$100B in old Bitcoin moved, raising ‘OG’ versus ‘trader’ debate

Key takeaways:

Over $104 billion in long-held Bitcoin has moved since 2024, sparking debate on whether older BTC investors are exiting the market for good.

Onchain data shows most moved Bitcoin was from short-term holders, not older addresses.

Bitcoin’s (BTC) price dip from $126,000 to $100,000 coincided with a notable uptick in selling by long-term holders (LTH). Cointelegraph reported that more than 400,000 BTC moved from LTH wallets in the past 30 days, prompting a debate over whether these flows represent genuine “OG” exits or routine redistribution by traders.

Alex Thorn, head of research at Galaxy, said that over 470,000 BTC older than five years have changed hands in 2025. Combined with 2024, that figure jumped to over $104 billion, accounting for nearly half of all Bitcoin that has been in circulation for five years or more. “An enormous amount of distribution has occurred,” Thorn said, calling the two years “unprecedented.”

The narrative had already drawn a reaction from Troy Cross, a professor of philosophy at Reed College and a long-time Bitcoin commentator, who said the selling challenges Bitcoin’s founding ethos. According to Cross, if early adopters are exiting in size, it suggests that “OG” holders no longer view Bitcoin as fundamentally different from traditional IPO-style investments.

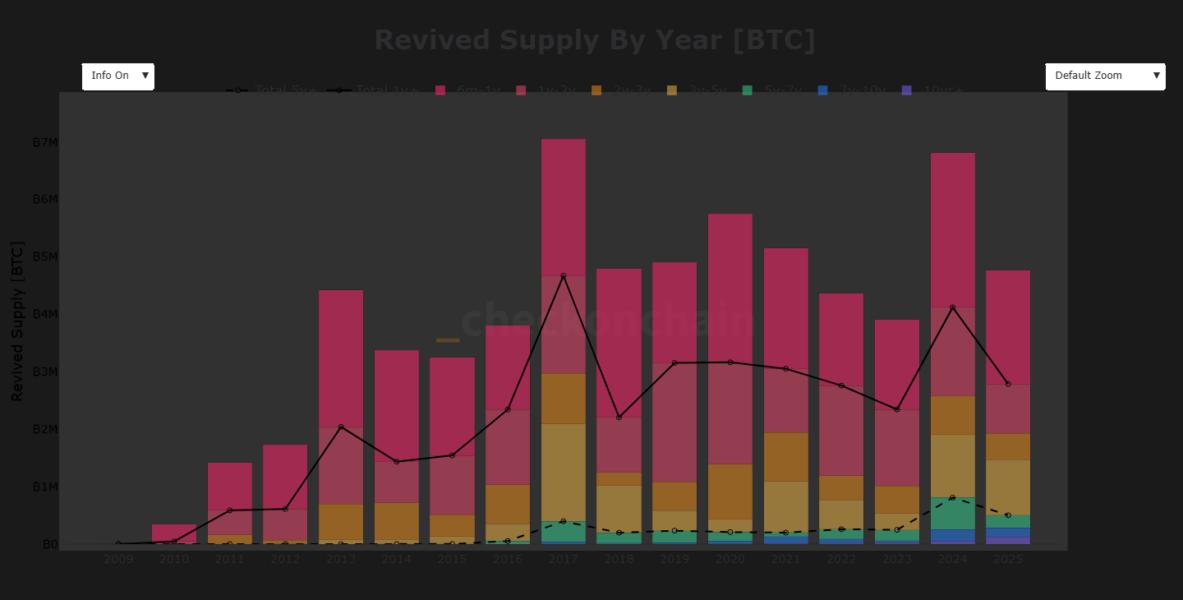

However, onchain analyst Checkmate disagreed, saying the term “OG dumping” is being misused. The analyst said that while roughly half a million old coins have moved, the majority of 2025’s revived supply actually comes from coins held for far shorter periods (six months to two years), typical of traders locking in profits rather than true long-term believers leaving the market.

Supporting that view, a breakdown of revived supply over 2024–25 implied that the majority of flows originate from coins dormant under two years: 700,000 BTC (six months to one year), 650,000 BTC (one year to two years), with much smaller volumes, from three to five years (120,000 BTC) and five to seven years (50,000 BTC).

Blockstream CEO Adam Back agreed, saying the charts “tell a very different story,” that most moved coins belong to recent-cycle traders, not Bitcoin’s original OGs.

Related: Bitcoin’s valuation metric hints at a ‘possible bottom’ forming: Analysis

Bitcoin faces dual pressure from ETFs, LTHs

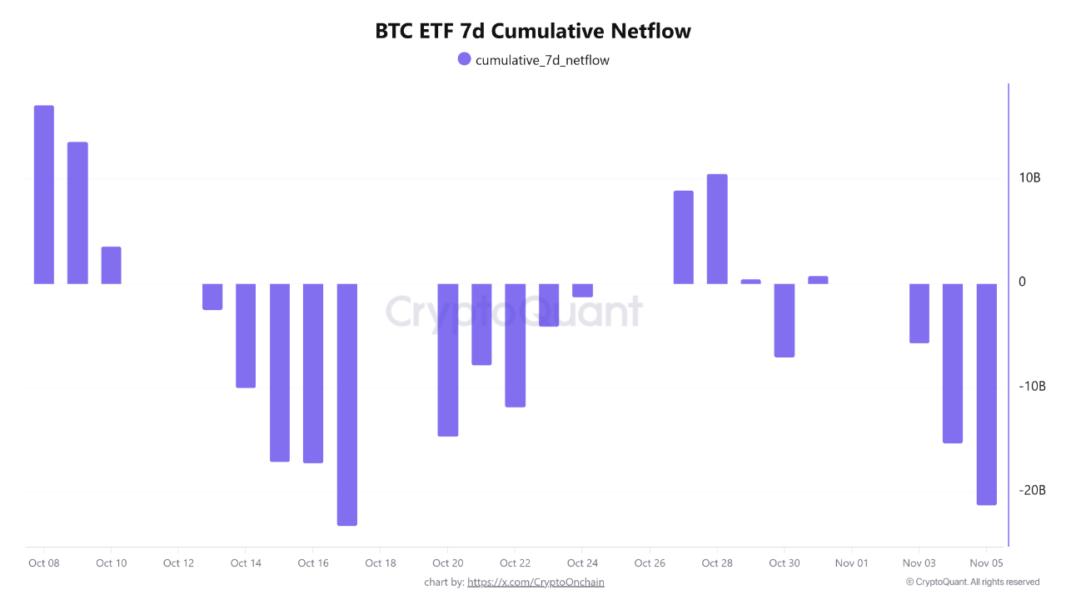

Data from CryptoQuant implied that Bitcoin’s recent dip stems from a two-front “selling war” between institutional spot exchange-traded fund (ETF) investors and LTHs, both of whom are now exerting synchronized downward pressure on price.

Onchain data shows that the seven-day cumulative netflow for spot Bitcoin ETFs has fallen by nearly $21 billion, marking the largest outflow in six weeks and signaling a notable shift in sentiment. The demand engine for Bitcoin has effectively turned into a source of supply.

With ETF inflows no longer offsetting LTH distribution, Bitcoin now faces a supply-heavy environment. Unless institutional demand returns or long-term holders pause their strategic selling, analysts warn the market’s near-term bias could remain tilted to the downside.

Related: Bitcoin faces ‘insane’ sell wall above $105K as stocks eye tariff ruling

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.