Barrick Gold Beats Forecasts in Strong Q2

1: Barrick Gold's 2Q25 Results Highlight Strong Gold Revenues, Solid Copper Contribution, and Ongoing Cost Discipline.

Barrick Gold Corporation, based in Toronto, Canada, is one of the largest gold producers globally, operating in the Americas, Africa, and the Middle East (copper). The company has significant mining sites in the United States, Canada, the Dominican Republic, Chile, and Mali. This article is an update of one I wrote on May 27, 2025.

Among Barrick's main competitors are Newmont Corporation NEM, the leading company in global gold production; Agnico Eagle Mines Limited

AEM, a prominent Canadian miner; and Kinross Gold Corporation

KGC, which operates in the Americas, Africa, and Russia. Other notable companies include Gold Fields Limited (GFI), a South African firm with international operations; Polyus Gold (PLZL), Russia's largest gold producer; AngloGold Ashanti (AU), which has mining assets in Africa, Australia, and the Americas; Zijin Mining Group (601899.SS), a Chinese multinational focusing on gold and copper; and Pan American Silver Corp.

PAAS, primarily a silver producer known for its significant gold output. Below is the chart that represents the proven and probable reserves (gold, silver, copper) for all the companies mentioned above.

Barrick Gold has reserves of 89 million ounces of gold and 13 million tons of copper, making it one of the largest mining companies in the world.These companies are frequently compared with Barrick in terms of production scale, financial performance, and operational efficiency, underscoring Barrick's standing as a top-tier global mining leader.

2: A quick look at the gold and copper production in 2Q25.

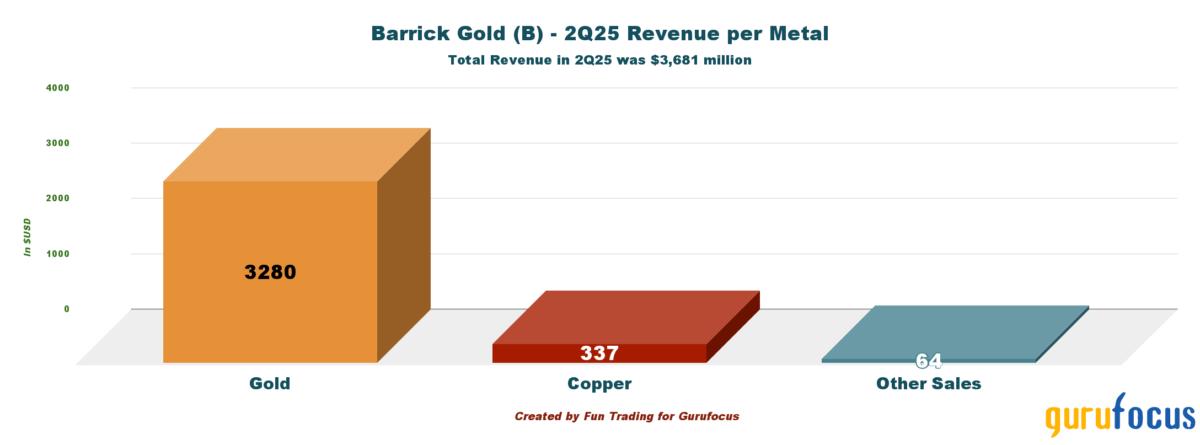

Barrick Gold is primarily a gold producer, with 89.1% of its revenue from gold sales as indicated below:

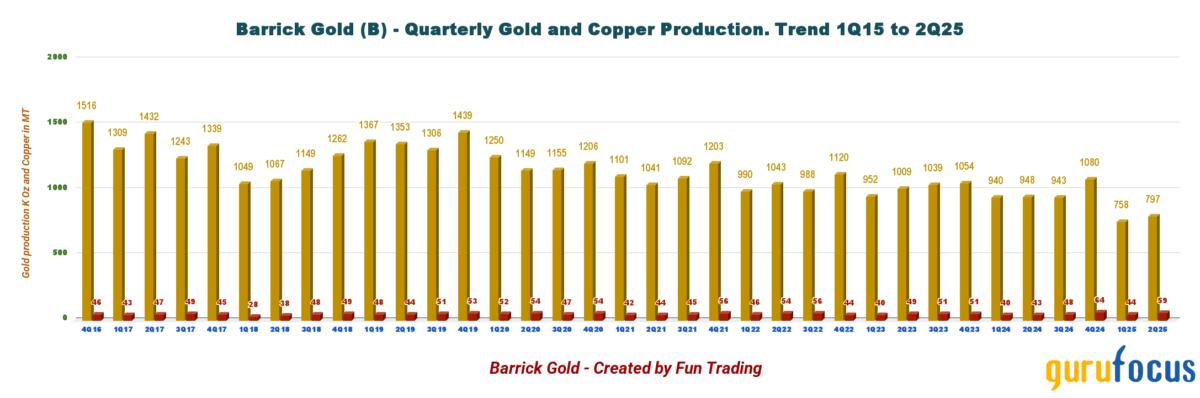

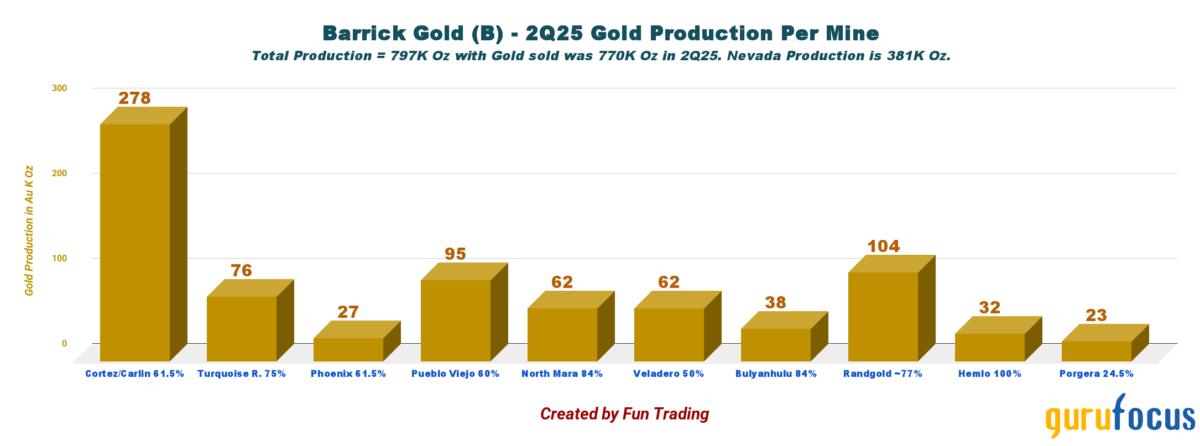

Barrick's second quarter of 2025 presents a compelling glimpse into how a mining giant navigates both opportunities and challenges. One notable standout was the company's ability to grow production despite significant pressure. Gold output reached nearly 797,000 ounces, an impressive figure considering that one of Barrick's key mines, Loulo-Gounkoto in Mali, was offline due to local disputes.

2.1: Lower gold production this quarter due to the Loulo-Gounkoto mine issue.

This mine typically contributes about 15% of the group's gold production, yet Barrick still managed to achieve growth. This indicates both the strength of its portfolio and the adaptability of its operations.

The situation in Africa highlights the balancing act that Barrick faces. On one hand, its mines in the region are world-class assets with decades of reserves and high grades that many competitors would envy. On the other hand, political uncertainty and disputes over resource ownership make it challenging to ensure consistent performance from these operations. Looking ahead, Barrick will continue to invest in its African mines, but it may increasingly rely on its operations in Nevada, Pueblo Viejo, and its copper projects for stability. If the issues in Mali can be resolved, Africa could once again serve as a core pillar of Barrick's gold business. However, a long history of problems is not truly encouraging.

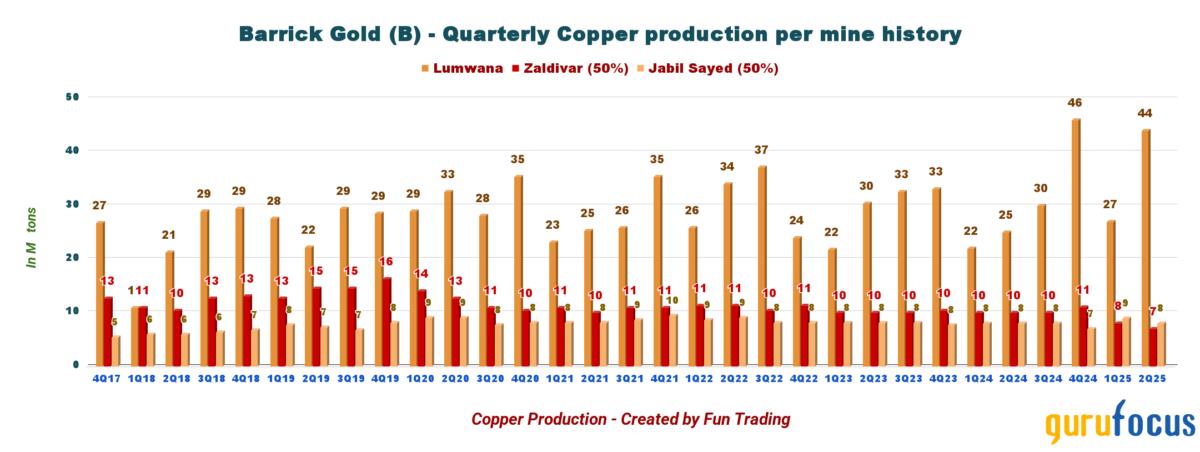

The real highlight, however, was copper production, which surged by more than 30% compared to the previous quarter, totaling 59,000 metric tons. Much of this success can be attributed to the Lumwana mine in Zambia, reinforcing that Barrick's long-term investment in copper is beginning to pay off. In a world increasingly focused on electrification and renewable technologies, Barrick's strategy to emphasize copper makes a lot of sense.

The copper price realized in 2Q25 was $4.36 per pound.

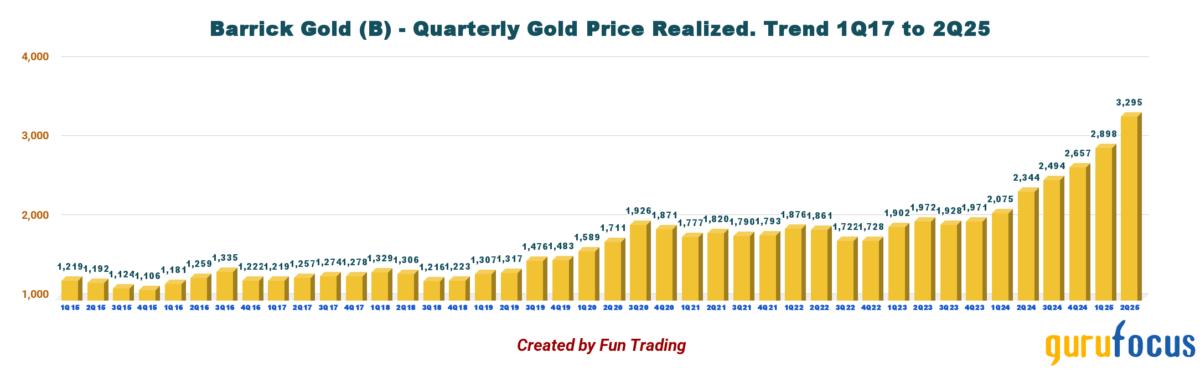

Regarding gold performance, Nevada Gold Mines and Pueblo Viejo showed particularly promising results. Nevada's production rose by 11%, while Pueblo Viejo experienced a nearly 30% increase, supported by ongoing expansion efforts. These gains not only offset the disruptions in Mali but also underscore how Barrick's diverse asset base provides resilience when specific regions face challenges. Additionally, the surge in gold price to new highs of $3,295 per ounce has significantly benefited the company.

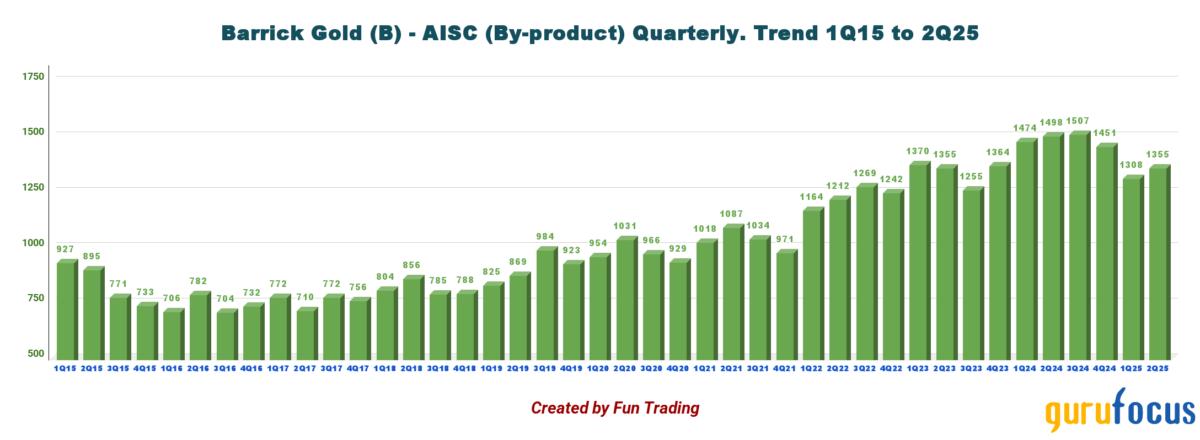

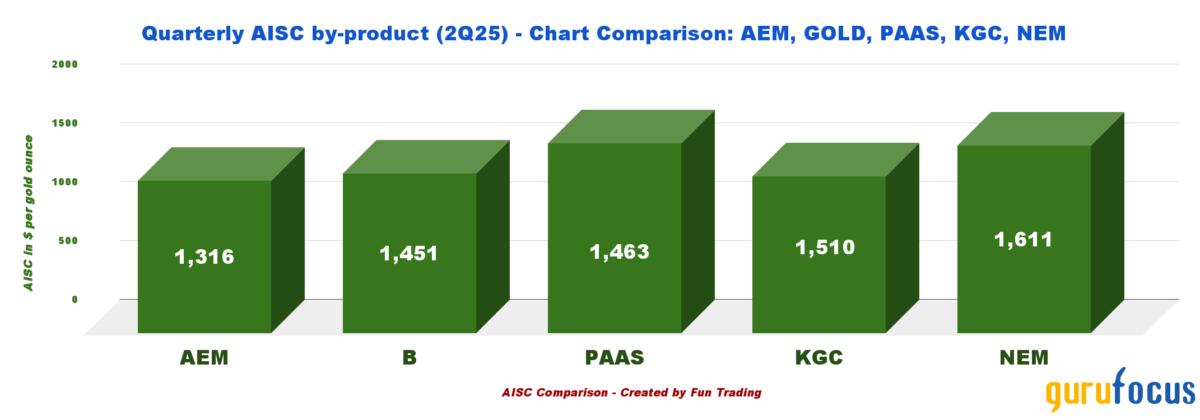

Barrick Gold's all-in sustaining cost for gold equivalent, using copper as a by-product, was $1,355 per ounce, whereas the AISC for gold alone was $1,655 per ounce.

By using copper as a by-product, Barrick Gold can significantly reduce its gold all-in sustaining costs (AISC) and remain competitive compared to its major peers.

2.2: From this quarter's results, it is clear that Barrick is gradually shifting its focus.

While gold remains the foundation of its operations, copper is evolving into a significant growth driver on its own. This quarter underscores a company that is not just enduring setbacks but is also positioning itself for the future of global metal demand. Looking ahead to 2026, Barrick will likely intensify its copper expansion strategy while stabilizing gold production through its flagship mines. If they can maintain this momentum, Barrick has the potential to become one of the most balanced gold and copper producers in the world, well-prepared for the energy transition and shifting investor priorities.

2.3: The Reko Diq Project contains one of the world's largest undeveloped copper and gold deposits.

When I think about Barrick's Reko Diq project in Pakistan during the second quarter of 2025, I recognize a significant turning point. The updated feasibility study and the conditional board approval for Phase One financing have propelled the project forward, despite some concerns regarding the safety of such an investment. Additionally, the selection of Fluor as the engineering partner adds further confidence. This project is not just another mine; it represents a bold move toward a shift to copper.

What truly caught my attention is the emergence of a new investor in the mine. Manara Minerals, supported by Saudi Arabia's Public Investment Fund and Ma'aden, is discussing a stake of 10% to 20% in Reko Diq, potentially injecting up to one billion dollars into the venture. Barrick will retain half of the ownership, but the involvement of Manara signals growing geopolitical interest and provides additional financial strength in a changing global minerals landscape.

However, the project is not without risks. Balochistan is a region with a complex political environment and occasional security challenges. Local community expectations, land disputes, and regulatory uncertainty could affect construction timelines and operational stability. Barrick will need to carefully manage relationships with government authorities, local communities, and other stakeholders to mitigate these risks. A clear and transparent approach will be essential to maintain investor confidence and ensure that the project progresses smoothly.

The Asian Development Bank has approved a significant financing package worth $410 million, which includes loans and credit guarantees. This marks a milestone in the bank's history of mining investments. These developments highlight Reko Diq's importance as a major mining project and its potential to drive economic transformation in Balochistan. Additionally, it signifies Barrick's strategic shift toward copper mining. As a reminder, Reko Diq is expected to produce annually 200,000 tons of copper (phase one) and 250,000 ounces of gold, targeted for late 2028.

2.4: Dividends have been raised in 2Q25. A good step in the right direction.

In the second quarter of 2025, Barrick Gold demonstrated a strong commitment to rewarding its shareholders. The company declared a quarterly dividend of $0.15 per share, which includes a $0.05 performance top-up. This decision reflects Barrick's dedication to providing value to its investors while maintaining a solid financial position. Additionally, Barrick repurchased 13.5 million shares during the quarter, totaling $268 million. This buyback initiative highlights the company's confidence in its long-term prospects and its strategy to enhance shareholder value. The diluted shares outstanding were 1,716 million in 2Q25.Reflecting on Barrick's strategy increases my appreciation for how well-managed companies can effectively balance operational success with rewarding their shareholders.

3: Critical analysis of the second quarter results.

The revenue reached an impressive $3.681 billion this quarter, driven by stable operations and strong metal prices. Net earnings increased to $811 million, or $0.47 per share, demonstrating record-breaking performance. Adjusted earnings of $800 million further highlight the consistency of operations and the company's ability to translate higher metal prices into actual profitability.

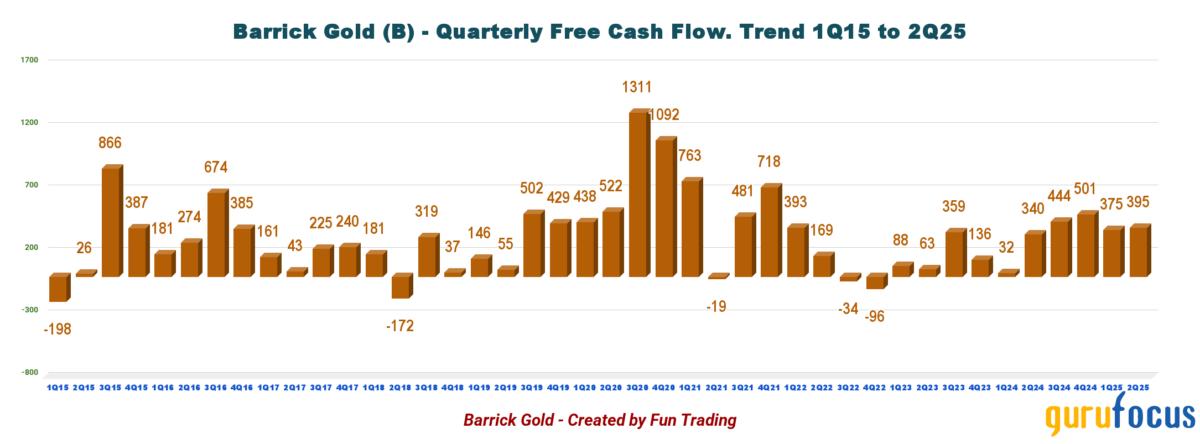

Barrick Gold's second-quarter report for 2025 shows the company's impressive ability to generate cash. The company reported an operating cash flow of $1.329 billion, largely driven by strong production levels and favorable prices for gold and copper. Additionally, free cash flow reached $395 million, reflecting both operational efficiency and careful financial management.

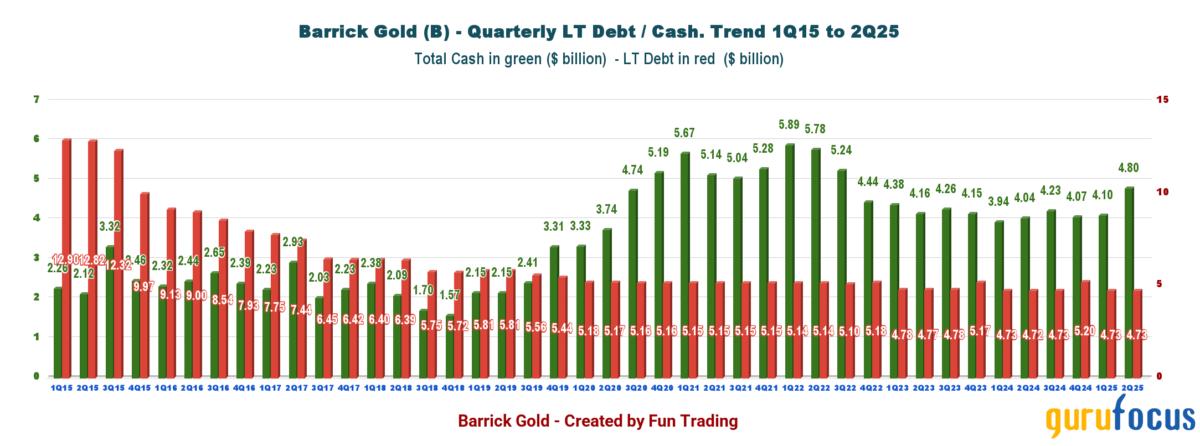

The most important thing about Barrick Gold in the second quarter of 2025 is its strong financial position. The company reported cash and cash equivalents amounting to $4.802 billion, while total debt was $4.729 billion. This resulted in a modest net cash position of $73 million. Compared to the previous quarter, this reflects a significant improvement, demonstrating Barrick's disciplined approach to managing its balance sheet.

4: Conclusion

Investing in mining companies has never been for the faint of heart. Commodity cycles, political risks, and the constant pressure of operating in some of the world's most challenging jurisdictions all make this sector unpredictable. Yet that is also what makes it fascinating. For me, Barrick Mining Corporation, formerly Barrick Gold, stands out as one of the most compelling stories in today's resource market.

The company's latest results in the second quarter of 2025 were impressive. Gold production increased, copper output surged, and net earnings per share reached their highest level in more than a decade. For a miner of Barrick's scale, that kind of performance is hard to ignore. What stood out most was the discipline behind the numbers: billions in operating cash flow, sharply higher free cash flow, and a dividend paired with share buybacks that signal confidence in the business.

Still, the risks cannot be overlooked, especially in Africa. The recent dispute in Mali, which saw the government take control of the Loulo-Gounkoto mine, shows how fragile mining agreements can be. That operation had been one of Barrick's most reliable assets, and losing it forced a billion-dollar write-down. The episode highlights the vulnerability of African operations to sudden political shifts and raises concerns about other assets across the continent that remain central to Barrick's gold output.

The situation in Pakistan adds to the complexity. While the Reko Diq project has world-class potential, it sits in a country with a history of regulatory uncertainty. Successfully developing it will demand both technical execution and careful diplomacy.

Even with these challenges, Barrick's strategy remains notable. Gold provides defensive value during uncertainty, while copper offers exposure to long-term growth tied to electrification and industrial demand. Few mining companies can offer this balance.

When I think about Barrick, I am not only considering what it is today but what it could become. If it can better manage geopolitical risk while advancing its copper portfolio, it has the potential to emerge as one of the defining resource companies of the next decade. Protecting its African assets will be the key to unlocking that future.

5: Technical Analysis: Ascending Wedge - Sell signal.

Note: The chart has been adjusted to account for the dividend.

Barrick is currently trading within an ascending channel pattern, with resistance around $37.5 and support near $34. The Relative Strength Index (RSI) is at 78 and descending, indicating a strong overbought condition. This suggests that it may be time to consider selling. I recommend selling about 50% (at least) of your position above $36 using a Last-In-First-Out (LIFO) strategy, with a secondary target at the upper resistance level of $39 which is not likely right now. I suggest closing your Barrick position if the stock trade above $37 and wait for a healthy retracement potentially early or mid-October.

For further context, please refer to the chart above. While a rising channel pattern is a bullish continuation pattern, we should remain cautious at this level. We may be at the end of the pattern and I see a potential breakdown by the end of September or early October.

Jerome Powell's recent remarks at the Jackson Hole symposium ignited a rally in gold stocks, with gold prices surging now to $3,750 per ounce. The FED rate cut in September has fueled optimism among gold investors. The recent job data is another clue. However, while the immediate market response is positive, the sustainability of this incredible rally remains uncertain. Factors such as persistent inflation and geopolitical tensions could pose challenges to sustained growth. Thus, investors should remain cautious and monitor upcoming economic data to assess the long-term viability of this rally.

The most challenging aspect in this case is deciding when to accumulate again after a healthy retracement. The 50MA sets the range for a potential breakdown. I recommend buying and accumulating between $31 and $28.75, with possible lower support around $27.

Note: It is important to monitor and frequently update your technical analysis (TA) charts, given the fast-changing market landscape.