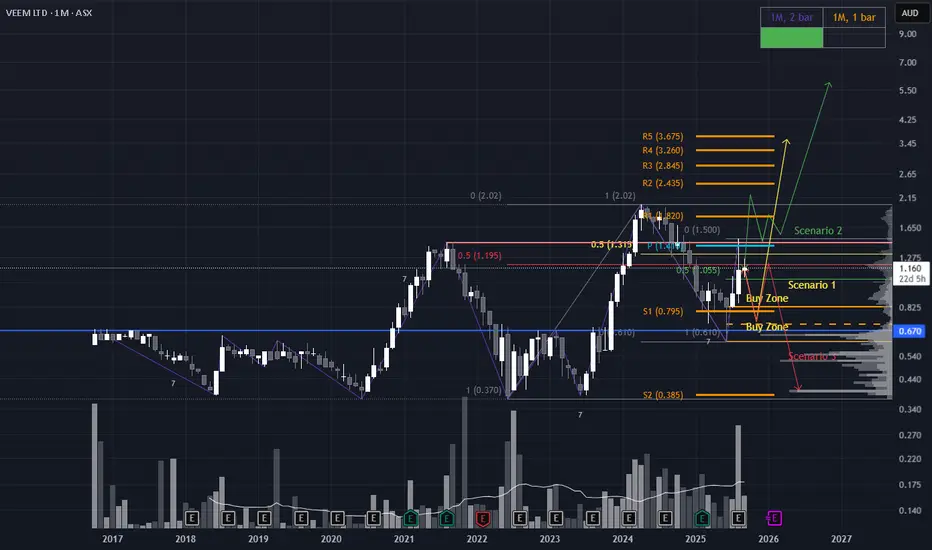

Scenario 1 (yellow line): Strategic Pullback to Value Zone

Price retraces to the ~$0.67 region, aligning with a Low Volume Node (LVN) and the Fair Value Gap from the June candle. A bullish reversal candle in this zone would signal a high-probability long setup, suggesting accumulation at a key structural level.

Scenario 2 (green line): Breakout & Reaccumulation Above Resistance

The most bullish scenario unfolds if price decisively breaks and closes above the major resistance at $1.50. A successful reaccumulation above this level would confirm strength, offering a textbook pullback entry for continuation higher.

Scenario 3: (red line) Rejection & Macro Lower High

Price pulls back but fails to hold above the ~$1.16 zone, facing rejection. A subsequent break of the recent lows would confirm a macro lower high (LH), shifting the bias toward bearish continuation and invalidating bullish setups.

Price retraces to the ~$0.67 region, aligning with a Low Volume Node (LVN) and the Fair Value Gap from the June candle. A bullish reversal candle in this zone would signal a high-probability long setup, suggesting accumulation at a key structural level.

Scenario 2 (green line): Breakout & Reaccumulation Above Resistance

The most bullish scenario unfolds if price decisively breaks and closes above the major resistance at $1.50. A successful reaccumulation above this level would confirm strength, offering a textbook pullback entry for continuation higher.

Scenario 3: (red line) Rejection & Macro Lower High

Price pulls back but fails to hold above the ~$1.16 zone, facing rejection. A subsequent break of the recent lows would confirm a macro lower high (LH), shifting the bias toward bearish continuation and invalidating bullish setups.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.