Ramelius Resources (ASX: RMS) –A Tactical Re-Entry Zone?

🟡 Gold-Linked Opportunity: Ramelius Resources (ASX: RMS) – A Tactical Re-Entry Zone?

Context: Ramelius Resources, a mid-tier Aussie gold producer, is showing signs of technical exhaustion after a strong rally from its 2024 lows. With gold prices consolidating and RMS pulling back to a key support zone, this could be a tactical opportunity for shareholders and swing traders alike.

📊 Technical Snapshot:

Current Price: $2.47

Trendline Support: The long-term ascending trendline remains intact, offering a potential re-entry zone for bulls.

Risk-Reward Setup: Defined green/red zones highlight a favorable R:R ratio for those targeting a rebound toward $2.80–$3.00.

🪙 Gold Correlation Insight:

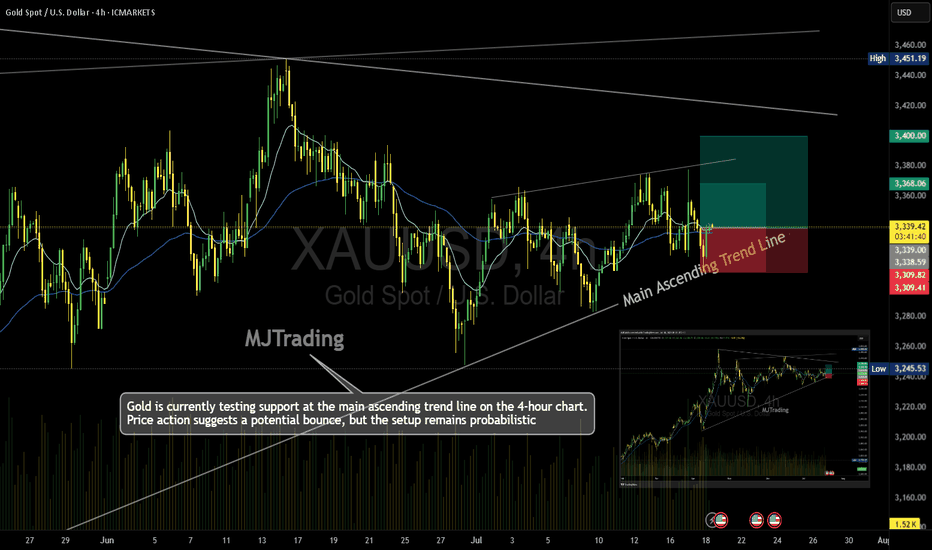

The inset chart shows gold (XAU/USD) stabilizing after a volatile June. If gold resumes its uptrend, RMS could follow suit, given its strong correlation with bullion prices.

🧠 Psychological Angle:

After a 40%+ rally from the $1.78 low, some profit-taking is natural. But this pullback may shake out weak hands before a continuation move.

Watch for sentiment shifts around gold and broader risk appetite—these could be catalysts for RMS’s next leg.

#RMS #Gold #ASX #MJTrading #Forex #Trading #Investment

Context: Ramelius Resources, a mid-tier Aussie gold producer, is showing signs of technical exhaustion after a strong rally from its 2024 lows. With gold prices consolidating and RMS pulling back to a key support zone, this could be a tactical opportunity for shareholders and swing traders alike.

📊 Technical Snapshot:

Current Price: $2.47

Trendline Support: The long-term ascending trendline remains intact, offering a potential re-entry zone for bulls.

Risk-Reward Setup: Defined green/red zones highlight a favorable R:R ratio for those targeting a rebound toward $2.80–$3.00.

🪙 Gold Correlation Insight:

The inset chart shows gold (XAU/USD) stabilizing after a volatile June. If gold resumes its uptrend, RMS could follow suit, given its strong correlation with bullion prices.

🧠 Psychological Angle:

After a 40%+ rally from the $1.78 low, some profit-taking is natural. But this pullback may shake out weak hands before a continuation move.

Watch for sentiment shifts around gold and broader risk appetite—these could be catalysts for RMS’s next leg.

#RMS #Gold #ASX #MJTrading #Forex #Trading #Investment

Trade aktif

Perfect time for buyers to enter...Catatan

"After Gold’s surge, RMS is back on track — showing renewed strength with today’s 8% rally.A solid move from the lows, reclaiming structure and momentum.

If gold holds above key levels, RMS may continue to shine as a leveraged play on bullish sentiment."

📌 Watching for follow-through confirmation over the next sessions.

🌟MJTrading | Private account manager and forex trader;

🌱 Join me to grow together👇:

▶️🔴 Youtube: youtube.com/@MJTradingYT

✈️🔵 Telegram: t.me/MJTradingTG

🌱 Join me to grow together👇:

▶️🔴 Youtube: youtube.com/@MJTradingYT

✈️🔵 Telegram: t.me/MJTradingTG

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

🌟MJTrading | Private account manager and forex trader;

🌱 Join me to grow together👇:

▶️🔴 Youtube: youtube.com/@MJTradingYT

✈️🔵 Telegram: t.me/MJTradingTG

🌱 Join me to grow together👇:

▶️🔴 Youtube: youtube.com/@MJTradingYT

✈️🔵 Telegram: t.me/MJTradingTG

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.