The Trojan Cycle: A New Framework for Altseasons & Liquidity

🧭 A Thesis for a New Crypto Cycle

This post proposes a new lens for understanding crypto’s macro structure in the institutional era—rooted in two frameworks: The Trojan Cycle and Synthetic Rotation.

It challenges the legacy “M2 = liquidity, BTC = lead, alts = profit” model, proposing a more engineered and asymmetric structure shaped by capital rails, narrative timing, and retail dynamics.

📖 Key Concepts

🔹 Trojan Cycle

A macro capital flow model where:

• BTC still triggers narrative momentum—but no longer drives liquidity alone

• Institutional capital enters via regulated wrappers like ETFs and through equities with crypto treasuries (e.g., MSTR, miners, COIN)

• Stablecoins replace M2 as real-time liquidity proxies

• Retail unknowingly front-runs these flows

🛠 Trojan access isn’t just through ETFs—it includes public stocks holding crypto on balance sheets. These Trojan equities serve as indirect exposure rails that institutions use stealthily.

🔹 Synthetic Rotation

Altseasons today are not spontaneous BTC profit spillovers. They are:

• Platform-driven

• Narrative-coordinated

• Liquidity-engineered

• Retail-targeted—by design, not coincidence

🛠 Media, influencers, and platform incentives synchronize narrative deployment to align with capital rotation windows, driving retail engagement at peak distribution phases.

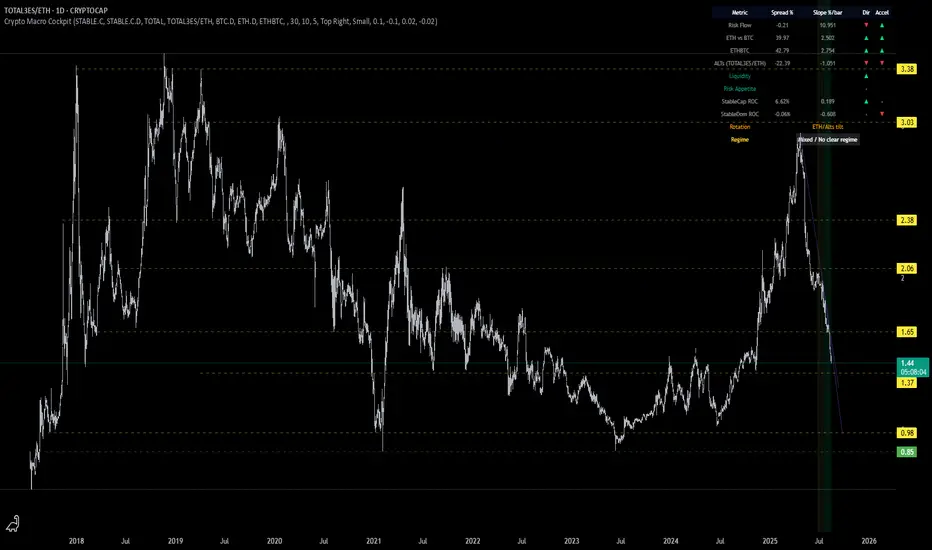

🔹 ETH as a Structural Fulcrum

Ethereum isn’t just a top asset—it’s the bridge:

• Serves as a midpoint for capital between BTC and high-beta alts

• TOTAL3ES/ETH ratio reveals directional bias in rotation structure

🛠 ETH is a liquidity buffer and rotational fulcrum—not just a layer-1 narrative asset.

🔹 Structural Liquidity Fragmentation

Institutional and retail flows now move on different rails, timelines, and tools:

• Retail is incentivized through volatility and engagement

• Institutions scale in/out passively, through wrappers and proxies

🛠 These cycles don’t just desync by chance—they’re structurally misaligned. This is why retail often exits late and enters at narrative highs.

📊 Visual Framework

Using the Crypto Macro Cockpit script:

• Spread and slope = flow direction and acceleration

• Stablecoin cap = capital injection

• Stablecoin dominance = risk appetite

• TOTAL3ES/ETH = alt rotation pressure

• Composite regime classification = macro posture (Risk-ON/OFF, Caution, Waiting)

📎 Why It Matters

Understanding engineered cycles vs organic flows is key to staying ahead.

Legacy cycle models no longer apply.

New frameworks are needed to decode capital movement, timing asymmetries, and narrative deployment.

💬 This isn’t a prediction—it’s a proposed mental model for discussion.

Would love to hear your thoughts—how are you navigating the new cycle?

This post proposes a new lens for understanding crypto’s macro structure in the institutional era—rooted in two frameworks: The Trojan Cycle and Synthetic Rotation.

It challenges the legacy “M2 = liquidity, BTC = lead, alts = profit” model, proposing a more engineered and asymmetric structure shaped by capital rails, narrative timing, and retail dynamics.

📖 Key Concepts

🔹 Trojan Cycle

A macro capital flow model where:

• BTC still triggers narrative momentum—but no longer drives liquidity alone

• Institutional capital enters via regulated wrappers like ETFs and through equities with crypto treasuries (e.g., MSTR, miners, COIN)

• Stablecoins replace M2 as real-time liquidity proxies

• Retail unknowingly front-runs these flows

🛠 Trojan access isn’t just through ETFs—it includes public stocks holding crypto on balance sheets. These Trojan equities serve as indirect exposure rails that institutions use stealthily.

🔹 Synthetic Rotation

Altseasons today are not spontaneous BTC profit spillovers. They are:

• Platform-driven

• Narrative-coordinated

• Liquidity-engineered

• Retail-targeted—by design, not coincidence

🛠 Media, influencers, and platform incentives synchronize narrative deployment to align with capital rotation windows, driving retail engagement at peak distribution phases.

🔹 ETH as a Structural Fulcrum

Ethereum isn’t just a top asset—it’s the bridge:

• Serves as a midpoint for capital between BTC and high-beta alts

• TOTAL3ES/ETH ratio reveals directional bias in rotation structure

🛠 ETH is a liquidity buffer and rotational fulcrum—not just a layer-1 narrative asset.

🔹 Structural Liquidity Fragmentation

Institutional and retail flows now move on different rails, timelines, and tools:

• Retail is incentivized through volatility and engagement

• Institutions scale in/out passively, through wrappers and proxies

🛠 These cycles don’t just desync by chance—they’re structurally misaligned. This is why retail often exits late and enters at narrative highs.

📊 Visual Framework

Using the Crypto Macro Cockpit script:

• Spread and slope = flow direction and acceleration

• Stablecoin cap = capital injection

• Stablecoin dominance = risk appetite

• TOTAL3ES/ETH = alt rotation pressure

• Composite regime classification = macro posture (Risk-ON/OFF, Caution, Waiting)

📎 Why It Matters

Understanding engineered cycles vs organic flows is key to staying ahead.

Legacy cycle models no longer apply.

New frameworks are needed to decode capital movement, timing asymmetries, and narrative deployment.

💬 This isn’t a prediction—it’s a proposed mental model for discussion.

Would love to hear your thoughts—how are you navigating the new cycle?

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.