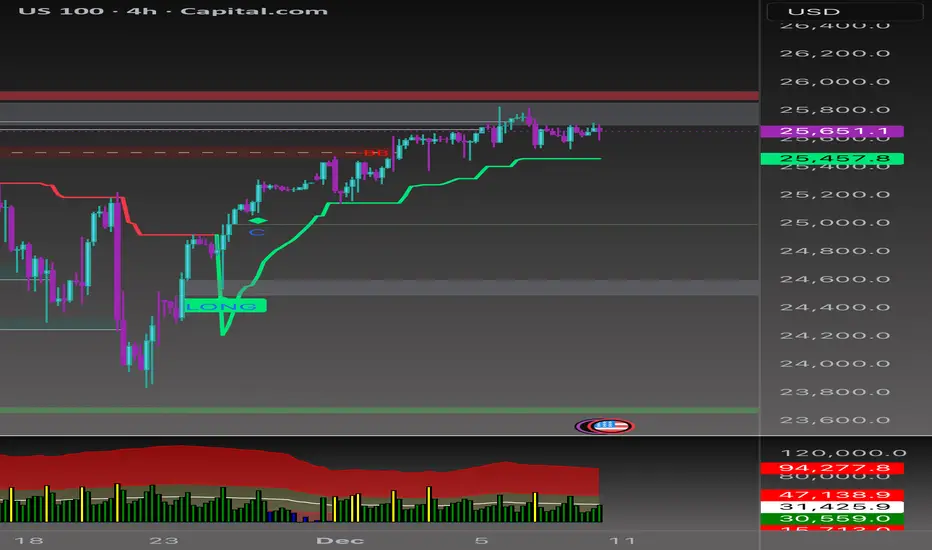

The 4H chart shows price repeatedly tapping into the premium PD arrays but failing to secure a clean breakout. Buyers are active, but they’re not strong enough to reclaim the upper liquidity shelf.

Your OG system reacted cleanly again:

• TrendMaster (4H) held as dynamic support on every dip, but it’s starting to flatten, showing we’re consolidating at the top.

• FlowMaster is printing reduced momentum on the latest pushes into premium zones.

• ScalpMaster (15M) nailed the intraday rejection perfectly, marking early short signals right after the PD Array tap.

Overall, price is respecting every OG zone point to point.

🟣 Short-Term View (15M–1H)

Structure is still choppy inside the premium band, but intraday momentum favors a corrective move.

Short bias unless 25,700 is reclaimed with strength.

Targets to the downside:

• 25,640

• 25,610

• 25,580 liquidity pocket

Invalidation

• A clean break and hold above 25,700 would switch intraday flow back into premium expansion.

🔵 Mid-Term View (4H)

Higher-timeframe trend remains bullish overall, but we’re extended into premium territory and showing early signs of distribution.

As long as TrendMaster holds above

25,450–25,500, bulls maintain control

on the midterm.

A deeper pullback into discount arrays would actually be healthy before the next leg up.

Midterm targets if discount is tapped:

• 25,300

• 25,150

• 25,000 major demand zone

A breakout above 25,780 would unlock continuation toward new highs.

📌 Summary

US100 is compressing at the top.

Your OG system is showing exhaustion on premium taps, favoring short term corrections while the mid term trend stays bullish until key support breaks.

Perfect environment for reactive trading:

Fade premiums intraday, accumulate in discounts on the HTF.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.