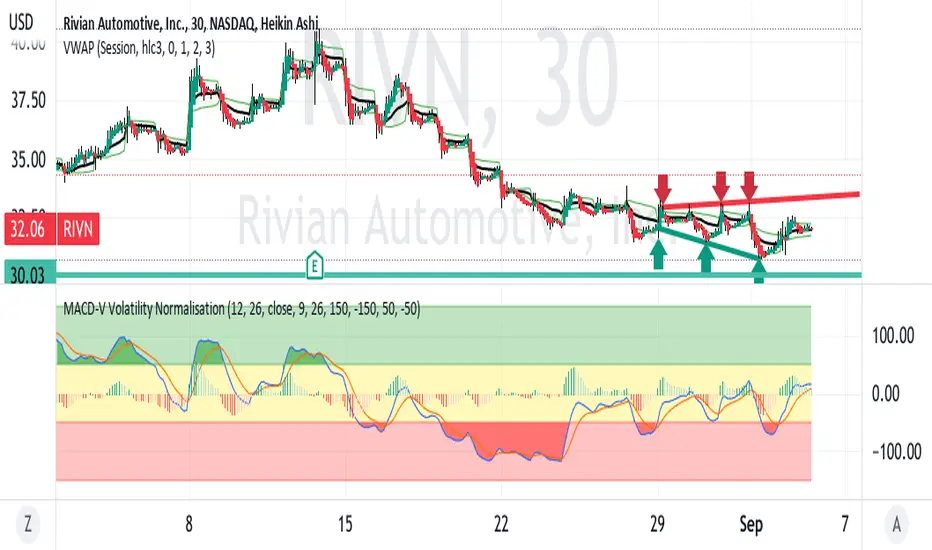

RIVN is in a slow down trending pattern right now within a megaphone

reflecting increasing volatility. The MACD shows the downward momentum

with more of the histogram negative below the zero level.

At present, the K / D lines are crossing over and above the histogram.

characteristic of a reversal to the downside.

Based on pivots in June and July, the horizontal support is at ~ $30.

Accordingly, a target on a short trade setup is just before $30.

This appears to be a good short trade setup where Rivian is

following the downtrend of the sector leader TSLA.

reflecting increasing volatility. The MACD shows the downward momentum

with more of the histogram negative below the zero level.

At present, the K / D lines are crossing over and above the histogram.

characteristic of a reversal to the downside.

Based on pivots in June and July, the horizontal support is at ~ $30.

Accordingly, a target on a short trade setup is just before $30.

This appears to be a good short trade setup where Rivian is

following the downtrend of the sector leader TSLA.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.