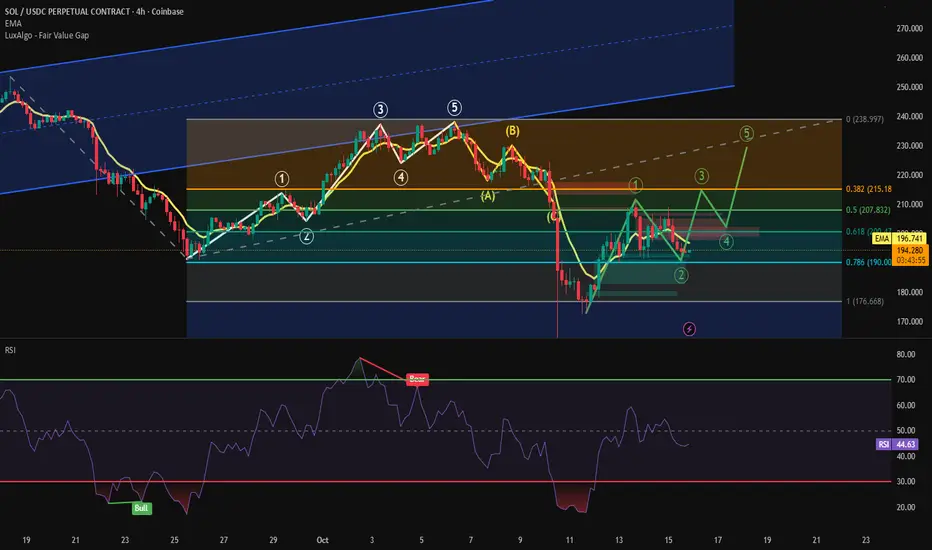

No clue what's going on since the rate cut announcement. Big dump then sideways the last 5 days. The green 5 wave move is my best guess at what's next. I can't see a long term bearish scenario with all the bullish news & sentiment. The sideways action is hella boring and makes ppl what to exit. Sideways boring action is most often bullish from my experience. It might be a couple more weeks of sideways boredom until the next Fed rate cut expected the end of October. Anything between 190 and 240 "feels" sideways. It's a wide range but we were at 240 Oct 6th just 10 days ago and currently 194. Remember SOL was at just $95 April 7th. $129 June 23rd. It'd take a major event, black swan even, to dump that hard. I think we're at the quarterly low. I'm expecting a bull but 60/40 chance is my feeling near term ( next 2 weeks). I don't expect a big move until the next Fed rate announcement. Hurry up and wait!

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.