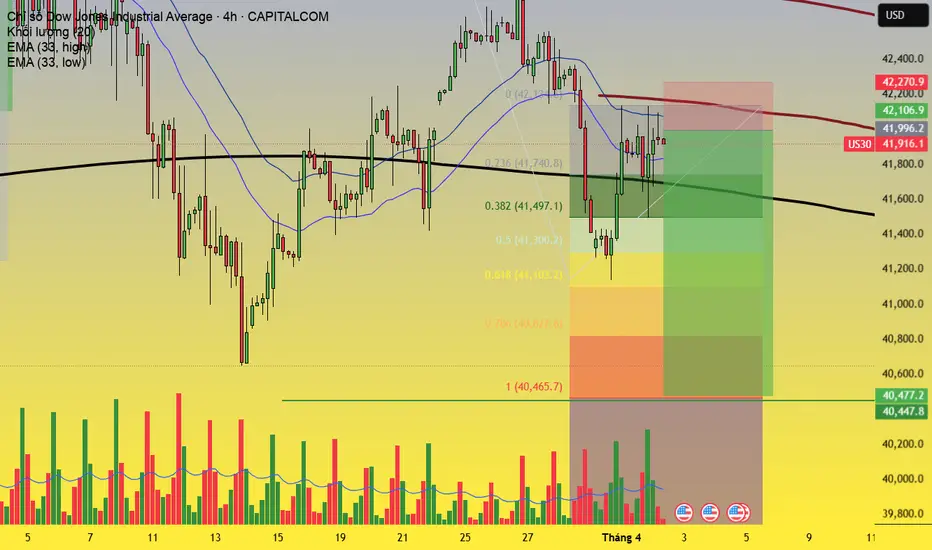

🔹 Market Structure & Trend:

US30 is currently in a short-term downtrend after being rejected at 42,200 and dropping sharply to around 41,200. The price is now retracing to a strong resistance zone between 41,900 - 42,000, where it aligns with the EMA 33 and 200 MA, creating an ideal setup for a short position.

🔹 Fibonacci & Resistance Analysis:

The 0.382 - 0.5 Fibonacci retracement levels (41,497 - 41,300) serve as key support zones.

If the price fails to hold above 41,900, a further decline towards 40,500 (Fibonacci 1.0) is highly probable.

📌 Entry & Risk Management:

Entry (Sell Zone): 41,900 - 42,000

Stop Loss: 42,270 (to avoid getting stopped out on a wick)

Take Profit: 40,500

Risk/Reward Ratio: ~1:3.5 – 1:4 (highly attractive)

🔹 Trade Plan:

✅ Expecting a strong rejection at 41,900 - 42,000, leading to a further drop.

✅ Holding the trade until the weekend or until TP 40,500 is reached.

✅ If price breaks above 42,270, exit the trade immediately to protect capital.

🚀 Recommendation: Traders can consider entering a short position if the price shows signs of rejection at the 41,900 - 42,000 zone. This setup offers a great risk-reward ratio, making it a promising swing trade opportunity for this week!

📢 Follow me to stay updated on high-probability, high-profit opportunities in the market. Let’s trade smarter and grow together! 🚀📈

US30 is currently in a short-term downtrend after being rejected at 42,200 and dropping sharply to around 41,200. The price is now retracing to a strong resistance zone between 41,900 - 42,000, where it aligns with the EMA 33 and 200 MA, creating an ideal setup for a short position.

🔹 Fibonacci & Resistance Analysis:

The 0.382 - 0.5 Fibonacci retracement levels (41,497 - 41,300) serve as key support zones.

If the price fails to hold above 41,900, a further decline towards 40,500 (Fibonacci 1.0) is highly probable.

📌 Entry & Risk Management:

Entry (Sell Zone): 41,900 - 42,000

Stop Loss: 42,270 (to avoid getting stopped out on a wick)

Take Profit: 40,500

Risk/Reward Ratio: ~1:3.5 – 1:4 (highly attractive)

🔹 Trade Plan:

✅ Expecting a strong rejection at 41,900 - 42,000, leading to a further drop.

✅ Holding the trade until the weekend or until TP 40,500 is reached.

✅ If price breaks above 42,270, exit the trade immediately to protect capital.

🚀 Recommendation: Traders can consider entering a short position if the price shows signs of rejection at the 41,900 - 42,000 zone. This setup offers a great risk-reward ratio, making it a promising swing trade opportunity for this week!

📢 Follow me to stay updated on high-probability, high-profit opportunities in the market. Let’s trade smarter and grow together! 🚀📈

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.