are common even during the most powerful bull markets) that can provide an entry point for underweight investors, but of course will remain vigilant in monitoring for signs of rising growth fears that could increase downside."

As for fixed income, NewEdge expects an upward bias on yields until there are cracks in the economic growth picture, which could revive hopes for an easier Fed and lower inflation.

(Terence Gabriel)

*****

FOREIGN CENTRAL BANKS EYED FOR FX INTERVENTION, WHAT ARE THE RISKS TO BONDS? (1100 EDT/1500 GMT)

Speculation that central banks in China and Japan could sell Treasuries to raise funds to support their ailing currencies is adding a risk to the bond market at the same time as participants are already grappling with growing supply and surging long-dated yields.

Analysts say that there is no evidence of widespread selling by these banks yet, however, and noted that if it does occur it will likely impact shorter-dated yields and swap spreads more than longer-dated Treasuries.

“If there is indeed official selling of Treasuries, we are not sure there would be a pronounced impact on the long end—foreign official holdings of Treasuries tend to be concentrated at the front end of the curve, so they can be more easily liquidated in times of financial stress,” JPMorgan analysts said in a report.

“Additionally, despite the chatter and the considerable moves in yields in the last couple of weeks, swap spreads have remained fairly stable. Overall, we don’t expect foreign official selling of Treasuries to be a meaningful driver of yields in the near-term, nor a significant negative for swap spreads,” they added.

Bank of America agreed that short and intermediate-dated swap spreads would most likely be impacted by foreign exchange intervention and added that Japan’s Ministry of Finance (MOF) and the People’s Bank of China (PBOC) also have other tools to help to stem currency depreciation.

The PBOC can use macroprudential measures such as window guidance to banks to access U.S. dollars and adjustments to FX reserve requirements.

The official sector can also withdraw cash held at the Federal Reserve’s foreign reverse repurchase program rather than reduce securities. “Compared with 2H 2022, we think a drawdown in repo balances may be more preferred based on relative attractiveness vs short-dated USTs,” BofA noted.

Bank of America concludes that the threat of central banks selling Treasuries is a risk as “USD strength not only sparks official sector sales but contributes to extremely high hedging costs for private investors. This puts more weight on domestic buying.”

However, “the most direct impact of any intervention-related reduced UST holdings is likely to be most concentrated at the US front end.”

(Karen Brettell)

*****

S&P, NASDAQ RISE AS INVESTORS LOOK TO JACKSON HOLE (1014 EDT/1414 GMT)

The S&P 500 SPX and Nasdaq

IXIC are higher early on Monday, while the Dow

DJI is slightly down, with investors looking to a central bank policymakers' meeting in Jackson Hole starting on Thursday for clues on where interest rates are headed.

Investors are also looking at quarterly results from Nvidia NVDA later this week. Nvidia is up in early market trading as HSBC raised its price target on the stock to $780, the second highest on Wall Street.

The market's focus though, for now, is on Jackson Hole. Fed Chair Jerome Powell is due to speak on Friday at the gathering, but many think Powell is unlikely to make big statements on interest rates.

"We think Friday's remarks from the Federal Reserves chair could be a bit of a snoozer. With another payrolls report and more consumer price data set for release between now and the central bank's September meeting, there exists no solid rationale for countering - or doubling down on - the bias toward higher-for-longer rates articulated in the last dot plot and meeting minutes," writes Karl Schamotta, chief market strategist at Corpay.

There are no major economic data releases due for release on Monday and the weekly calendar looks thin, except for a few housing data points. But the U.S. economy continues to defy expectations, with upside surprises in recent data, pushing Treasury yields higher.

In any event, at about 4.35% on Monday, the U.S. 10-year yield US10Y has now hit its highest level since November 2007.

Here's a snapshot of assets across financial markets:

(Gertrude Chavez-Dreyfuss)

*****

S&P 500 INDEX: TRADERS EYE LEVELS AHEAD OF WEEK'S BIG EVENT RISKS (0900 EDT/1300 GMT)

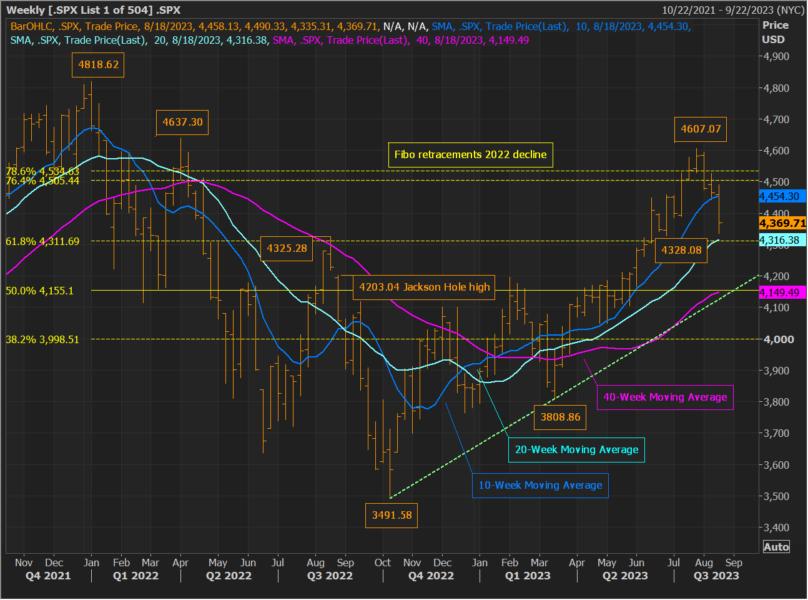

The S&P 500 index has closed down for three-straight weeks. With this, the benchmark index has lost as much as 6% from its late-July intraday high.

Amid a percolating VIX VIX, which hit a three-month high last week, traders continue to eye key levels ahead of a number of event risks this week, including earnings from Nvidia

NVDA on Wednesday, and Fed-Chair Powell's highly anticipated Jackson Hole Symposium speech this Friday:

Last Friday, the SPX hit a low of 4,335.31 before bouncing to finish at 4,369.71.

With its low on Friday, the SPX nearly tagged a support zone defined by late June low (4,328.08), its mid-August 2022 high (4,325.28), its rising 20-week moving average (WMA), which should ascend to just over 4,320 this week, and the 61.8% Fibonacci retracement of the January 2022-October 2022 decline, which should now attempt to act as support at 4,311.69.

If the index is unable to stabilize around this area, the next major support zone is in the 4,203.04-4,135 area. This zone includes the August 2022 Jackson Hole Powell speech high, the rising 40-WMA, which should ascend to around 4,155 this week, the 50% retracement of the January 2022-October 2022 decline (4,155.10), and the support line from the October 2022 low, which should be around 4,135 this week.

On a recovery, the index will need to reclaim its 10-WMA, which should be resistance around 4,460 this week.

Additionally, the 76.4%-78.6% Fibonacci retracement zone of the January 2022-October 2022 decline is now a barrier again at 4,504.44=4,534.83.

(Terence Gabriel)

*****

FOR MONDAY'S LIVE MARKETS POSTS PRIOR TO 0900 EDT/1300 GMT - CLICK HERE