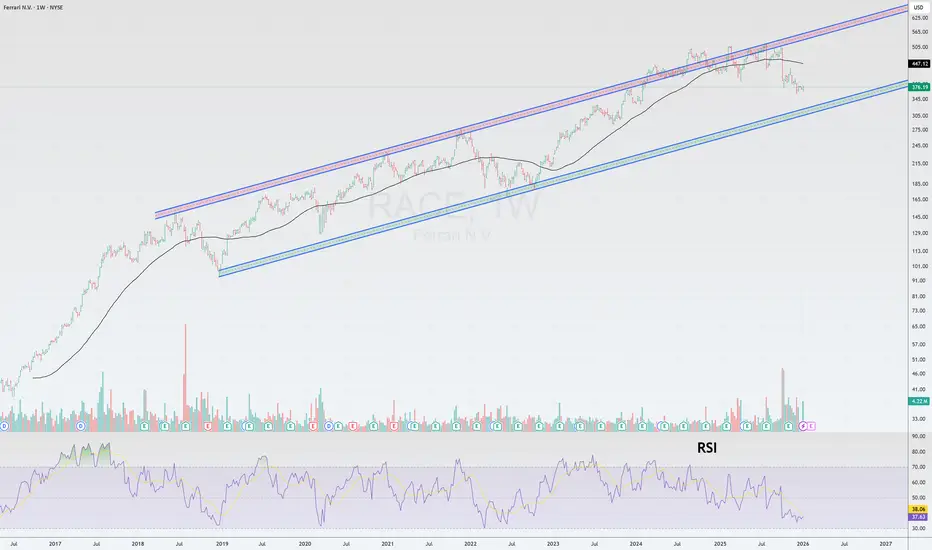

FERRARI ( RACE): A Buying Opportunity or an Investor Trap?

RACE): A Buying Opportunity or an Investor Trap?

Shares of the Italian legend slumped following the October Capital Markets Day, as the market was disappointed by a modest growth forecast.

During this key investor event, Ferrari made two major announcements that triggered the correction:

Conservative 2030 Targets: The company set a revenue target of approximately €9 billion. This implies a compound annual growth rate (CAGR) of only ~5%—significantly lower than in previous years.

EV Strategy Shift: The projected share of all-electric models by 2030 was halved, from 40% to 20%. The focus has shifted toward "horizontal diversification," emphasizing more limited-edition models.

The market perceived this as a slowdown in the growth story.

However, management emphasizes that growth will not be driven by volume, but by a richer product mix, personalization, and price increases.

What the market may have underestimated:

Despite the conservative forecasts, the company continues to demonstrate phenomenal operational efficiency.

Ahead of Schedule: At Investor Day, Ferrari raised its guidance, announcing it would hit its 2026 profitability targets a year early (in 2025).

Shareholder Returns: A €2 billion share buyback program (3.34% of market cap) has been completed, and a new €3.5 billion buyback program for 2026–2030 has been approved.

Dividends: The payout ratio increased from 35% to 40% of adjusted net profit.

Strong Demand: The order book is full until 2027. Scarcity and anticipation remains a core pillar of the brand’s value.

Key Figures:

🔎

Shares of the Italian legend slumped following the October Capital Markets Day, as the market was disappointed by a modest growth forecast.

During this key investor event, Ferrari made two major announcements that triggered the correction:

Conservative 2030 Targets: The company set a revenue target of approximately €9 billion. This implies a compound annual growth rate (CAGR) of only ~5%—significantly lower than in previous years.

EV Strategy Shift: The projected share of all-electric models by 2030 was halved, from 40% to 20%. The focus has shifted toward "horizontal diversification," emphasizing more limited-edition models.

The market perceived this as a slowdown in the growth story.

However, management emphasizes that growth will not be driven by volume, but by a richer product mix, personalization, and price increases.

What the market may have underestimated:

Despite the conservative forecasts, the company continues to demonstrate phenomenal operational efficiency.

Ahead of Schedule: At Investor Day, Ferrari raised its guidance, announcing it would hit its 2026 profitability targets a year early (in 2025).

Shareholder Returns: A €2 billion share buyback program (3.34% of market cap) has been completed, and a new €3.5 billion buyback program for 2026–2030 has been approved.

Dividends: The payout ratio increased from 35% to 40% of adjusted net profit.

Strong Demand: The order book is full until 2027. Scarcity and anticipation remains a core pillar of the brand’s value.

Key Figures:

🔎

🔎 Full Research :

🌐 t.me/A3MInvestments

🌐 t.me/A3MInvestments

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

🔎 Full Research :

🌐 t.me/A3MInvestments

🌐 t.me/A3MInvestments

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.