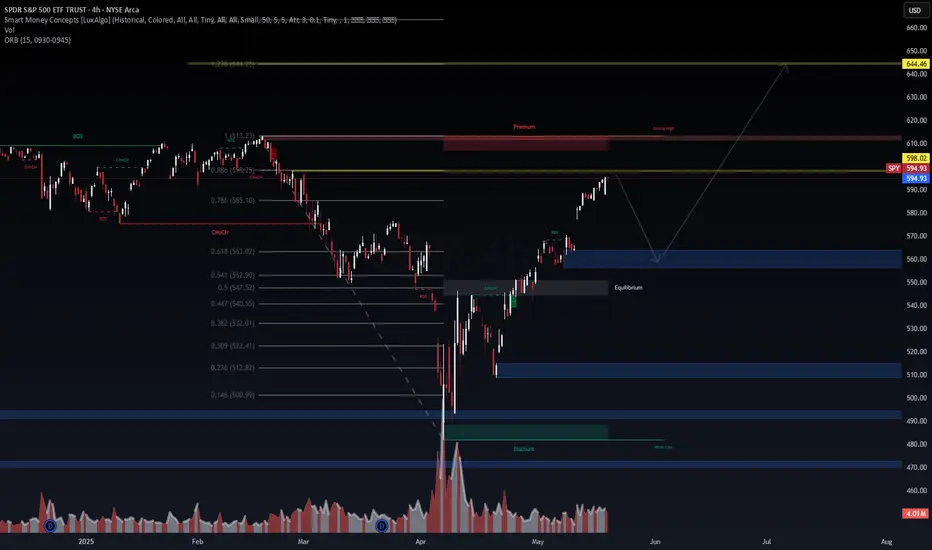

Price has rallied into premium territory (above the 0.786–0.886 Fibonacci retracement), tapping into a prior strong high with signs of exhaustion. From a Smart Money perspective, we're entering a high-probability sell-side liquidity sweep zone. 📉

Key Technical Highlights:

🔺 Strong High @ ~613.23 aligning with FVG and premium zone

🔻 Projected retracement target: 560–565 zone (mid-FVG & equilibrium)

⚖️ Equilibrium at ~563 — likely acting as magnet for price

🟦 Demand zone and breaker block overlap between 560–570

📈 Long-term bullish trajectory remains intact if this corrective leg plays out and holds

Bias:

Short-term Bearish: Potential rejection from premium into equilibrium

Mid-term Bullish: If we reclaim the demand zone with strength, we likely re-accumulate and target the ultimate liquidity grab @ 644.46

"Liquidity seeks liquidity. Patience is premium." – Wavervanir DSS

📍Watch for volume confirmation and reaction near 560–570 before scaling in. If invalidated (close above 613), reevaluate bullish breakout scenario.

#SPY #SmartMoney #Fibonacci #Wavervanir #Liquidity #VolumeProfile #OrderBlocks #TradingView #QuantStrategy #PriceAction #SMC

Key Technical Highlights:

🔺 Strong High @ ~613.23 aligning with FVG and premium zone

🔻 Projected retracement target: 560–565 zone (mid-FVG & equilibrium)

⚖️ Equilibrium at ~563 — likely acting as magnet for price

🟦 Demand zone and breaker block overlap between 560–570

📈 Long-term bullish trajectory remains intact if this corrective leg plays out and holds

Bias:

Short-term Bearish: Potential rejection from premium into equilibrium

Mid-term Bullish: If we reclaim the demand zone with strength, we likely re-accumulate and target the ultimate liquidity grab @ 644.46

"Liquidity seeks liquidity. Patience is premium." – Wavervanir DSS

📍Watch for volume confirmation and reaction near 560–570 before scaling in. If invalidated (close above 613), reevaluate bullish breakout scenario.

#SPY #SmartMoney #Fibonacci #Wavervanir #Liquidity #VolumeProfile #OrderBlocks #TradingView #QuantStrategy #PriceAction #SMC

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.