Broader indices underperform, these smallcaps slumped 10-25%

The mixed performance from broader indices continued in the second week, underperforming the main indices, with the BSE Smallcap index falling 0.6%, the Largecap index rising 1.5%, while the Midcap Index ended flat.

For the week, the BSE Sensex index surged 1451.37 points or 1.75 percent to close at 83,952.19, and Nifty50 added 424.5 points or 1.67 percent to finish at 25,709.85.

The Foreign Institutional Investors (FIIs) remained net buyers for the last three sessions of the week, but for the week, they offloaded equities worth Rs 586.76 crore. On the other hand, Domestic Institutional Investors (DII) continued their buying in the 26th week, as they bought equities worth Rs 28,044.45 crore.

On the sectoral front, the Nifty Realty index gained 4%, the Nifty Capital Markets index added nearly 4%, the Nifty FMCG index rose 3%, the Nifty Auto index rose 2%, while the Nifty Media index shed 2.7%, the Nifty IT index fell 1.8%, Nifty Metal and PSU Bank indices declined 0.5% each.

"In the last week, the benchmark indices continued their positive momentum. Technically, on daily and intraday charts, the indices are holding higher high and higher low series formation. On weekly charts, a long bullish candle has formed, which supports the possibility of further uptrend from the current levels," said Amol Athawale, VP Technical Research, Kotak Securities.

"We are of the view that the short-term market texture is bullish, but due to temporary overbought conditions, some profit booking may occur at higher levels. For traders, 25,550-25,350 /83000-82400 would act as key support zones, while 26,000/84400 and 26,300/85300 would be the crucial resistance levels for the bulls. However, below 25,350/82400, the uptrend would become vulnerable."

"For Bank Nifty traders, 57,000 would act as a strong support zone. As long as it continues trading above this level, the bullish sentiment is likely to persist. On the higher side, it could move up to 58,000-58,500," he added.

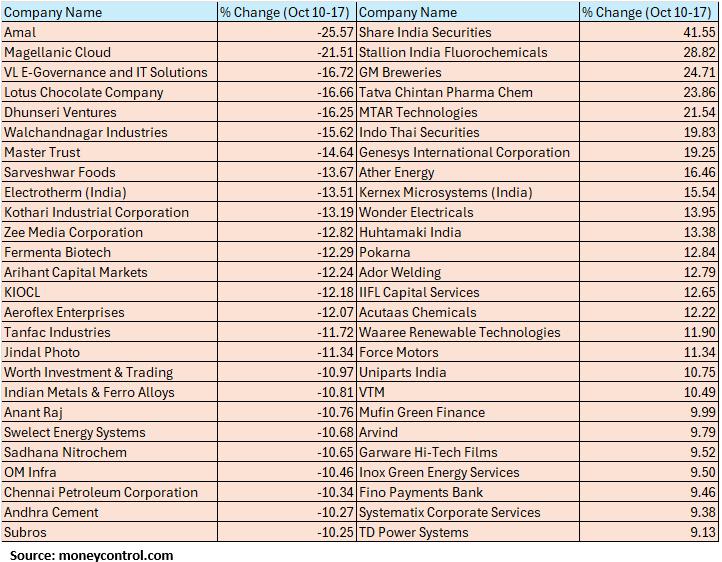

The BSE Small-cap index shed 0.6 percent with Amal, Magellanic Cloud, VL E-Governance and IT Solutions, Lotus Chocolate Company, Dhunseri Ventures, Walchandnagar Industries falling between 15-25 percent, while Share India Securities, Stallion India Fluorochemicals, GM Breweries, Tatva Chintan Pharma Chem, and MTAR Technologies added between 21-41 percent.

Where is Nifty50 headed?

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

The present bullish chart pattern indicates a decisive breakout of a crucial hurdle, like down down-sloping trend line around 25400-25500 levels.

Nifty on the weekly chart formed a long bull candle that surpassed the crucial trend line resistance around 25500. A bullish pattern, like higher tops and bottoms, is intact as per the weekly timeframe chart. The next upside target to be watched is around 26200. Immediate support is placed at 25500.

Ajit Mishra – SVP, Research, Religare Broking

Looking ahead, participants will react to the quarterly results of heavyweights Reliance Industries, HDFC Bank, and ICICI Bank in early trade on Monday, which could dictate market direction.

Technically, the Nifty’s prevailing positive tone remains intact, with the next targets seen at 26,000, followed by new lifetime highs. However, given the recent underperformance in the broader market, traders are advised to focus on index heavyweights and larger midcaps for long trades.

Vinod Nair, Head of Research, Geojit Investments

Looking ahead, the trajectory of Indian equities will be shaped by the ongoing earnings season and policy signals from major global central banks. Market optimism was bolstered by clarity in India–US trade relations, with both sides tentatively agreeing to conclude the first phase of the deal by November.

Investors are expected to maintain a preference for high-quality names across consumption, banking, and real estate, with any market corrections likely to attract renewed buying interest. The week ahead will be a holiday-led truncated week on account of Diwali. Investors are likely to remain cautious in view of the release of key economic data, such as US inflation, employment, and India’s PMI figures."Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.