When Optimism Becomes Income - Palantir's Fragile Tax Game

Investment Thesis

Palantir Technologies has delivered impressive top and bottom line growth this year, but I remain deeply skeptical. The stock trades at an extreme valuation that assumes flawless execution for years to come. More troubling is the company's fragile tax strategyone that relies on massive stock-based compensation to keep effective tax rates artificially low. This approach has worked brilliantly while shares surged, but it creates a dangerous dynamic: as the stock price rises, the risk profile intensifies. I see an inflection point coming where this strategy unravels, potentially becoming the "straw that breaks the camel's back" for investors.

Product Analysis

Palantir is a data analytics company that analyzes raw data at mass scale and distills it into actionable insights for clients. The company operates three main platforms: Gotham serves government agencies like the CIA, FBI, and DoD for counterterrorism and threat detection; Foundry targets commercial enterprises across industriesfrom supply chain management at Airbus to patient monitoring in hospitals; and Apollo provides software delivery for organizations that can't use cloud platforms like AWS or Azure. These platforms have established Palantir's foothold in both government and commercial markets, with deep ties to the US government through early investor Peter Thiel.

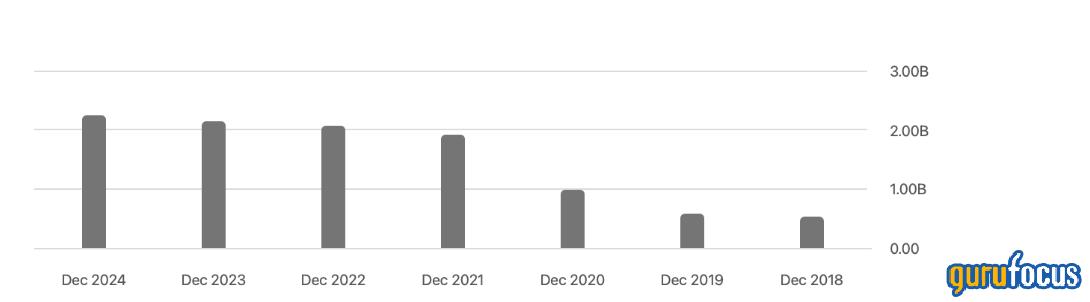

Scalability And The Impressive Growth Of ROIC

The biggest argument by bulls for Palantir has been the opportunity to scale the platform rapidly without necessarily needing to grow the headcount and in turn operating expenses. When I started following the stock in 2021 after it became one of the most talked about in investment circles it had $1.613 billion in annual operating expenses as per the 10-K. Since then it has grown to $2.184 billion on a 12-month trailing basis, a 35.3% increase. Most of that came from SG&A, while R&D stayed relatively stable, growing from $359 million to $559 million.

However, during the same period revenues grew from $1.905 billion annually to $2.865 billion during 2024. With momentum continuing in this year, Palantir raised its full year revenue guidance to $4.150 billion. This represents a growth rate of 44.8% from the year before. It seems reasonable to assume between 30 - 40% in annual top line growth over the next 5 years at least. Most of the recent reports include these figures and management seems confident it can continue like this.

When measuring ROIC for Palantir it becomes a little tricky so I've divided it into two camps. The primary reason being that Palantir has had a very low tax rate of just 2.59% ($793 million EBT and $20.6 million income tax expense) the past 12 months due to benefits from deferred assets and stock based compensation. Without this it would most likely be in the range of 22%, similar to the statutory tax rate.Interestingly, in the first half of this year and last quarter the effective tax rate was even lower at 1.7% and 1.1%.

Moreover, at 2.59% tax TTM NOPAT is $554 million and at 22% tax TTM NOPAT is $443 million. Calculating invested capital I've used $237 million of total debt, $6.025 billion total equity and $6 billion in cash and ST investments. I've decided to use all of the cash positions to reflect just how little cash is tied up in operations right now. This gets me a ROIC of 114% and 69% depending on the tax rate used.

In 2021, the ROIC was negative due to revenues being too low and operating expenses still relatively high. During 2023 Palantir faced the same issue as invested capital exceeded NOPAT. During 2024 it was able to clear this hurdle and ROIC skyrocketed as a result.

What I don't see talked about enough is the high cash conversion rate that Palantir has. Because of revenues growing so has FCF margins, averaging over 36% the past 12 months. If growth remains the same it could generate over $2 billion in FCF next year. Currently, over 90% of operating cash flows are used in financing activities.

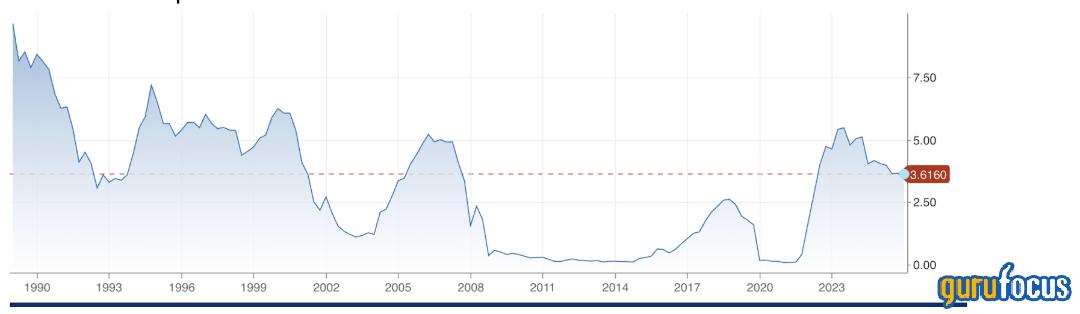

Most of this increased cash flows is going straight into US treasuries, an asset which has grown by nearly $2 billion YoY. Since these are accounted for as current assets they wouldn't be longer than 12 months to maturity. Currently US 1-year treasuries have a 3.607% yield. Down from 4.41% in late November 2024. It's better than keeping it as all cash seeing as the US dollar index is down 8.41% YTD.

What this strategy also underlines is two things. Either the management sees little value in buying back their own stock at the current price levels, or they have a really undeveloped capital allocation strategy where everything is simply funneled into treasuries. Perhaps they see the most value in this, which is a little confusing since I haven't seen any other large tech company allocate nearly this amount of FCF to buying US treasuries. Maybe Palantir knows something the others don't? Most likely it's a combination of the two reasons I mentioned lack of value in buying back shares at current levels and poor capital allocation strategy. Neither explanation flatters the management.

Stock-Based Compensation, A Ticking Time Bomb For Investors - Hidden Tax Risk

I don't think it's inflammatory to suggest that stock-based compensation for investors is a ticking time bomb. Over the past 5 years shares outstanding have risen from 977 million in 2020 to 2.317 billion as of Q2 2025. Since Palantir was unprofitable for several years it has leveraged this along with stock-based-compensation (SBC) to pay a very low effective tax rate, most of the time below 2%.

The risk I see is that if the price of the stock drops sharply, the amount of deductible taxes also drops significantly.

Currently Palantir has the following tied up in SBC:

RSU (Restricted Stock Units) - 53.2 million - weighted AVG $19.42

Stock Option - 158.9 million - weighted AVG $9.77

SAR (Stock Appreciation Right) - 7.2 million - weighted AVG $65.31

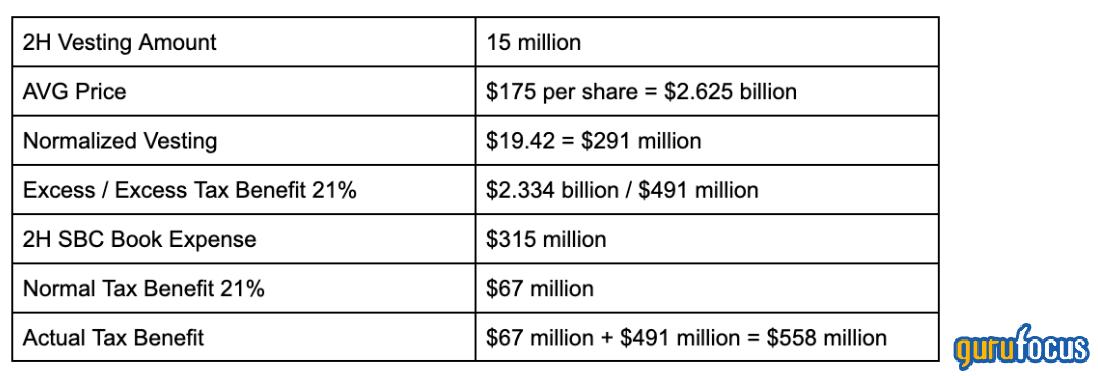

RSU is the most important area for tax deductions. Based on the first 6-months its set to have an annual vesting run rate of 30 million shares. The shares have surged this year so forecasting a specific tax benefit is difficult, but for the sake of this exercise I'm assuming it stays at $175, which is around where it trades at the time of writing this.

At the current run rate of 30 million per year Palantir is set to reach a breaking point in 2027 or 2028. I see this as very plausible since the granted amount was only 3.2 million in the first half of this year and the vested amount 13.4 million. The newly granted RSU also had a weighted average price of $106. This leaves a lot less margin of safety for the tax strategy. At $19.42 per share Palantir would need to drop like a rock for there to be no tax benefit. At $106 per share the fall is much shorter. The slowdown in granted RSU suggests that this strategy might come to an end eventually and with that Palantir will be forced to recognize a much higher tax rate. This will impact EPS forecasts and suggest the stock is even more overvalued than now.

I see this as the biggest risk to Palantir shareholders right now because it creates a dangerous spiral where if the stock price falls, a vested RSU could incur a book expense rather than offset taxes. This lowers earnings. Stock compensations might have to continue to keep staff incentives at the same amount, but lower share price creates accelerated dilution, further pressuring EPS.

This table shows the impact if the price drops from where we are now in the next 12 months. I've used a set share amount of 2.317 billion, similar to previous models. The risk here is that PLTR already trades at a high valuation so it can fall a lot more to reach fair value than other stocks in the sector. I'm taking Oracle (ORCL) for example which also benefits from increased AI usage and is another popular tech stock. It trades at a FWD P/E of 43. It could fall 43% to reach the sector median of 24.59x. Palantir would have to fall 90.9% to reach the same multiple.

Any sign of a slowdown in revenues or earnings and the stock will tumble seeing as it trades at such a high FWD multiple already. This is a special kind of risk that I haven't seen in any other stock, which is all the more reason for me to stay far far away.

Stock Based Compensations, Hiding True SG&A Costs

When accounting for the true cost of SBC, which often gets hidden in reporting and bundled up in SG&A, the profitability picture changes dramatically. Between 2020 and now (Q2 2025) the share count has grown by 1.34 billion, 285 million annually and 70.5 million per quarter. Running the average closing price since its IPO up until the end of last quarter I've gotten a few different answers:

Weighted average - $29.5

Simple average - $32.55

Conservative average - $35

Moderate average - $40

I'm going to use the moderate average. I could adjust this for volume as well to get an even more accurate number, but since these four outcomes are all quite close to each other I've decided my argument still is supported by not doing that. It should be said the largest amount of dilution occurred between 2020 and 2021 when shares grew by nearly 1 billion, effectively accounting for over 70% of all dilution. Based on this the effective cost of SBC would be $11.28 billion annually - 285 million shares per year x $40 avg per share.

Being more moderate when accounting for dilution we can look between 2021 and now instead, being 394 million shares. This comes out to 21.8 million per quarter (divided by 18) or 87.55 million per year. This seems like the "normalized" dilution rate Palantir will be running on. Using the same moderate $40 avg share price the annual true cost of SBC is $3.5 billion. During the last 12 months Palantir has reported $1.7 billion in operating cash flows. Subtracting the now calculated true cost of SBC I get a negative $1.8 billion. This speaks to how fragile profitability actually is for the company when taking into account the true and somewhat hidden cost of SBC.

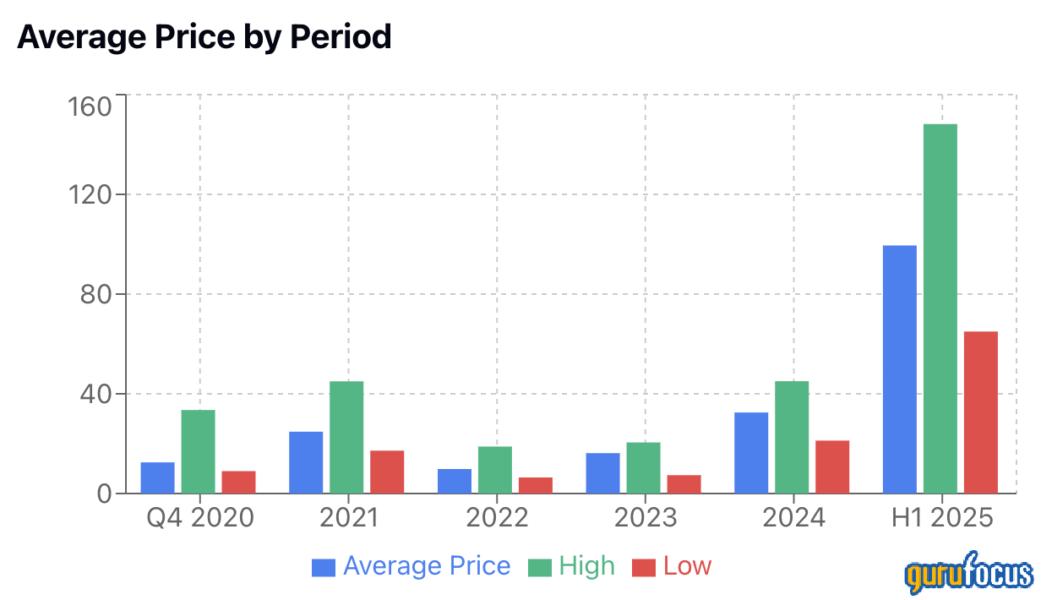

Before going into how Palantir isn't publicly discussing what they plan on doing once this strategy eventually ends I want to highlight the shift in price now from a few years ago. The price has had a tremendous run, which only pushes up the average cost in SBC, meaning more true costs being hidden. Dilution hasn't exactly stopped which means the $3.5 billion true annualized cost I mentioned will likely grow even larger the next few years if the price doesn't come down.

No Pronounced Strategy After This

Reading through both the last 10-Q and the 2024 annual report there seems to be a lack of strategy if and when the tax rate changes for Palantir.

This is from the 10-Q and basically means that Palantir knows the rate will change but completely leaves out any mitigation strategies as it just ends there.

This comes from the management discussion and again boils down to the strategy being to just generate more income to not use up the NOLs. From the latest DEF 14A it included short-term RSU grants for 2 of the 5 NEOs, (CFO and CRO/CLO). Transitioning to short-term grants basically means cash compensation which implies that Palantir realises its current tax strategy might be at the end of the road. I suspect that in Q3 2025 the weighted average price on granted RSU will be over $150 but at a much lower rate than the quarter before. I don't think it will be over 3 million shares. This will undoubtedly mark the peak of this tax strategy cycle. If the management is not confident the price can rise from here on out to as before, then why should the market?

Insider Activity Points To Large Selling, Opposite Of Market Sentiment

I've mapped out some of the insider activity which has been reported so far this year as the stock price has surged to new highs.

CEO Alexander Karp sold in August shares worth $62 million. This was equivalent to roughly 42% of the vested shares he received. In May he also sold shares, worth over $50 million, equivalent to 41% of the vested amount.

CFO David Glazer has been equally active. In September he exercised stock options for 37.770 shares but sold a total of 80.000 shares worth $12.4 million. During August he sold 42% of the vested shares for $2.4 million. In May he again sold 41% of the vested shares received, valued at $4.35 million.

This is worrisome since the people in these positions are meant to be a guiding light of sorts for the sentiment around the stock price. We don't see any insider buying at all in Palantir. It's only vested shares who get kep but a large portion gets sold off straight away. Both the CEO and CFO still have large substantial ownership but not seeing any buying isn't instilling any positives in my opinion.

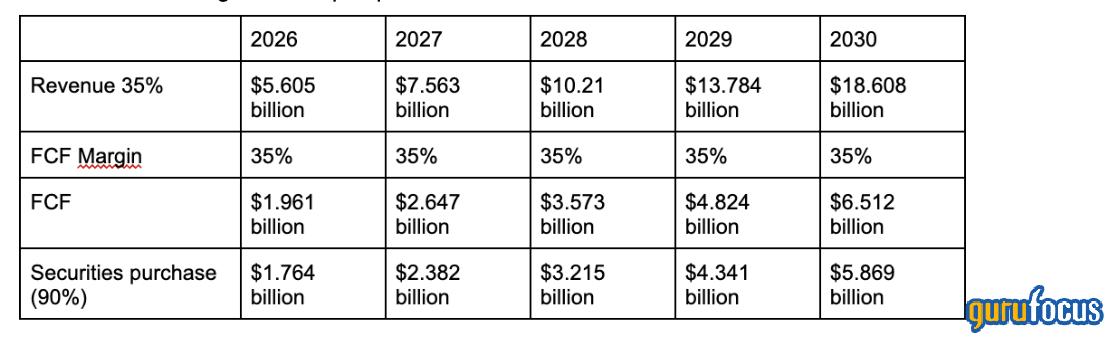

Cashflows Are Creating A Sustainable Income Stream By Going to Short-Term US Treasury Securities

My point here is that Palantir is turning into a massive cash cow with its SaaS business type. The dilemma comes when you consider the massive premium the shares are trading at which means the return on share buybacks is not that attractive. I see the company continuing to build up an even bigger cash pile the next several years, potentially ballooning to over $15 billion if growth keeps up. I've visualized this below.

Palantir is converting its growing cash flows into US Treasury securities rather than share buybacks. Using 90% of operating cash flows (Palantir used 95% over the past 12 months), cumulative investments would reach $17.6 billion through 2025 and over $22 billion by 2030.

These short-term securities generated $213 million in investment income over the past 12 months at a 4.12% yield. At a more conservative 3.15% yield reflecting expected Fed rate cuts, this would produce $722 million in annual pre-tax income by 2030higher than current earnings from these investments. Management has chosen this approach over buybacks given the stock's premium valuation, effectively building a Treasury portfolio that could rival the company's core operating income.

The risk I identify here is that rates continue to go lower and so does the 1-Year. In times of a very dovish FED the 1-Year drops like a rock and these investments would generate little income each year. On the other hand some might say Palantir should move this capital over to long-term, which I expect it will to a certain degree. Does Palantir just want to funnel all of its FCF into long-term investment and tie up capital there? Perhaps, because it would generate a lot more income since short-term securities are likely to fall further.

2030 Earnings Forecast

At 35% CAGR of revenues, by 2030 Palantir should see $18.608 billion, starting from the 2025 guidance provided of $4.150 billion. OPEX has grown at a CAGR of 5.825% between 2024 and 2021. For the sake of being conservative I'm assuming a 7% CAGR until 2030 to reflect the chance Palantir might have to invest more aggressively into R&D to fend off competition. This gets me $2.984 billion by 2030.

Gross margins should gradually increase over the next 5 years through scaling and platform adoption. If Palantir maintains its treasury purchase pace at 90% of OFC, it would accumulate $22.929 billion by 2030. With yields around 3.15% (reflecting Fed rate cuts), this generates $722 million in annual investment income.

Taxes are uncertain. Palantir has kept rates low using deferred tax assets and stock-based compensation, but sustainability is questionable. Using 15-17% rates to reflect actual federal taxes, net income reaches $11 billion by 2030 as OPEX grows slower than revenue. If sub-2% rates persist, net income hits $13.465 billion instead. Based on these scenarios, Palantir trades at:

2% Tax Rate - $13.465 / 2.317 (basic shares) = $5.81 EPS = FWD P/E of 30.11x

17% Tax Rate - $11.404 / 2.317 (basic shares) = $4.92 EPS = FWD P/E of 35.56x

Palantir's share count will likely exceed 2.317 billion by 2030. Between Q4 2020 and Q2 2025, shares grew 31.4% (1.74% quarterly over 18 quarters). Continuing this trajectory puts shares at 3.396 billion by Q4 2030, which drastically changes the FWD P/E:

2% Tax Rate - $13.465 / 3.396 (basic shares) = $3.96 EPS = FWD P/E of 44.19x

17% Tax Rate - $11.404 3.396 (basic shares) = $3.35 EPS = FWD P/E of 52.23x

Palantir relies on SBC to suppress taxes, so I expect this continues. Even with that, the valuation is unattractive in both scenarios. Projecting beyond 5 years is unreliable given how much can change. If growth slows to 15% YoY, paying 44x earnings (best case) is expensiveI'd prefer 30x. But waiting for that valuation means missing years of appreciation. This is why it's a sell. Current pricing assumes 30% perpetual growth, which feels like wishful thinking.

Gurus

Notably during the past months has been an increase in gurus selling off shares in Palanitr. It was clearly more stock sales happening during the first half of this year and it seems plausible this trend will continue for as long as the price remains elevated like this. I think it's part of a broader trend of fund managers and larger investors de-risking and going into more value stocks. Or at least those companies which are more reasonably valued.

The largest sales that occured the past 6 months is Jeffires Group selling 97% of their stake, Ken Fisher (Trades, Portfolio) selling 22% after adding 33% back in March. It seems to be mostly Ken Fisher (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) who has been the buyers of Palantir this year, at least to any noticable degree. Both of these guys are heavily focused on the tech-sector. Both posted strong returns as the price of NVIDA rose the past few years after having been relatively early investors. Palantir does not break the top 10 in either portfolio so I see the recent buying and selling more as trading rather then long-term investing.

The Full Picture

It's not often you write about a stock which is so heavily polarized in terms of sentiment. On one hand you have bulls who say the stock will only go up and up because of more government contracts. The other side says it's grossly overvalued and not trading based on fundamentals. I'm in the second camp. I can admit that its investments into US treasury securities might add a meaningful source of income if rates stay at above 3% over the long-term.

But it's not sufficient to change my mind on the stock. Besides trading a substantial premium I think investors don't realize just how much of the current earnings are from tax benefits, only made possible through aggressive SBC and deferring assets from previous years of being unprofitable. Eventually it will have to start paying a higher tax rate and this will have a massive impact on earnings and could be what sends shares tumbling.