Pembelian

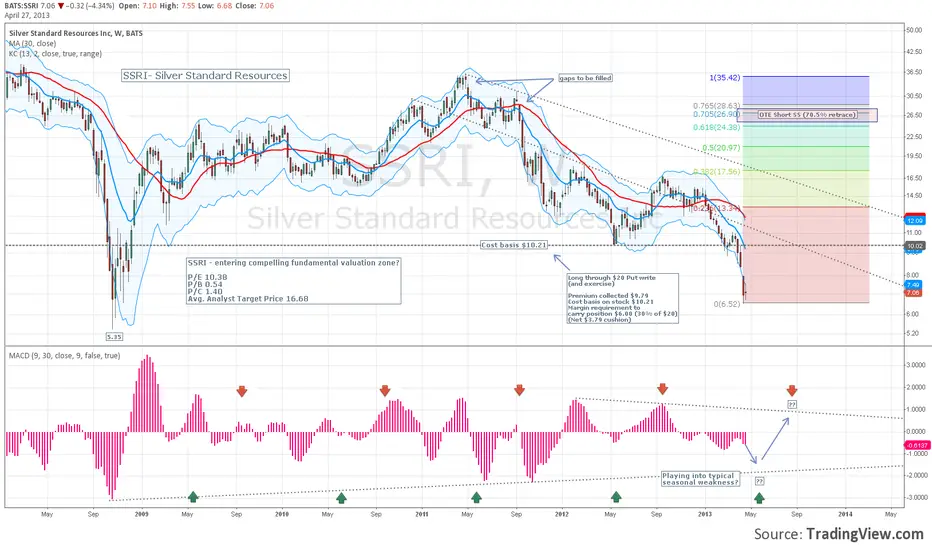

SSRI- Using seasonal weakness to buy cheap 'paid for' position

Along the same lines as Thompson Creek Metals, I am using seasonal weakness and WDB Options Model to 'get paid' to take a position in this fundamentally cheap name. Currently long (through $20 Put option write and exercise) with an average cost of $10.21 per share. Trading below book value and with over $5.00/share in cash, this is one name in the metals space I would be more than happy to sit on for some time to come...

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.