Pabrai and Azvalor Are Betting Big on This $5.5B Offshore Compounder

Offshore drillers are supposed to be bloated, overleveraged, and forever stuck in a boom-bust cycle. They're supposed to destroy capital, burn cash, and bleed shareholders dry during downturns. They're supposed to be relics of a past erawhen $100 oil made anything look profitable, and Wall Street applauded capital expenditures like drunken sailors. But Noble Corporation doesn't look like that anymore. Not after 2020. Not after Maersk. Not after Diamond. And not after returning over $575 million to shareholders in 2024.

This isn't the Noble of the last cycle. This is a different company. And if you believe in buying capital-efficient, cash-generating operators with disciplined management and a real plan to return value to shareholders, then Noble deserves a spot on your radar. Because right now, the market still sees it as a cyclical oil services name limping out of bankruptcy. It's not. It's quietly becoming one of the most compelling capital return stories in energy. And no one's paying attention.

The Business Beneath the Surface

Let's start with what Noble actually does. It owns and operates a global fleet of offshore drilling rigs25 floaters (for deepwater projects) and 13 jack-ups (for shallower wells). Its customers are the majors: ExxonMobil XOM, Shell

SHEL, TotalEnergies

TTE, Chevron

CVX. They don't want to own or maintain $500 million rigs. They just want wells drilled. Noble supplies the rigs, the crews, the engineering, and the expertise. And it gets paid to drill the well, not based on whether oil is ultimately found or produced.

This isn't wildcatting. This is industrial-scale contract drilling. Noble doesn't speculate on oil prices. It signs long-term contracts, sometimes 12 to 48 months at a time. As of April 2025, it had a $7.5 billion backlogenhancing the forward revenue visibility through 2030. Those rigs are booked. Those payments are coming in. And every new contract that gets signed is happening at rates materially higher than the ones they replace.

The rig market is tightening. Day-rates for seventh-generation drill ships are brushing up against $450,000 a day. Harsh-environment jack-ups are back to $150,000. Utilization is climbing. And with no meaningful newbuilds entering the market, Noble has all the leverage. Yet the stock still trades like the cycle hasn't even started.

The Operating Results Tell a Different Story

The numbers don't look like a turnaround. They look like a business hitting its stride. Noble exited 2024 with over $3 billion in revenue and over $1 billion in adjusted EBITDA. In 2025, it's guiding to $3.25$3.45 billion in revenue and $1.1 billion in EBITDAroughly 33% margin. Net income in Q1 2025 came in at $108 million. Cash from operations was $271 million in the quarter. And despite spending $141 million in capex that quarter, the business still finished with over $113.5 million in cash and nearly little short-term debt pressure.

More importantly, return on invested capital is finally visible againand climbing. With over $4.65 billion in equity and ~$1.98 billion in long-term debt, Noble is operating with moderate leverage. Based on 2024 net income of $448 million, and capital employed around $6.3 billion, its ROIC lands in the 7% and rising. For a capital-intensive business that just emerged from a restructuring cycle, that's a notable achievement.

The reason? Operating leverage. Every additional dollar of day-rate revenue now flows through with minimal incremental cost. Legacy SG&A has been cut. The Maersk and Diamond integrations are delivering ~$100 million in synergies. And older low-rate contracts are being replaced by high-margin ones at $400,000+ per day. This isn't the kind of operating result you'd expect from a company trading at 9x trailing EBIT. It's the kind you expect from a business regaining pricing power after years in the wilderness.

The Valuation Is a JokeEven Against Its Peers

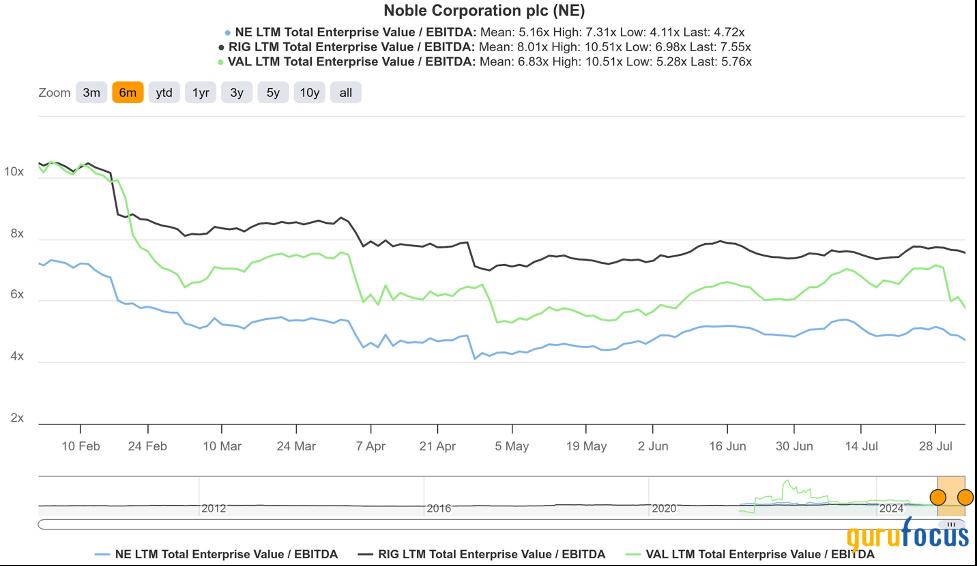

Let's talk about what you're paying. Noble trades at roughly $30 per share, or roughly 9x trailing EBIT and 5.2x trailing EV/EBITDA. That's not just cheap on an absolute basis. It's cheap relative to peers.

Transocean RIG, the largest offshore driller by fleet size, is still bleeding GAAP net income and trades at ~7.55x EV/EBITDA despite a heavier debt load, lower margins, and no dividend. Valaris

VAL, the other major post-bankruptcy survivor, trades around 5.76x EV/EBITDA with similar earnings quality but no dividend and a more modest capital return strategy.

Put simply, Noble is the most profitable, the most disciplined on leverage, and the most aggressive in returning capital yet it's still the cheapest of the three. The market isn't just undervaluing Noble. It's misreading it. This isn't a mid-tier asset trading on sentiment. It's a top-tier operator trading on stigma. Investors still see Noble through the lens of 2020. But Noble isn't competing with that version of itself anymore. It's competing with the other two healthy survivorsand winning on cash return, backlog momentum, and fleet quality. And it's doing all of it while yielding over 6% in trailing dividends alone.

If I tried to order Noble's fleet new today, I'd be staring at roughly $22.3 billion of replacement cost about $750 million per floater and $275 million per jackup, in line with current shipyard quotes of $250300 million for jackups and up to $850 million for modern drillships. The market, meanwhile, is offering me the whole business for roughly $5.5 billion EV just ~0.25 replacement value. That's cheaper than the ~0.300.40 replacement-cost marks seen in recent offshore deals like NobleDiamond and SeadrillAquadill, and Noble's $7.5 billion contract backlog alone covers nearly 1.4 its enterprise value. In a capital-intensive industry, that's the kind of asset-to-price gap disciplined investors wait years to buy.

So ask yourself: if this business were private, earning over $448 million in net income, distributing more than 60% of its income in trailing dividends, and carrying low debt with hard assets at only 25% of the replacement costwhat would you pay? Because the market says just over ~$5.5 billion in enterprise value.

Management Is Playing the Long GameAnd So Should We

CEO Robert Eifler doesn't speak like a Wall Street operator. He speaks like an owner. Quiet. Rational. Intentional. He personally bought $350,000 worth of Noble's stock at over $27 in February 2025. He led the company through two major mergers, executed flawlessly on cost savings, and returned over $1.5 billion to shareholders in both dividend and share buybacks since 2020. And he did all of this while keeping net leverage at below 1.5x. There's no empire building here. No trophy rig orders. No wildcat growth plans. Just clean execution and capital return.

It's rare to find this kind of discipline in a cyclical industry. But that's exactly what makes Noble interesting. It's not betting on higher oil prices. It's harvesting cash from existing assets, locking in work, and giving that cash back to shareholders.

And it's doing it in a way that compounds. Every buyback at 9x EBIT lifts future per-share returns. Every dividend distribution signals confidence. Every high-rate rig renewal widens the margin stack. It's not just a business bouncing off the bottom. It's a capital compounder in motion. And it's not just management that's aligned. The shareholder base tells the same story a quiet group of long-term owners who know exactly what they own.

If you scan Noble's shareholder list, you won't find a swarm of fast money. You'll find quiet conviction. A.P. Mller Holdingstill anchored from the Maersk Drilling legacyowns nearly 20% of the business. They're not going anywhere. Vanguard and BlackRock show up, as they always do. But beneath the index giants are some of the more thoughtful value allocators in the market. First Eagle, a firm that doesn't chase headlines, owns nearly 7.7%. Sourcerock, a concentrated energy hedge fund, increased its exposure by over 43% the current quarter. And then there's Mohnish Pabrai (Trades, Portfolio), Warren Buffett (Trades, Portfolio)'s protege. The Pabrai fund currently holds nearly 1.73 million shares in the company, accounting for 9.4% of Pabrai's portfolio. That tells you more than most sell-side notes ever could.

Another long-time shareholder, Azvalor Asset Management, doubled its Noble position in Q4 2024 to 4.96 million shares (about 8.34% of Azvalor's total portfolio), worth roughly $136.7 million. That's not a top-up; that's a deliberate, high-conviction move by a deep-value shop that has made a living buying irreplaceable assets at cycle lows and waiting for cash flows to show up. When Pabrai and Azvalor lean in together, I pay attention. These are not traders. These are investors with long clocks, backing a business that's throwing off real cash and not pretending to be something it's not.

Key Takeaway

At a ~$5.5 billion enterprise value, I'd be buying a business with $7.5 billion in contract backlog, generating $1.1 billion in forward EBITDA. The fleet is modern, globally deployed, and backed by a balance sheet with sub-1.5x leverage and no near-term maturities. Cash returns are realstarting with a 6% trailing dividend and layered with buybacks. Most important, it's led by a CEO who acts like an owner and allocates capital like one. If this were private equity, this would already be off the market.

But because it's offshore energyand because it went bankrupt five years agothe market still sees smoke. The irony is that Noble is one of the few oilfield services names not burning anything anymore. Not cash. Not goodwill. Not balance sheet. Not shareholder trust. So while Wall Street waits for a reason to believe, I'm content owning the cash, the rigs, the backlog, and the management team already proving it. Because sometimes the best investments aren't the ones making the most noise. They're the ones quietly buying back stock, boosting dividends, and compounding value in plain sight.